On Friday we submitted an analysis by Vince Lanci of Echobay Partners on the possibility of a Fed rate hike and its implications for the Bullion market.

The Fed is Out of Ammo

On the flip side, what can the Fed materially do if there is another crisis? Pretty much nothing. They have no ammo. This is reflected somewhat in Janet Yellen's speech which gives a rather wide berth for rates in 2018.

"The shaded region, which is based on the historical accuracy of private and government forecasters, shows a 70 percent probability that the federal funds rate will be between 0 and 3-1/4 percent at the end of next year and between 0 and 4-1/2 percent at the end of 2018.2 The reason for the wide range is that the economy is frequently buffeted by shocks and thus rarely evolves as predicted. When shocks occur and the economic outlook changes, monetary policy needs to adjust. What we do know, however, is that we want a policy toolkit that will allow us to respond to a wide range of possible conditions." - From Yellen's Speech at Jackson Hole.

Note the last sentence. That is basically an admission that they have no bullets to use if there were another crisis. The only way to have anything in reserve for a crisis event is to reload the gun by raising rates. And by the way, a 70% probability is not very good. That is 1 standard deviation from where we stand in a world where 3 STD moves are becoming not the norm, but the reaction to almost any exogenous shock in other markets.

Full Article HERE

Here is the chart the FRB Chair and Mr. Lanci were referring to:

Chart Notables

- There are no NIRP provisions

- The top end shows rates potentially rising to 4.5% by the end of 2018.

- The chart shows a very wide range of outcomes that are still approx. 1 STD wide, probably to keep the Rate zero bound for nay sayers

On Monday Kitco News interviewed Martin Murenbeeld, chief economist for Dundee Economics. He agreed with Vince in a most straightforward fashion:

According to Murenbeeld, the U.S. central bank needs higher rates as a buffer for any inadvertent economic weakness because right now, yields are too close to zero.

“Their biggest concern is, in my view, zero lower bound, they want to have room to lower rates in the event that the U.S. economy were to suddenly slow unanticipatedly,” he explained. “That’s their primary tool, and their toolbox is pretty empty.”

Murenbeeld also noted that Gold hit its low for 2015 the day right after the Fed raised rates and that the market has done nothing but go up since then. And he is right. Mr. Murenbeeld dismissed a 25 point rate hike saying it would not have any serious implications for the economy. We also agree and went back to Vince for additional comment. For his part he said:

""I'm no economist, but I agree from a reductio to absurdam perspective. Look at that chart Yellen used in her presentation again. Our analysis focused on the lower bound of zero in her 70% confidence scenario. Forget the downside and look at the upside area. What would it take to reach the upper bound of the range? This actually makes me think it is extremely likely that the Fed will shoehorn a hike in post election if they can't do it before.

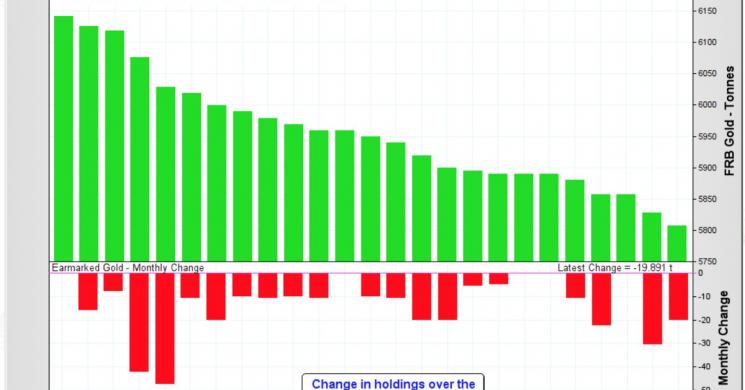

Chart Break: Any particular reason we are calling our Gold back?

Vince Continued: Ten rate hikes, one after the other easily. I do not think that is feasible. But if I'm wrong it will likely be because of surprise rampant inflation, the kind that the Fed has to play catch up with. The kind Volker stomped on and this Fed thinks they can do easily again. So where is Gold if the Fed is forced to raise rates every month for a year? It's not feasible. i'd make sure my Gold was in the form of a gun if that were the case.""

He concluded:"So yes, I agree rates could go up and Gold could go down, but that would be a dip to buy whether they raised rates thereafter or not. Note: one of our commenters Rob S. made this very point. H/t to Rob S.

More from Kitco's Sarah Benali:

Murenbeeld also commented on the upcoming employment report, which he says will likely push the Fed towards raising rates. However, he explained that he prefers to look at the three-month moving average of the nonfarm payrolls print since the month-by-month number is rather “volatile.” Based on this, he predicts that around 190,000 jobs were created last month.

Full Article HERE

Raise Rates Now

We cannot argue with the logic of ignoring the noisewhen it comes to rate hikes. As traders we believe a September hike has a low chance of happening and Fischer spent this morning backing our feeling up. In a Bloomberg interview he back tracked a tad on his declaration in Jackson Hole that " the Aug Jobs number is very important on our next decision" . And since this was the man who actually got the markets to believe Yellen, we think his credibility has downticked b/c ofhis hedged statements. So who are we to argue with Murenbeeld and Lanci? As traders we think a hike is coming and think it will be postelection. As investors, we want it to come now

Read more by Soren K.Group