In other market manipulation news, a U.S. district court judge dismisses 3 lawsuits accusing JP Morgan Chase of rigging Comex silver futures.

As first reported on MarketSlant by Soren K. and later on Kitco, "The lawsuits alleged that in late 2010 and early 2011, JP Morgan placed artificial bids, harangued employees at Comex to obtain prices it wanted, and made misrepresentations to a committee that set settlement prices."

But, Judge Paul Engelmayer in New York (I want to specify, Manhanttan...as in, the island Wall St. is on...) cleared JP by saying the plaintiffs didn't show the bank "intentionally rigged the market."

Reuters added that the Judge's dismissal of the lawsuits was with prejudice, which means JP can't be sued for this again.

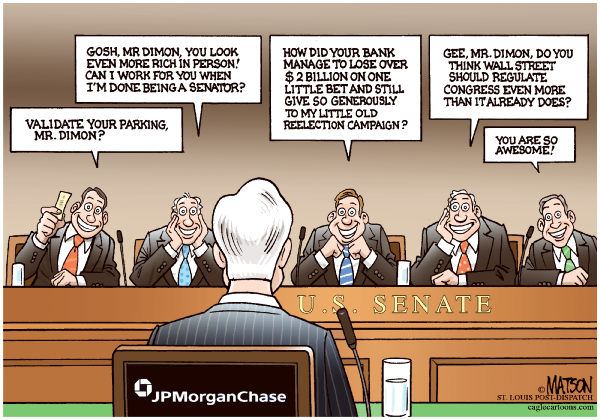

Gee, I wonder who JP had to pay to get away with this one...

Read more here

Image credit: Washington Times, philstockworld.com

Read more by Wall St. Whisperer