Overnight

Japanese stocks enjoy continued strength on ABEnomic's QE promise, but EU stocks lose the tailwind created yesterday. Supply data drives Oil lower, while Copper and Silver continue to rise. Gold gets a breather after Brexit hot money leaves in a hurry.- Soren K.

Headlines

- Stocks Climb With Copper as Brexit-Induced Volatility Subsides- BBERG-

- Yen under pressure as global stock markets rally- RTRS

- China vows to protect South China Sea sovereignty RTRS- UN is powerless and broke

- Venezuela Trucks Food Directly to the Poorest as Chaos Spreads-BBERG

- New Black Panther Party says to carry arms in Cleveland if legal- RTRS- Black Lives Matter,Classic Liberalism and NRA partner- Sanders endorses?

- Unicredit to raise €1bn in two days by selling stakes in other European banks BBC- The answer is "What is diversification?" Alex

Markets

- Japan- shares continue to rally on stimulus expectations.- back to pre-Brexit levels on words and paper promises

- EU- stocks lose global momentum as Italy, Brexit issues become focus- guess they'll need more printing

- GBP- Rallies most since Brexit vote on new PM stability- makes sense after a 20%+ devaluation

- US- stocks flat overnight so far- unchanged is the new "down 10%"

- Currencies- JPY has dead cat bounce, GBP strong, Yuan weaker, Gold up vs USD

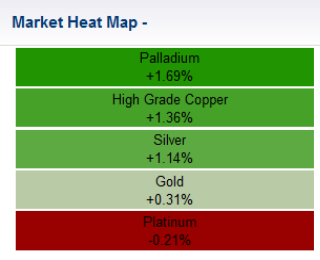

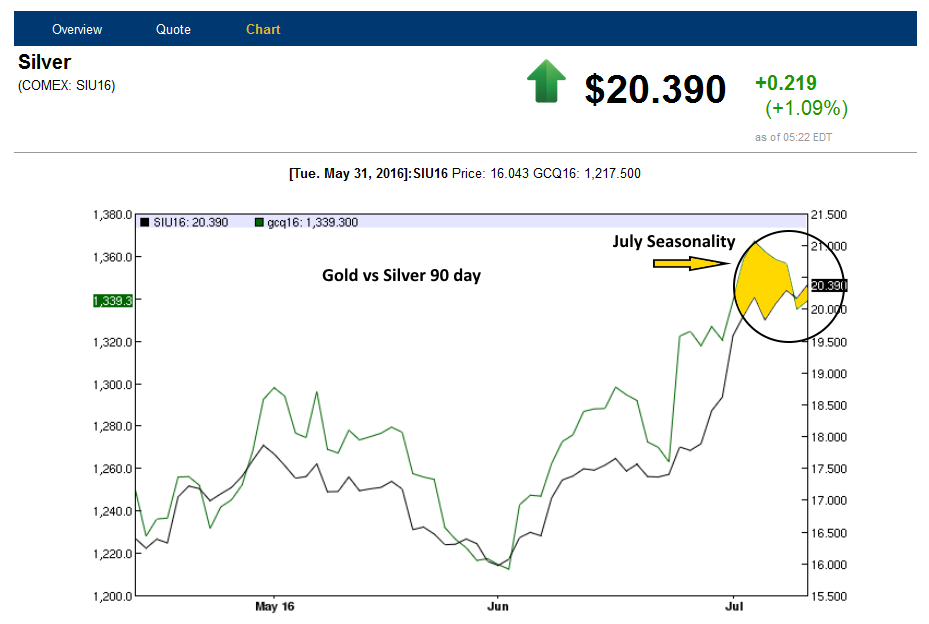

- Commodities- Copper and Silver continue to rally, Gold bounces, Oil backs off on increasing supply data- Silver divorces from Gold, Judge Judy mediates

Silver Resilient in the face of Risk-Off

- for interactive chart click here

Market Comment:

Everybody on the Stimulus-Go-Round

The drivers of the past 2 days activity are still in place. Overnight is a pause as markets digest what they've done. We feel the markets are all starting to price a global Stimulus-Go-Round . Central Bankers will coordinate stimulus packages to help bolster their economies from continent to continent. Japan was first. The EU has announced they will address their Italy banking woes. They will do more in light of potentially losing 18% of their GDP if the UK actually leaves. The UK itself will likely lower rates 25 basis points on Thursday AFTER the Brexit GBP swoon. The FOMC trotted out 4 horsemen of the Stock-apolypse to calm nerves with ambiguous but consistent comments.

FOMC message

We feel their main message was: What is happening outside the US will not affect you. That means: If everyone else injects more money, so will we. The meta-message: Everyone is trying to export their deflationary woes by debasing their currency. The US will not be importers of their liquidity woes. We stand ready to print. Buy stocks.

Lather Rinse Repeat

We also know that talking markets up is a good way to set the stage for not having to do anything real at all. The cycle goes like this:

- Stocks down:Hint that we will print money if stocks stay down

- Stocks then go up: Fed doesnt have to print money

- Fed doesnt print, hints stocks too high, may raise rates

- Stocks go back down

- Go to 1 above

Oldie but Goodie

The Fed's Tool Box is Empty Except for Words

Central Bankers have 1 real tool to moderate market behaviour, interest rates. When interest rates are at zero, that tool is no longer in their kit. All they have left is the power of words. And they are not afraid to use them. QE, in case you are wondering is not monetary ploicy. It is a coordination of the Fed (monetary policy) with the Treasury (fiscal policy). It will happen when Fed words lose their power. Our problem is that people are in charge. And people can become arrogant from their own success.

FED: We'll use words to "manage" markets

Stocks are untethered from the economy now

The stock market is supposed to mirror future economic expectations. It is a very public barometer of how investors feel. Intended or not, a rallying stock market is no longer a barometer of economic outlook. It is an indicator of future Fed action. The Fed may think that getting the market high enough will get the economy going. We do not think so. We think the Fed is sweating bullets because the money is not being spent on cap expenditures or osustainable growth. To simply print money in this age of electroncic fund movement is to encourage mal-investment, or bubble behaviour.

Helicopter Money is Next

That is where Helicopter money comes in. Helicopter money is an atttempt to bypass the banks and get money to main street without the intermediary. Its intentions are good. Its use would become necessary because of other good intentions gone bad

Lets say helicopter money puts $10k in every americans bank account overnight. Good right? From there 1 of 2 things happens. OR BOTH. None are good.

- Inflation-stores raise their prices because people have more money to spend

- Taxation- Taxes are raised to pay for that handout.

This is exactly what happened in LATAM countries like Argentina.Which resulted in frozen class mobility. The end game in the USA is inflation of one asset class the Fed is trying to keep their easy money away from, Gold. Because that would mean the end of FIAT confidence. Doctor Yellen is on line 1. She says you've got inflation, but its the good kind in your equity system dont worry. As long as it doesnt metastazise to the Precious Metals area you'll be fine

Bernanke caught after meeting Abe in Japan

Other Articles

Japan's Money Printing has done nothing for 10 years

Good Morning

Soren K.

Read more by Soren K.Group