Top Day

Gold and Silver

Goldman Sees Weakening Yuan as Supportive for Gold

“The potential drivers of increased Chinese physical buying include purchasing gold as a way to hedge for potential currency depreciation in the face of capital controls”- essentially saying that the fear of further Yuan depreciating is incentive for China retail to buy now

Gold/Silver Ratio Hits Levels not Seen Since Pre-Brexit Vote

Gold at Multi Week Highs

On Oct 6th, MarketSlant made the call that Gold was a speculative buy and outlined the levels to look for. Since then the yellow rock has made multi week highs with room to $1300 Today's Technical Brief will give updated support levels as well as an update on our S&P call. Previous analysis here, here, and here

Oct 19th Update

interactive Chart HERE

Fed Aims to Raise rates "differently" this time

"Instead of following a relatively linear path, it will have pronounced “stop-go” characteristics (ominous if happens-SK).... perhaps more importantly, the 'neutral rate' will be considerably lower than recent historical averages." -Mohamed A. El-Erian

Volker on why the Fed Can't Raise Rates

"If we let our debt grow, and interest rates normalize (i.e. raise them- SK), the interest burden alone would choke our budget and squeeze out other essential spending. There would be no room for the infrastructure programs and the defense rebuilding that today have wide support- P. Volcker (more on this today-SK)

- Gold dn $1.30 at $1272.3 last

- Silver dn 6 cents at $17.72

Global Headlines

(BBG)Deutsche Bank Said to Weigh Alternatives to Cash Bonuses- giving shares instead of cash , will not change culture

(RTR)Apple Holiday Forecast Disappoints Given Samsung’s Troubles - pinning hopes on iPhone is not a strategy

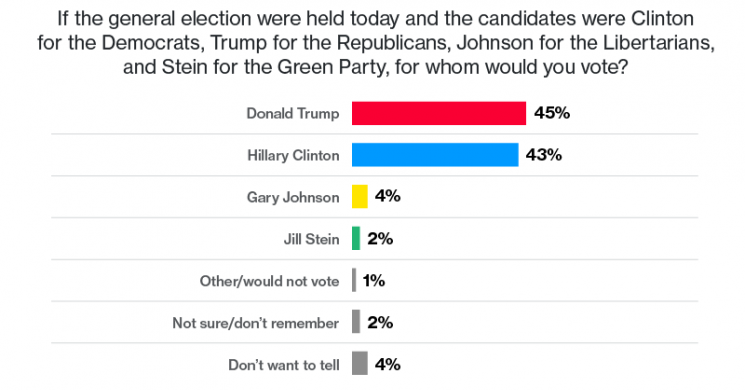

(BBG)Donald Trump surprisingly has a 2% lead in Florida- was behind 3% 2 weeks ago ...hmmmm

Wholesale inventories Data at 8:30 AM ET- september expected is small 0.1% growth

(BBG)Goldman hopes you won't notice how many people it is laying off- while it brags about avg comp

(CNN)Obamacare woes to linger long after Obama is gone - Trump and GOP have seized on this

Japan now adding foreign workers in break with past- aging homogeneous population is driver

PBOC said to trial monitoring some wealth management products- more control measures to "help" middle class

Markets

- S&P 500 futures down 0.4% to 2129

- Stoxx 600 down 0.8% to 340

- FTSE 100 down 1% to 6946

- DAX down 1% to 10649

- Nikkei 225 up 0.2% to 17392

- Hang Seng down 1% to 23325

- WTI Crude futures down 1.4% to $49.27

Good Luck

Read more by Soren K.Group