Here in San Antonio, grocery stores were packed with families stocking up on water and canned food in preparation for Hurricane Harvey, which has devastated Houston and coastal Texas towns. I hope everyone who lives in its path took the necessary precautions to stay safe and dry—this storm was definetely one to tell your grandkids about one day.

Similarly, I hope investors have took steps to prepare for some potentially disruptive economic storms, including this past weekend’s central bank symposium in Jackson Hole, Wyoming, and the possibility of a contentious battle in Congress next month over the budget and debt ceiling.

As you’re probably aware, central bankers from all over the globe visited Jackson Hole this past weekend to discuss monetary policy, specifically the Federal Reserve’s unwinding of its $4.5 trillion balance sheet and the European Central Bank’s (ECB) ongoing quantitative easing (QE) program. Janet Yellen gave what might be her last speech as head of the Federal Reserve.

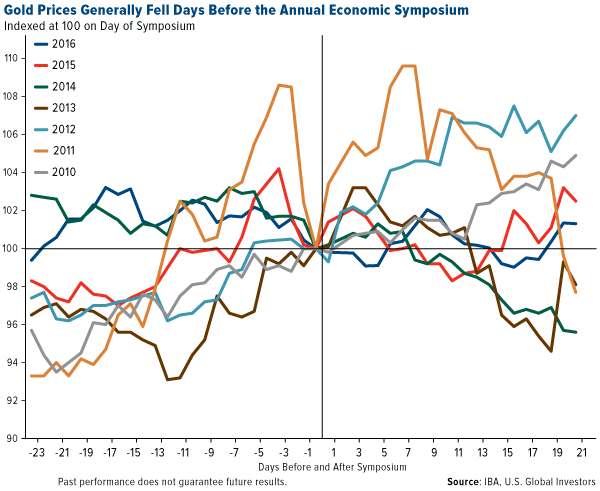

As I told Daniela Cambone on last week’s Gold Game Film, there are some gold conspiracy theorists out there who believe the yellow metal gets knocked down every year before the annual summit so the government can look good. I wouldn’t exactly put money on that trade, but you can see there’s some evidence to support the claim. In most years going back to 2010, the metal did fall in the days leading up to the summit. Gold prices fell most sharply around this time in 2011 before rocketing back up to its all-time high of more than $1,900 an ounce.

Many of the economic and political conditions that helped gold reach that level in 2011 are in effect today. That year, a similar Congressional skirmish over the debt ceiling led to Standard & Poor’s decision to lower the U.S. credit rating, from AAA to AA+, which in turn battered the dollar. The dollar’s recent weakness is similarly supporting gold prices.

In August 2011, the real, inflation-adjusted 10-year Treasury was yielding negative 0.59 percent on average, pushing investors out of government bonds and into gold. Because of low inflation, we might not be seeing negative 10-year yields right now, but the five-year is borderline while the two-year is definitely underwater. Bank of America Merrill Lynch sees gold surging to $1,400 an ounce by early next year on lower long-term U.S. interest rates.

Are Government Inflation Numbers More “Fake News”?

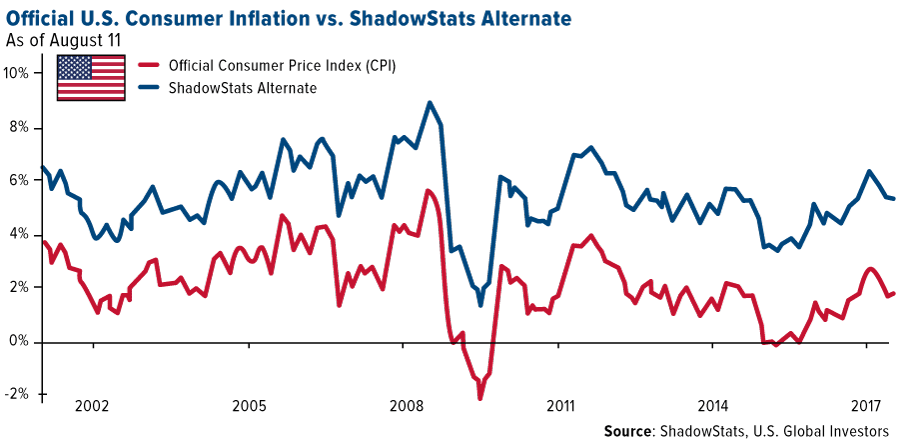

If we use another inflation measure, though, yields of all durations look very negative. For years, ShadowStats has published alternate consumer price index (CPI) figures using the methodology that was used in 1980. According to economist John Williams, an expert in government economic reporting, “methodological shifts in government reporting have depressed reported inflation” over the years. The implication is that inflation might actually be running much higher than we realize, as you can see in the chart below.

If you believe the alternate CPI numbers, it makes good sense to have exposure to gold.

Recently I shared with you that Ray Dalio—manager of Bridgewater, the world’s largest hedge fund with $150 billion in assets—was one among several big-name investors who have added to their gold weighting in recent days on heightened political risk. That includes Congress’ possible failure to raise the debt ceiling and, consequently, a government shutdown. Dalio recommends as much as a 10 percent weighting in the yellow metal, which is in line with my own recommendation of 10 percent, with 5 percent in physical gold and 5 percent in gold stocks, mutual funds and ETFs.

I urge you to watch this animated video about opportunities in quality gold mining stocks!

