Last week I was pleased to be the keynote speaker at the Denver Gold Show in beautiful Colorado Springs, Colorado. Attendance was strong, sentiment was up and my presentation on quant gold investing was very well received.

As I’ve explained before, our firm uses quantamentals in our gold investing process, combining old-fashioned, bottom-up stock picking with big data and machine learning. This allows us to screen for the best possible producers with the most attractive balance sheets. We prefer miners that have a proven track record of sustainable profitability even when precious metal prices are down.

It’s these quantamentals that went into the creation of our newest quant ETF, our first to launch in Canada.

On Friday, I was thrilled to be back in my hometown of Toronto, where Galileo team members and I had the privilege of opening the Toronto Stock Exchange. The TSX, as you may know, has a long history of being the world’s premiere marketplace for mining stocks, and in 2016, 57 percent of the world’s financing for mining companies was done on the TSX. It’s only fitting, then, that our new ETF is traded there.

I urge you to listen to the ETF Trends webcast in which Tom Lydon and I discuss the gold market today and the factors we use in picking the strongest gold stocks.

Prepare for Gold to Get Sloppy, but Backdrop Remains Strong into Year-End

Early last week, North Korea said it was interpreting some of President Donald Trump’s comments as a declaration of war, insisting it can freely shoot down American military planes even if they’re not flying in North Korean airspace. As everyone is pointing out, the country has made similar threats in the past, but with Trump as president, there could be an added level of unpredictability.

Ordinarily, we would expect geopolitical risk of this scale to boost the price of gold on increased safe haven demand. Instead, the yellow metal struggled last week to extend the gains it’s made in 2017 so far.

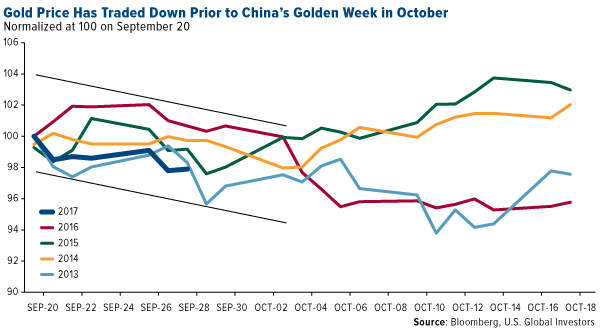

The main contributor to the pullback is likely the fact that markets in China will be closed this week in observance of Golden Week. Think of Golden Week as China’s Fourth of July—if the Fourth of July lasted for several days. This year marks the 68th anniversary of the founding of the People’s Republic of China.

Given that the country is the world’s largest gold market, the metal has in the past depreciated leading up to the week-long celebration. If you remember from last year, gold was knocked down significantly after someone dumped as much as $2.25 billion of the metal in the futures market, and on October 2, gold suffered its biggest one-day loss in three years. Last week it fell 1.33 percent.

As you can see above, gold immediately rallied following the correction in 2014 and 2015, but it continued to drop in 2013 and 2016.

There’s no telling what it might do this year, of course, but I believe this could be a good buying opportunity, as the fourth-quarter Indian wedding season has historically brought with it higher gold prices on stronger demand. The backdrop looks favorable for all metals, in fact, as we head into the final quarter of the year, with improving global economic and manufacturing activity suggesting demand could surge.

Granted, other factors besides Golden Week are putting pressure on gold right now. The U.S. dollar just had one of its best months of the year, and the real five-year Treasury yield turned positive. Keep your eyes on yields, though, because as soon as they turn negative again, gold could take off.

Then there’s the record-setting stock market, which might discourage some investors from seeking a safe haven. But I think it’s worth pointing out that gold has remarkably held its own during this bull run, closely keeping track with the S&P 500 Index in 2017. As of last Friday, the S&P 500 was up 11.6 percent year-to-date, gold 11.5 percent.

U.S. Ready to Reform Tax Code for First Time in More than 30 Years

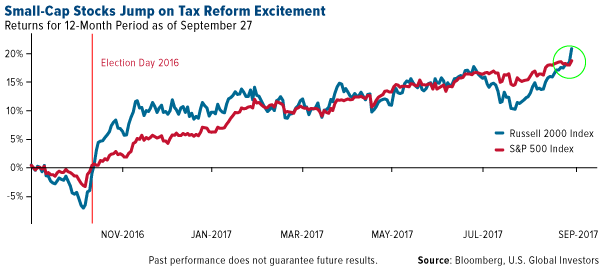

Small-cap stocks, as measured by the Russell 2000 Index, were among the biggest winners immediately following the November election, the idea being that Trump’s “America first” policies would benefit smaller, domestic companies with less exposure to foreign markets the most.

This trade was put on hold somewhat as Trump’s pro-growth agenda repeatedly stalled in Congress. But renewed talks of tax reform last week excited investors, helping to push the Russell 2000 back into record-closing territory. For the 12-month period, the index of American small-cap stocks is beating the S&P 500 by nearly 3 percent.

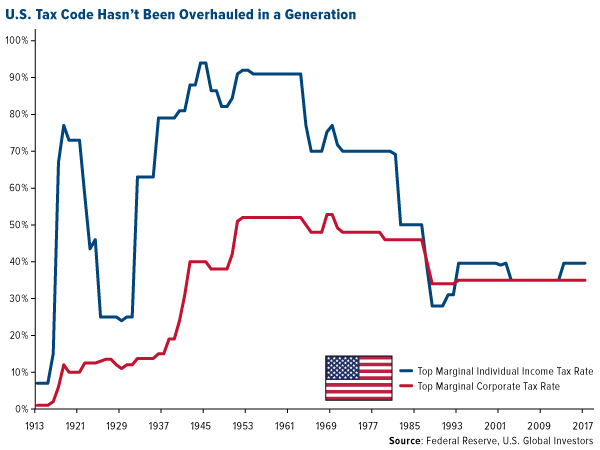

The bottom line is that Congressional Republicans—and Trump—need this win after the multiple failed attempts to repeal and replace Obamacare. Tax reform should be much easier to achieve, as there seems to be greater consensus on what needs to be done.

Indeed, the tax code has not been fundamentally changed in more than 30 years. If Trump gets his way, the number of personal income tax brackets will fall from seven to three, with the top marginal rate lowered from 39.6 percent to 35 percent.

The corporate tax rate, meanwhile, would be set at a more reasonable 20 percent, down from 35 percent—currently the highest rate in the world among developed economies. This should help U.S.-based firms become much more competitive, and ideally it would encourage multinationals to bring home the estimated $3.6 trillion in cash held overseas.

As I told Fox Business’ Liz Claman on her show recently, I’m very bullish right now, with global GDPs and the purchasing manager’s index (PMI) headed higher. U.S. tax reform should only encourage further growth, both here and abroad.

Stay Informed

Many exciting developments are coming down the pipeline! I’ll be traveling more, speaking to investors, executives and other business leaders. Make sure you’re subscribed to my award-winning CEO blog Frank Talk to stay in the loop!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Russell 2000 Index is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000. The Russell 3000 Index consists of the 3,000 largest U.S. companies as determined by total market capitalization.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

Read more by Frank Holmes