Expect to be online full time Tuesday. In meantime, Here are some technical briefs.-Good Luck, Soren K.

- Wider trading range in Gold as mentioned before- wish the BBand breakout followed through

- Bonds show weakness that bears closer scrutiny as a clue to the potential effect of future stimulus.- must confess we are giddy on this one

- Stocks are bullish for every reason but fundamentals- and that is reason enough to not be short

- Oil is fundamentally bearish, but may have been getting ahead of itself- got nothing

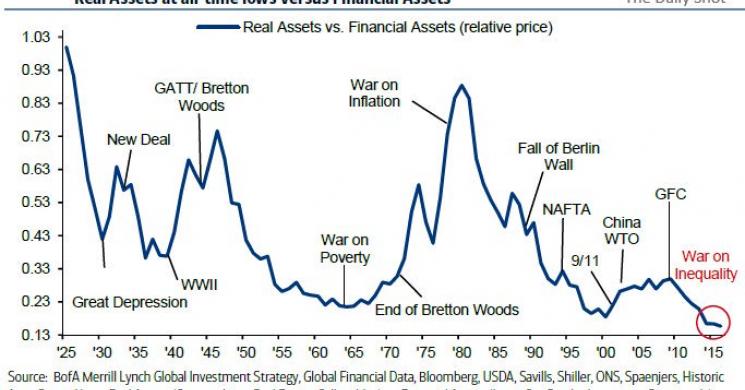

We now think the next serious selloff in US equities will be met with quick Helicopter fiscal stimulus that begins the blow off pre-inflation rally.

Japan Helo money begets UK which begets EU... which ends in US fiscal stimulus. That's why Bernanke was in Japan a couple weeks ago, prodding for perpetual debt monetization.

Global Helo money (sans US) will end with some crisis that provokes US Helo money. Stocks will scream higher in a blow off in that scenario. We are not alone in that opinion. DB which sorely needs fiscal stimulus of its own sees that as well. That is just one roadmap of many to the end game of lessening the US debt burden with financial engineering.- Soren K.

The title should be "The FOMC can manipulate cash flows longer than you can remain solvent"

DEC GOLD Resist: 135020, 1355, 136130* ST Trend: Sdwys/Down(134140) Supprt: 133980*, 1331, 1307* Obj: 1331 TRP: 1361.30Comment: Friday’s break alerts for a short term peaking turn. The failed secondary rally cautions for aharder reactionary selloff. A close under the 133980* support point targets a bear wave to 1331 and likely1307*. Trade may try to recover off 133980* and congest within Friday’s downturn, but only a close over136130* rekindles bull trend forces to again reach for 138060*.

SEP T-BONDS: The failed secondary push around the 17417 Resistance warns for a short term turnover to169-168. Consider selling at 17216 and risk a close over 17231 or 17313 Stop. The objective is 16900-.

SEP CRUDE OIL Resist: 4241, 4305+/-?, 4409* ST Trend: Sdwys/Down(4202) Supprt: 4126-06, 4029*, 3950- Obj: None TRP: 44.09Comment: Overall the market is short term bearish, but showing a reversal / bottoming turn off the earlyApril upturn level at 3950-00. Trade is poised for further corrections the next few days and could boostretracements to test 4409* resistance for a short term bottoming turn. Residual bear forces could promptdips, but a close under 4029* is needed to send another selloff against 3950-00 April upturn levels.

SEP MINI S&P Resist: 2181, 2200+ ST Trend: Sdwys/Up(217750) Supprt: 2144-, 213350* Obj: 218100 TRP: 2133.50Comment: Overall the market is bullish. A breakout over 2181 could launch a drive to 2200+. If trade backsoff from the 2181 target, be ready for a 1-2 day drop back to 2155. Only a drop under 2144- warns for anegative turn and retracement down to support at 213350*. A close under 213350* is needed for a criticalreversing turnover with potential declines along 2100+/-.

- War with China: Thinking Through the Unthinkable

- Putin: You buy our Bonds, we buy your Gold, da?

- Michael Oliver’s Plate Tectonics Provides Future Visibility

Good Luck- SK

Read more by Soren K.Group