Falling Dollar Good for U.S. Trade

Returning to the dollar for a moment, respected CLSA equity strategist Christopher Wood writes in this week’s edition of GREED & fear that it’s “hard to believe that the political news flow in Washington has not been a factor in U.S. dollar weakness this year.”

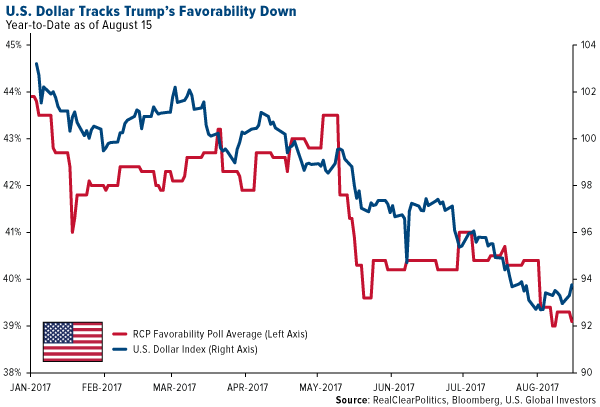

The U.S. media certainly wants you to believe that Trump is bad for the dollar. Take a look at this chart, showing the dollar’s steady decline alongside President Donald Trump’s deteriorating favorability rating, according to a RealClearPolitics poll.

However, a weak dollar is good for America’s economy. I’ve commented before that Trump likes a falling dollar, because it is good for the country’s export trade of quality industrial products. It’s also good for commodities, which we see in a rising gold price and usually energy prices.

Ready for a Big Fight?

You might have watched the Mayweather vs. McGregor fight, but have you been watching the fight between Trump and the Fed?

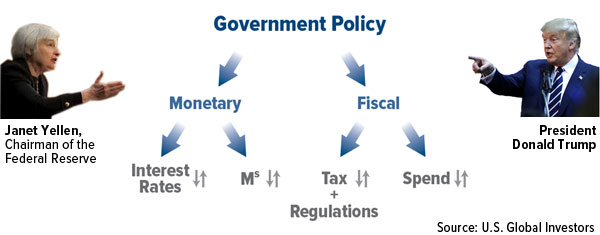

At the symposium in Jackson Hole, Fed Chair Janet Yellen squared up directly against Trump when she defended the strict regulations that were put in place after the financial crisis. Echoing these comments was Dallas Fed chief Robert Kaplan. This is the opposite of what Trump has been calling for, which is the streamlining of regulations that threaten to strangle the formation of capital.

It’s important to recognize that the market is all about supply and demand. The number of public companies in the U.S. has been shrinking, with about half of the number of listed companies from 1996 to 2016. Readers have seen me comment on this previously, and I believe that the key reason for this shrinkage is the surge in federal regulations. The increasingly curious thing is that we are seeing the evolution of more indices than stocks, as the formation of capital must morph.

As I told CNBC Asia’s Martin Soong this week, there is a huge amount of money supply out there, and investors are looking for somewhere to invest. The smaller pool of stocks combined with the greater supply of money means that the market has seen all-time highs. In addition, major averages were regularly hitting all-time highs not necessarily on hopes that tax reform would get passed, but on strong corporate earnings, promising global economic growth and the weaker U.S. dollar.

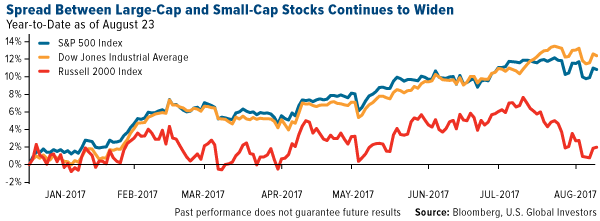

Meanwhile, small-cap stocks are effectively flat for 2017 and heading for their worst year since 1998 relative to the market, according to Bloomberg. Hedge funds’ net short positions on the Russell 2000 Index have reached levels unseen since 2009. Remember, these are the firms that were expected to be among the biggest beneficiaries of Trump’s “America first” policies.

However, the weakness in U.S. manufacturing has a great impact on the growth of these stocks, as indicated by the falling purchasing managers’ index (PMI). The slowdown in manufacturing is offset by strength in services, shown by the Flash composite PMI score of 56.0 which came out this week. Though there is a spread between large-cap and small-cap stocks, historically this strong score is an indicator of growth to come.

Some big-name investors and hedge fund managers are turning cautious on domestic equities in general. On Monday, Ray Dalio announced on LinkedIn that he was reducing his risk in U.S. markets because he’s “concerned about growing internal and external conflict leading to impaired government efficiency (e.g. inabilities to pass legislation and set policies).” Pershing Square’s Bill Ackman and Pimco’s Dan Ivascyn have also recently bought protection against market unrest, according to the Financial Times. Chris Wood is overweight Asia and emerging markets.

Stay Hopeful

It’s important to keep in mind that there will always be disruptions in the market, and adjustments to your portfolio will sometimes need to be made. For those of you who read my interview with the Oxford Club’s Alex Green, you might recall his “Gone Fishin’” portfolio, which I think is an excellent model to use—and it’s beaten the market for 16 years straight. Green’s portfolio calls for not just domestic equities, Treasuries and bonds but also 30 percent in foreign stocks and as much as 10 percent in real estate and gold.

Stay safe out there! In the meantime, explore investment opportunities in emerging markets!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Russell 2000 Index is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000. The Russell 3000 Index consists of the 3,000 largest U.S. companies as determined by total market capitalization. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The U.S. Dollar Index is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies.

Read more by Frank Holmes