After a mini roller-coaster day where a stock slide dictated other activity, Gold weathered the push and pull eking out small gain on the day when the dust settled and the USD finished lower. On the re-open the trend continues as global stocks slide, and the dollar remains weak

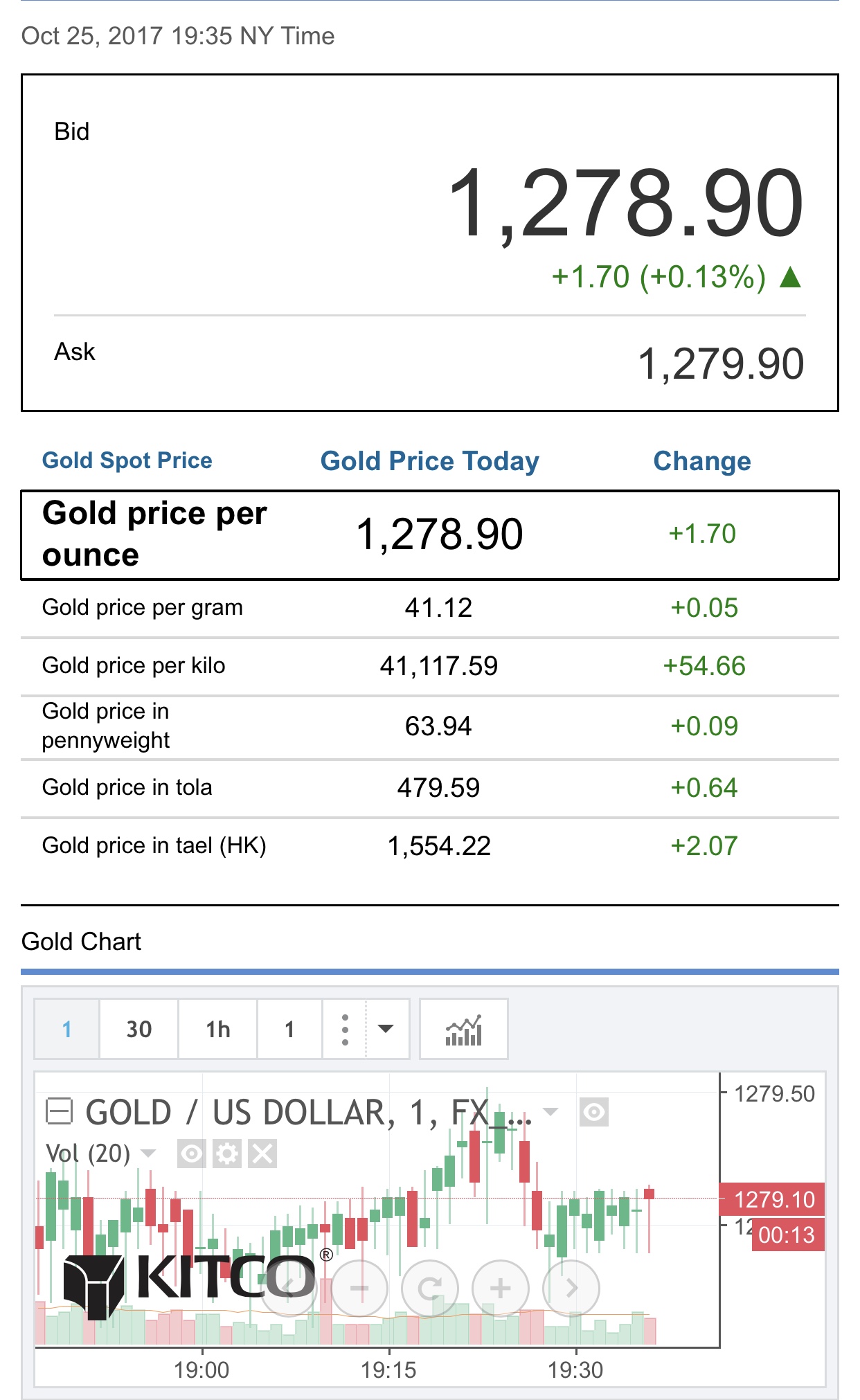

Gold is trading slightly under $1279 as of this post. Click graphic for real time updates.

Dow Jones Hourly- stocks sold off and the end of day ramp failed.. azearoty.

Dollar Index Daily

Spot Gold 15 Minute

Asian Open

Markets turn lower, Cohn won’t be the next Fed Chair, and Singapore’s central bank head issues a warning. Here are some of the things people in markets are talking about.

Markets Take A Tumble

It wasn’t a good day for U.S. stocks, which fell the most in seven weeks amid disappointing earnings reports from the likes of Chipotle Mexican Grill Inc. and Advanced Micro Devices Inc. The dollar slid, bitcoin took a breather, and gold whipsawed investors. Outside of earnings, more questions than answers out of Washington were also putting a damper on the bull market as Republican senators Jeff Flake and Bob Corker publicly criticized President Donald Trump just as he tries to push through big changes in the U.S. tax code. The Nikkei and Hang Seng are both sitting lower in the pre-market.

Fed Race Narrows

We’re getting closer to finding out who the next Fed Chair will be. Unfortunately for Gary Cohn, it’s not him. People told Bloomberg Wednesday that Trump does not intend to appoint Gary Cohn, currently the National Economic Council Director, to lead the central bank. Trump apparently still thinks Cohn is doing a good job, but due to him not getting this role, there’s now speculation how long he’ll actually stay in D.C. Current chair, Janet Yellen, Fed Board Governor Jerome Powell and Stanford University economist John Taylor appear to be the front runners, though there are questions about Yellen's chances. Trump may have more to say on the subject in a Fox Business interview scheduled for 8 a.m. Tokyo time.

Speaking of Central Banks…

Singapore's central bank head is worried about the risks out there when it comes to global markets these days. In a new interview, Ravi Menon, the managing director for the Monetary Authority of Singapore, said markets have been incredibly resilient and keep hitting new highs despite recent episodes like tensions with North Korea. On top of that, all eyes will be on the European Central Bank Thursday as members meet. President Mario Draghi has fueled tapering expectations, and economists expect him to say purchases will continue until September next year at a reduced pace of 30 billion euros a month from the current 60-billion euro rate. A more gradual wind down of stimulus is expected to create more tempered moves in a market positioned for a relatively benign outcome, but there is a lot uncertainty and range of expectations, leaving traders positioning for a swath of results.

Turkey Troubles

The German government is now restricting financing to Turkey over an escalating political dispute. According to a report from Bloomberg, Germany is actively working to cut funding to Turkey from the country’s state-owned KfW bank, the European Investment Bank and the European Bank for Reconstruction and Development. All of the banks have imposed tighter restrictions, but have yet to cease funding. Germany isn’t the only country with which Turkey is having issues. The country has struggled with a number of its traditional Western allies as of late, including the U.S. America suspended visa services to the country last month. The hit from Germany could be particularly painful though, as it’s Turkey’s largest economic partner by far.

South Korea and Other Economic Data

First up on the data docket is economic growth out of South Korea. We’ll get fresh GDP numbers shortly, with expectations for year-over-year growth of three percent. Next up will be Vietnamese inflation, with the Consumer Price Index expected to sit at 3.1 percent, falling from 3.4 percent in the last report. After that there’s Hong Kong’s trade balance figures, with imports expected to rise 5 percent year-over-year and exports rising 5.9 percent.

Read more by Soren K.Group