Today ICE raised margins went into effect on Gold and Silver. WE expect the CME to follow suit shortly if they have not made an announcement already. We also expect this to slow if not stall the rally as it dissuades Fund activity. That is because Funds use leverage and they will have to decide whether to commit more capital to maintaining positions. If you own metal outright or are not using leverage, You should care less.- Soren K.

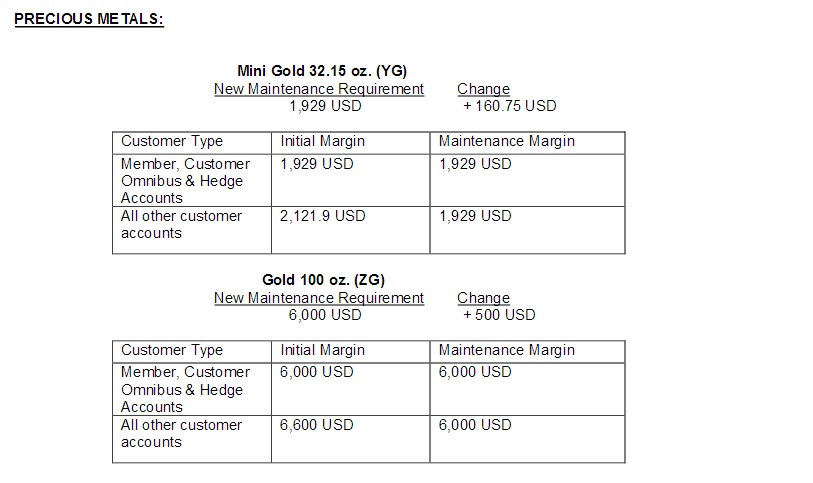

New York, NY (July 6, 2016) – Effective with the open of business Thursday, July 7, 2016 and thereafter, the margin requirements are as follows for Precious Metals:

Margin requirements were raised across the board with focus on the GBP. Margin raises are ostensibly to protect a market from becoming overheated in either direction. However the effect they have is frequently to reverse trends in the market. For these reasons one rarely sees margins raised as open interest is shrinking.

What to Look for

- If margins are raised where open interest is rising, expect that market to slow or reverse trend at least short term

- If they are raised in a market with decreasing open interest, expect the margin raise to exacerbate the current move.

Translation: Margins are like caps on moves in markets. They help keep markets orderly.

Discretionary Power must be used with discretion!

If mishandled margin increases have the similar effect of prohibiting a stock from being shorted. Governments like the USA in 2008 did this to stem the washout of banks. In essence the Fed created the ZOMBIE BANK term. We now see it in Italy. It is no longer permitted to short certain banks under pressure as Italy struggles with its own banking crisis. WE believe that margin requirements are necessary adn only question the subjectivity wiht which they are handled. The person steering the ship has to be smart.

h/t @sdbenali , George Gero

-Soren K.

Read more by Soren K.Group