UPDATED: Post Mortem of today's activity: Click HERE

Clicking scrolls to the Gold trade

Comment: So much to talk about despite light activity. This is a good time to catch up on what has happened, and to look for clues as to what is next. Topics for discussion in subsequent posts are:

- Why are bonds so strong globally? We look at the implications of the failed BOE purchase, PIMCO's new holdings, and front running the Fed in context.

- The (un)likelihood of a Fed hike before the election. Like it or not, the Fed is influenced by political events, and Trump is in their crosshairs

- What is next for precious metals ?- With opinions from both sides

- What happens to Gold if deflation fears are a myth?And Central Bankers did their job

- Trump and Hillary race to outspend each other on infrastructure- Trump will spend like a drunken sailor, but at least we will have something to show for it

- Marc Faber, Trump/Icahn, Pension Partners and PIMCO's market perspectives. Diverging opinions, but all potentially correct based on their styles.

No inflation, unless you happen to rent.

Overnight Markets:

Precious metals are strong with PGMs leading the way. Stocks are mixed and net lower, Bonds are suspiciously strong, Volumes are light as summer doldrums continue to grip markets. Most significant is the BOE's failed purchase of bonds pursuant to its QE stimulus program.

- Did PIMCO just front run the Fed?

- Dr. Gloom Is Back, and He's Predicting a 50% Correction in the S&P 500

- Precious Metals: The whole complex is strong.Gold is up $13+ and Silver is higher by 55 cents- in part a reflection of growing doubts that the Fed will hike this year

- Commodities: Oil continues to slide on more reaction to the API data.- yesterday we noted rally was NOT a trend reversal, but lower on a weaker USD is a bonus

- FX: The USD is behaving like it does not believe the Fed will hike this year- the longer term trend is higher, but at least for now, pre-election action is skeptical

- Bonds: Gilts are stronger after BOE fails to successfully execute a QE purchase- a Central Bank is unfilled on its attempts to BUY bonds at any price. Implications later today.

- Stocks: Mixed in Asia, down in Europe and flat in the US on light volumes overnight

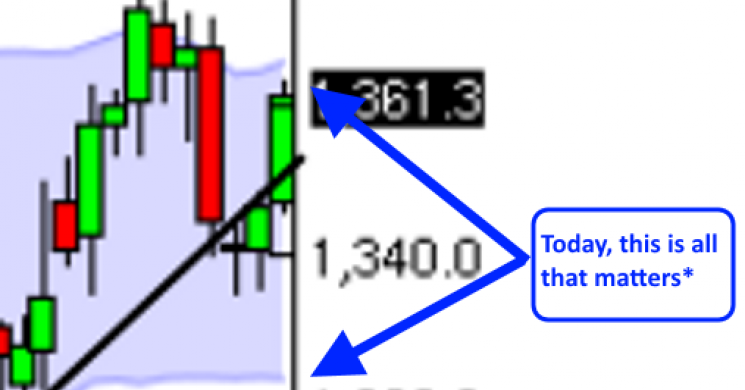

HOW TO TRADE GOLD TODAY

Gold is in danger of disappointing bears: the trade

*Today is another chance for the BBand indicator to give us a signal for momentum ignition and a 3 to 1 risk reward trade. if it hits, the Brexit top in July will likely be meaningless resistance

- The above band is widening today.

- If the bottom band needs to widen in the opposite direction

- If 1 and 2 are in place on the close, the trade is to go home long with a stop loss $5.00 below entry

- If the market comes in higher tomorrow raise your stop loss to the previous day's BBand top line price.

- if the trade is not ITM by tomorrow's close consider taking it off.

What if the BBand break out doesn't materialize? Here is a trade from the short side that is precisely how one would play the market if it started to fail late in the day.

DEC GOLD: Rallies above the trend line that fail to settle above 1360 alert for a bigger correction. Consider selling at 135310-50 and risk135880 Stop. The objective is 133970 or exit by the close

interactive chart HERE

Technicals

DEC GOLD Resist: 134970, 1355, 135940* ST Trend: Sdwys/Down(134660) Supprt: 133980*-, 1333-, 1307* Obj: 1331 TRP: 1359.40Comment: Friday’s break alerts for a short term peaking turn. The failed secondary rally cautions for aharder reactionary selloff. A close under the 133980* support point targets a bear wave to 1331 and likely1307*. Trade is trying to recover off 133980* and congest within Friday’s downturn, but only a close over135940* rekindles bull trend forces to again reach for 138060*.

SEP SILVER Resist: 2000-2002, 2011, 20335* ST Trend: Sdwys/Down(1987) Supprt: 19565-, 19405-, 1918* Obj: 19405 TRP: 2033.5Comment: Friday’s break alerts for a short term peaking turn. The failed secondary rally favors harderreactionary selloffs. A close under the 19575 indicates a slide to 1918*. Trade may try to recover andcongest within Friday’s downturn, but only a close over 2041* rekindles bull trend forces to again reach for2100+.

Related Reading:

- Currency Wars: yuan and pound take lead in race to bottom

- Trump’s Economic Speech Was Enough to Convince Carl Icahn

- War with China: Thinking Through the Unthinkable

Read more by Soren K.Group