Source: Michael J. Ballanger for Streetwise Reports 08/27/2018

Precious metals expert Michael Ballanger explains why he believes the tides may be changing for precious metals.

Feeling the psychological effects of a four-and-a-half month decline in gold and silver prices, I decided in July to refrain from trying to fight the forces of intervention and suppression for the balance of the summer and instead try to focus on companies that carry sufficient project strengths so as to (hopefully) withstand the debilitating pressure of commodity price weakness and ensuing investor apathy. However, the last two COT Reports (for gold and silver) have changed the landscape in a serious fashion to the extent that I now feel comfortable in calling the August 16 capitulation low in the December gold contract at $1,167.10 as "THE" low for the move and for the year. It further appears that the senior and junior gold miners have also marked their respective 2018 nadirs with the HUI (NYSE Arca Gold BUGS Index) touching 138.96 the very same day. The wretched TSX Venture Exchange limped into its 2018 low on August 15 with a print of 665.35 in tandem with copper where the December contract had its 2018 low at $257.45/lb.

These are across-the-board synchronized correlations and as I wrote about last week, the computer-driven "algobots" exacerbate and exaggerate every short-term trend in virtually all markets around the globe and since they never sleep, when Chicago shuts down, London picks up the reins and when London retires for the day, Tokyo carries the mantle such that over and over and over again, the pattern-recognition-driven algorithms implanted into the brains of the algobots feed upon themselves and overshoot their marks every single time, as happened on August 15 and 16 in (again) ALL markets. Now these pulse-less, robotic vermin are trapped and quite possibly, in deep trouble.

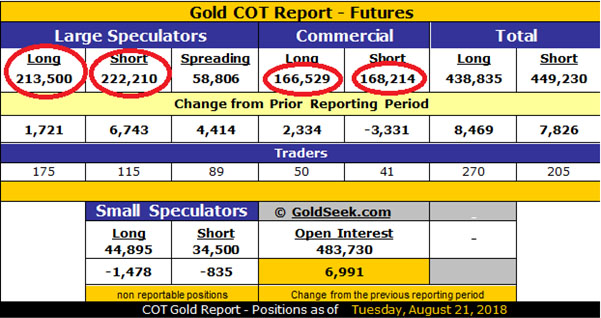

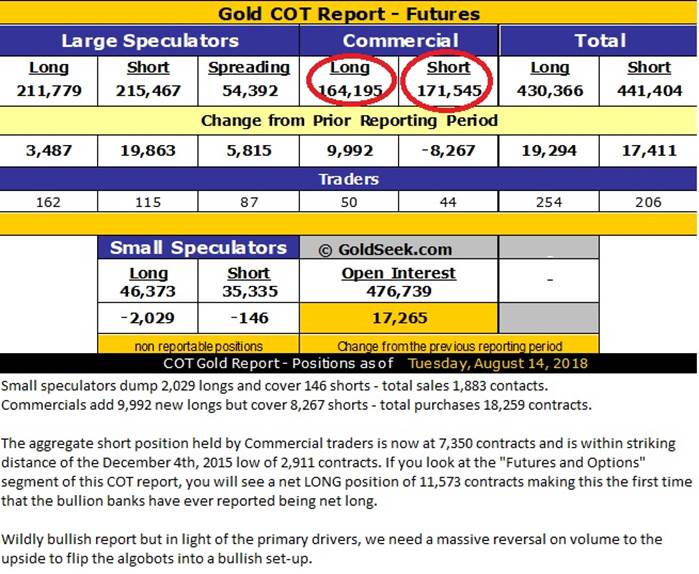

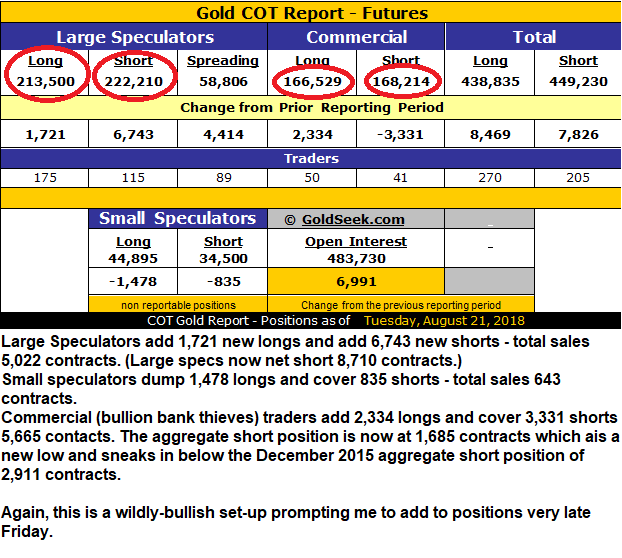

I wrote last week that the August 14 COT Report was "wildly bullish" and indeed the lows were seen immediately thereafter as we did indeed get that "massive reversal in volume to the upside" that we were all praying for. Below I have posted the August 14 COT and beside it is the August 21 COT so you all can see just how "crowded" the gold-short trade is right now. It is already nearly $50 off the August 16 lows and we aren't even through August yet. What pleases me to no end is that the seasonality trade finally kicked in so if the Indian wedding season (Diwali) and the restocking by the Italian jewelry trade is the fuel and fan required to ignite this tinderbox of dry twigs, we may be about to witness one of the biggest short squeezes of the last 50 years. Mind you, those primary drivers I spoke of last weekend are still forces with which to be reckoned and while I am placing bets on the good guys, I want additional evidence that the algobots have flipped over to BUY mode, which means these idiot computers will keep covering until they have stretched the market into massively OVERBOUGHT territory.

The SPDR Gold Trust (ARCA) (GLD:US)(U.S.$114.16) is the proxy most popular for the institutional community and is therefore highly liquid and infinitely visible. The GLD October $115 calls at $1.60-1.75 look friendly as a speculative bet on my earlier thoughts and might even surprise us as no one truly knows the impact of an algobot-driven, MINDLESS short squeeze if it grabs hold in the Crimex gold pit. The underlying premise for this trade is the notion that the elasticity of the gold volatility band will allow the 'bots to chase the market to an egregiously overbought condition, which, I should add, is somewhere around $127–129 on the GLD which was the range the last time RSI pressed through 70 (back in January). What I am targeting for this trade near-term is a range between the 50 and 200 dma marks at $116.44 and $122.38 respectively. With zero premium, that gives me a printed range of $1.44 to $7.38 as an exit price for the calls. If we get an acceleration to the UPSIDE approximately equal to the same downside deceleration seen in the past few months, the returns could be scarily good. If the "best-case" algos-gone-wild scenario takes hold, these calls will be worth $12–14 and I will be re-stocking the bar with single-malt by the liter as opposed to the "local blend" by the barrel, a welcomed change in all aspect and view.

As always, look in the mirror before you act upon these "suggestions" and make damn sure your wife knows about your activities because if you wind up blowing the money that was supposed to pay down your brother-in-law's credit cards, you are going to be sleeping in the guest bedroom. You will also be getting a visit from your brother-in-law's biker buddies over his drug debt, an item the nature of which his sister (your wife) conveniently forgot to mention AFTER WHICH you will be accused of gambling away the "family fortune," the origin of which was entirely the product of your work and effort. Life, as we know it, takes all turns and trials.

Back up the truck and caveat emptor.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Read more by MarketSlant Editor