Summary:Here is the case against further easy money explained quite logically. The only fault we find with it is the Fed isn't thinking like Mr. Bilello, who basically says inflation is here in a somewhat Austrian manner. But he is also a data miner and sees the inflationary signs like increasing rent . What most intrigues us is this statement:

"As far as I’m concerned, Europe and Japan can have their negative interest rates. I’d much prefer higher interest rates accompanied by higher growth.."

First it confirms our feelings for one of PIMCO's drivers in loading up on US Teasuries. More controversially, it implies that stocks can go up as rates do. Certainly that is true. Inflation can cause stocks to rise for a period while bond rates rise. That is a function of domestic of inflation returns ( as opposed to real) and also reallocation of assets out of bonds and into stocks. We don't see that lasting long. Especially in light of the stock market already being at ATH and almost entirely focused on Fed policy for movement.

From the article:

The U.S. Federal Reserve bucked the trend last December in raising rates to a paltry 25 bps (its first hike since 2006), and remains the only developed central bank in the world whose last move was a hike.

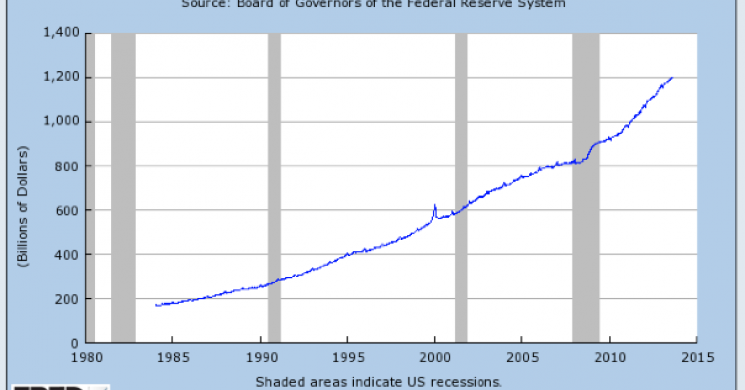

Since the December move, the Fed has refrained from hiking again, due in part to increasing fears of deflation during the market correction to start the year. During every correction, as long yields fall, the perma bear deflationistas come out in full force screaming of deflation and another Great Depression.

How accurate are these fears of deflation in the U.S?

Inflation, Deflation...Does it really matter who is right to the guy who works for a living?

Looking at history during times of high inflation, stocks do actually rise at first in tandem with devalued currency. That makes sense. But as inflation increases there is a point where consumer budgets cannot keep pace with product prices. Thus profit margins are squeezed. Even exporters of domestically built goods that are paid in foreign currency succumb to this phenomenon. That isn't opinion. it is fact rooted in the Weimer Republic Reichmark hyperinflation of the 1920's. To swing back to his point, and our take: We are not talking hyperinflation at all, and see his statements very sensible. In short, "Fix the problem when you can, not when you have to." if global Central Bankers followed this advice, GDP contraction or not, we'd have a restoration of sound policy.- Soren K.

Previously on MarketSlant

Dow Jones To Trade Above 20,000 ? Not Unforeseeable- and frankly consistent with an inflationary spike top- SK

Did PIMCO just front run the Fed?

Dr. Gloom Is Back, and He's Predicting a 50% Correction in the S&P 500

Soren k.

Read more by Soren K.Group