Although a little late to the show, silver has really upped its game among the precious metals!

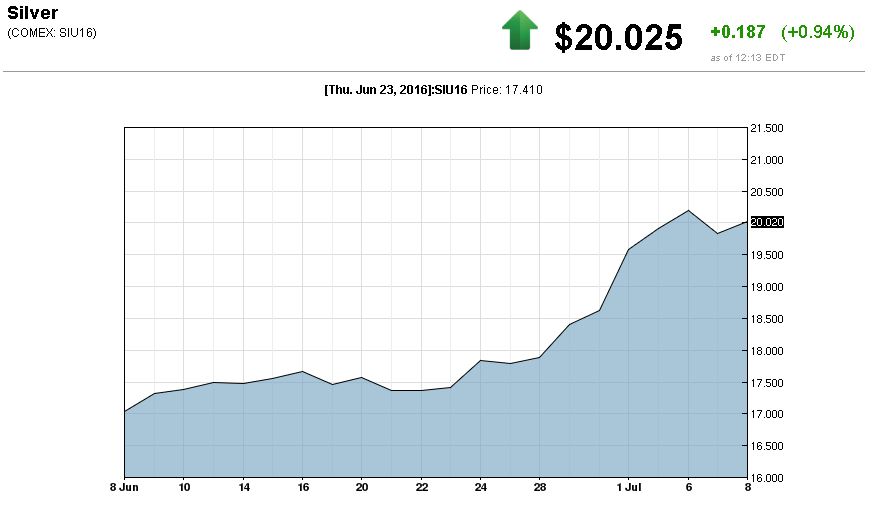

The grey metal is up nearly 8% this month alone, compared to gold’s 2.9% rise; this week silver price managed to rally over $21 an ounce, levels last seen two years ago.

But, with all this enthusiasm towards the metals -- trading at multi-year highs -- investors may feel they’ve already missed the boat. Guess what? Maybe not…

There may still be potential to make profits if you look at silver miners.

As Motley Fool reported Friday, there are three companies that may be positioned to move higher with rising silver prices: First Majestic Silver, Pan American Silver and Great Panther Silver.

“[S]ilver mining is a risky business, which means investors should only consider miners with low operating costs, solid balance sheets, and high-quality assets,” they wrote, adding that these 3 companies meet this criteria.

Let’s look at their charts since silver’s full-throttle rally began post-Brexit.

Gold’s volatile sister metal is up over 15% since June 23.

Over the same time frame….

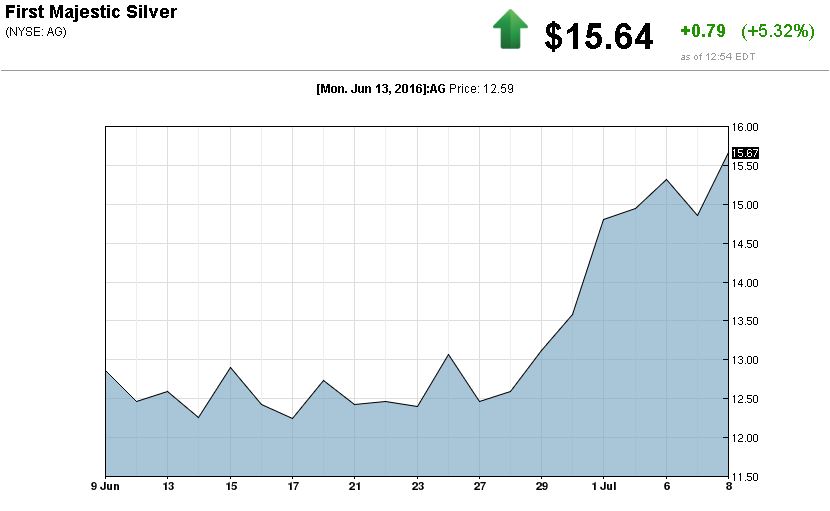

First Majestic rose over 26%.

“Not only did it strengthen its balance sheet, completing a $50 million equity raising and securing a US$60 million credit facility earlier this year, but it took advantage of weak asset prices to acquire SilverCrest Mines Inc. in late 2015,” Motley Fool wrote.

Pan Am moved up by 22.4%

“Not only does it have a solid balance sheet with long-term debt totaling a mere US$38 million, but it has considerable liquidity with US$120 million of cash on hand at the end of the first quarter,” they continued.

After rallying some 23%, Great Panther stock price has fallen back, up only 1% since June 23.

However, Motley Fool noted that the company is well positioned as it has successfully managed to cut costs. “First-quarter all-in sustaining costs fell by an impressive 26% year over year to be a mere US$9.25 per ounce,” they wrote.

Ok, but what about the rest?

"Most operating leverage, least debt, tends to underhedge production," noted fellow staff writer and silver veteran Soren K.

Let’s take a look at some other charts…

Coeur up 32% since Brexit vote.

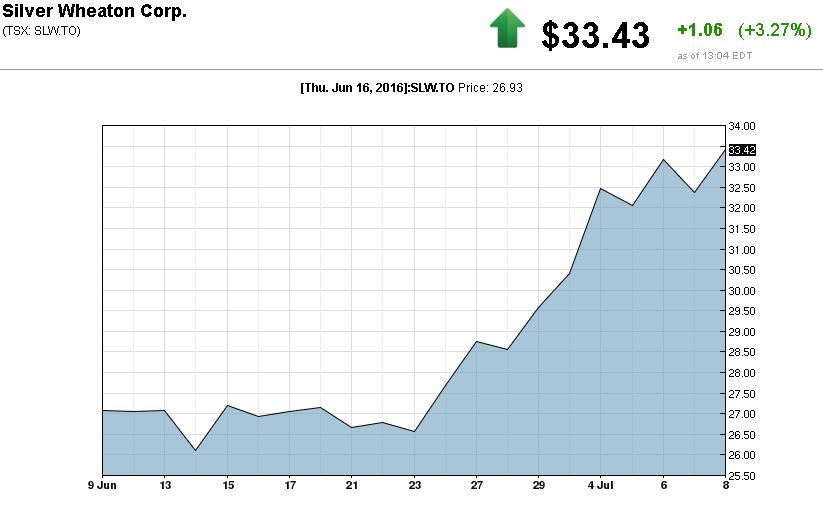

Silver Wheaton up nearly 26%

The list goes on and on...Where would you put your money and why?

Read more by Wall St. Whisperer