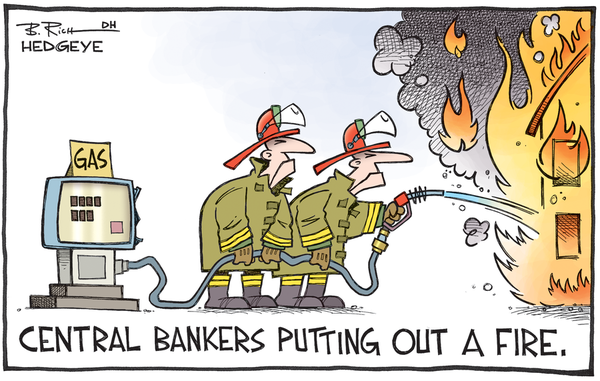

Following the surprise vote by the British public to oust itself from the European Union, many are starting to question what policy responses the European Central Bank, the Bank of England and even the Federal Reserve will introduce to smoothen the blow.

Any idea what it could be? You guessed it…more easing, at least in Europe.

However, on Friday, a central banker from a key European nation said it is not a good idea and he wouldn’t support it.

As reported by the Wall Street Journal, Deutsche Bundesbank president Jens Weidmann said he would oppose any new stimulus action by the ECB as the central bank’s policies are already “very expansionary.”

"I don't see the need for further loosening of monetary policy in response to the Brexit vote," he said.

On the other side of the Atlantic, a Federal Reserve official said the U.S. central bank has no intention to cut rates into negative territory in response to the market turmoil.

"If there is one thing we don't want to do, we have no plans to move into negative territory," Fed Vice Chair Stanley Fisher told CNBC Friday.

“Our primary obligation, it's set out in the law, is to do what's right for the American economy. Of course we take what happens abroad into account because it affects the American economy,” he noted.

Read more by Wall St. Whisperer