Overnight

We are going to keep this short as a tragic shooting in Dallas demands some focus and reflection.- Soren K.

Equity markets are stabilizing globally. Precious metals are softer as the EU and GBP stabilize at lower levels post Brexit. Oil and other industrial commodities are flatlining. If the markets were our only guide, it would seem that the whole world is again comfortable with the current situation from Brexit, to the Yuan debasement, to the Italian Bank crisis, to sovereign debt like Australia being downgraded.The market is never wrong, But it can change its mind rather quickly.

Bill Gross made a nice comment on the credit situation in a Bloomberg interview. More below.

Precious Metals weaker in light trading

Headlines

- DALLAS: 2 SNIPERS KILL 5 POLICE OFFICERS THURSDAY NIGHT DURING STANDOFF

- UPDATE: 6:40 AM- STANDOFF ENDS AS FINAL SHOOTER KILLS HIMSELF

- INVESTORS PILE BACK INTO OIL- BBERG- "investors" have been buying for the last 5 days in the downfall

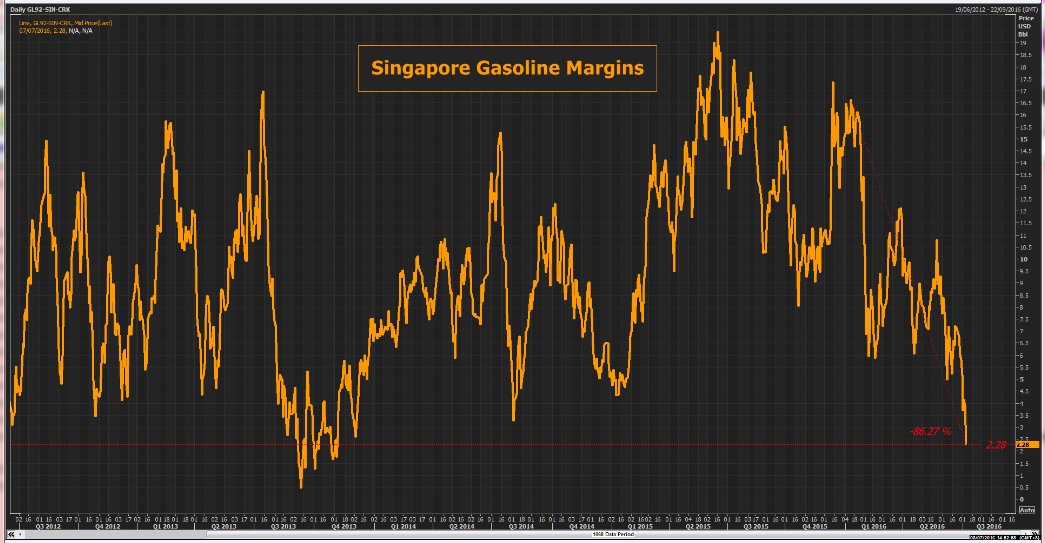

- CRUDE OIL DEMAND FALLING- REUTERS- gasoline demand is at multyear lows during high season.

Monopoly Money

Bill Gross likened the economy to the game of monopoly where players get $200 every time they pass the GO square. That payment ensures expansion and a longer game. But in the end everyone is doomed as expenses on the board go up while that payment stays the same. His comments were directed at Cntral Bankers Yellen etc. "If only Fed Governors understood more about Monopoly and less about outdated historical models, our eceonomy might have better future prospects"

Monopoly Isn't Capitalism

For our part the analogy is imperfect but good. The "Payday" at GO is given for nothing, but in the end assets determine the winner. you pay more each round to hotel owners but the hotel employees get no raise. So if you are stuck paying bills on other people's properties because of their lucky dice roll and your unlucky roll, you will never accumulate savings or be able to purchase assets in your own right. That's why in the end oen person has a "monopoly" and everyone else is bankrupt. The game has that name for a reason. It is not capitalism. How many of you put money under FREE PARKING to counterbalance the rising costs and stagnant salaries? We do. That is us creating socialism to balance out the plutocracy in Monopoly, like the lottery gives people false hope while they struggle under the yoke of greed and their own complacency.

Gold Technicals- the Bull Story

Yesterday we gave you the bear side of the chart. Today is a brief synopsis of the bull side, from Doug Piranha, our colleague.

- Gold: As long as the market stays above 1333.70 Bull forces remain intact. A moveover previous highs of 1362.20 should not be faded as it will increase momentum. Dips above 1344 should bull flag. Only a close under the TRP (1301.20) reverses momentum

- Silver: We think the market is overextended here, and unless can make it over 2060 is in danger of a selloff. Dips above TRP of 1938 can be bought wiht tight stops.

- Oil: We are bearish short term and see the fundamentals starting to assert themselves.

G-d bless the officers who were killed in the line of duty last night. And our condolences go out to their families.We will be reporting on this event, as soon as we wrap our heads around it. Facts only

Please be careful

- Soren K.

Read more by Soren K.Group