‘Tine marches on

By Grants Almost Daily

Those extra 177 basis points or so found in the 100 year bonds may look like meager compensation indeed if the Land of Silver reverts to its regular past form and finds it has none to pay its debts.

We'd line up to buy that issue if it were secured by the natural resources Argentina has. But as Grant states, that is not the case. - Soren K.

Argentina to issue 100 year sovereign bonds? A drowsy early morning headline reader may have wondered if he or she was still dreaming. It is all too real. The “Land of Silver” is indeed planning on tapping the ultra-long term sovereign lending market for U.S. dollar bonds.

[EDIT- Argentina has a history of Mining physical and defaulting on paper. Recent increases in mining forays from US companies might be yet another 'short paper, mine physical' end result. What was a disastrous socialist government ( we were there in 2003 and 2008) might now become an equally disastrous right of center rule by kick back corporatists and greedy politicians. Or maybe not. A rose by any other name...Soren K.]

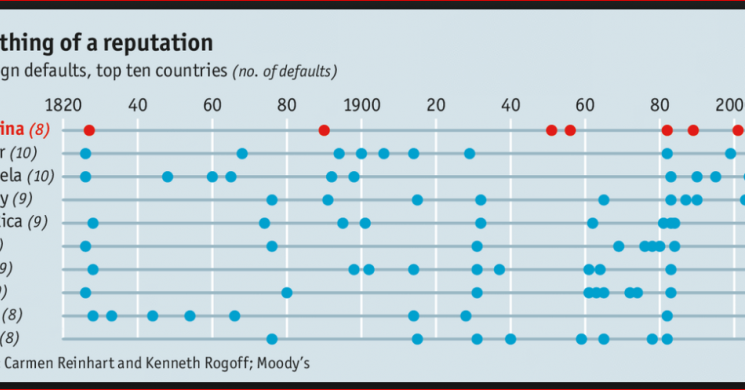

Eight times in its 194 year financial history has Argentina defaulted on its borrowings, most recently in 2014 amidst its dispute with creditors from its prior episode of financial ruin in 2001. At its historical pace, the soon to be-issued 7.125s of 2117 (priced at $90 to yield around 7.92%) will default more than four times over before that so very-distant prospective maturity date.

From banking crises, to political dysfunction, to depression-level economic contractions and hyperinflation, Argentines (and their creditors) have seen it all, usually more than once. Among their unhappier economic episodes include the Baring Bank Crisis in 1890-91, an event that included default amidst three separate bank runs, the last leaving Argentina’s largest private banks holding a cash-to-deposit ratio of just 22% and forcing the country into a painful fiscal realignment (not to mention major losses absorbed by foreign investors). In a 2001 postmortem, the National Bureau of Economic Research identified the symbiotic dysfunction at the heart of the trouble:

(National and local) governments had no incentive to control the lending procedures of the banks of issue since the governments were major beneficiaries of the banks’ lending function as fiscal agents of the state.

Another instructive period for prospective debt buyers was the hyperinflationary epoch seen in the late 1970’s and 1980’s. According to the NBER, monthly CPI inflation registered 5% or higher in most every quarterly period from 1975-1990. The council notes that 6% monthly inflation equates to around 100% on an annualized basis. That pace of debasement was the norm for well over a decade.

Capital controls, unchecked money printing, and, eventually, the replacement of the Argentine peso with a currency unit known as the austral were ineffectual in preventing the skyward price spiral: Wholesale prices in 1989 rose by 5,400% from the prior year.

Their 2002 default was perhaps the most spectacular of all, one of the largest sovereign defaults in history at over $82 billion according to Moody’s. Most creditors accepted a 70% haircut, with some holdouts seeking and obtaining better terms from a U.S. court. That decision helped push Argentina back into default in 2014.

Proximate cause of that early-aughts meltdown was largely more of the same, including high public debt and fiscal mismanagement, including an eventually deleterious currency peg to the dollar. According to the IMF’s 2003 paper, “Lessons from the Crisis in Argentina”, the seeds of that crisis were sown in the preceding boom:

There was little sense of urgency to address these vulnerabilities at that time, given the widespread eagerness to interpret the (1990’s) boom as the onset of an era of permanently higher growth founded on structural reforms and sound macroeconomic policies.

Back in the present day, the 2015 election of business-friendly Mauricio Macri has been well received by investors, the MSCI Argentina index has gained more than 47% from its interim lows last December, while the Argentine 10 year dollar bond yield has declined to around 6.15% from north of 7.5% at the end of last year.

Fundamental indicators have yet to confirm Mr. Market’s bull whims. Real GDP fell by 2.3% in 2016 for its third annual decline in the past five years, and the Argentine peso continues to trade near a 52 week low of around 16.15 per dollar, compared to a five year average of roughly 9.5. Perhaps most importantly for potential debt holders, its fiscal situation looks again to be deteriorating. In the fourth quarter of 2016 (the most recently available data point in this series), the Argentine budget deficit exceeded 1.5% of GDP, roughly double the fourth quarter levels over the prior three years and easily the biggest shortfall going back to 2002.

If one was inclined to take a flier on Macri and Co. why not the 10 year U.S. dollar bonds yielding around 6.15%? Those extra 177 basis points or so found in the 100 year bonds may look like meager compensation indeed if the Land of Silver reverts to its regular past form and finds it has none to pay its debts.

- Philip Grant

CLICK HERE to begin a six-issue Trial Subscription to GRANT'S. Offer ends June 24, 2017.

Read more by Soren K.Group