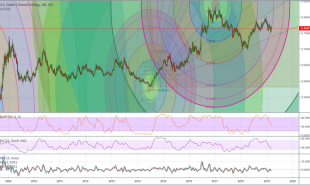

Chart: SPX red line:: gold is candle.

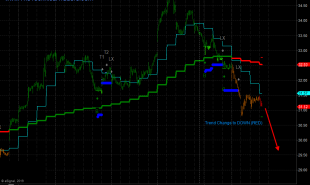

You call that a dip?

UPDATE: What happened today? Weren’t we supposed to selloff on a strong CPI number?

Dips may be harder to come by in this new regimeof fed indecisiveness.Up $5 may soon become the dip to buy..

For now, look for $1350 to be an option related magnet. If it breaks free from that, $1400 shouldn’t be a problem.

February 14, 2018

Fed Must Chase Inflation- Gold is a Buy

Written by guest contributor Vince Lanci

Cover photo: SPX vs Gold Daily.

CPI is strong today at 0.5 on expectations of 0.2 This makes the Fed more likely to raise rates. Per my interview with Daniela Cambone on Kitco to be posted later.

Sell the Rate Hike Rumor if You Must, But Buy the Hike News

When news comes out to justify interest rate hikes like CPI today.. gold and stocks will (should) sell off.

When (if) the rate hike actually comes.. Gold will be more likely to rally as the fed must lag inflation keeping real rates close to zero or negative to prop stocks.

H/T @CharlieBilello and Pension Partners

And the unintended consequences of Gold rallying as the Fed attempts to orchestrate an orderly low volatility type of descent in stocks will become obvious.

Gold traders should consider selling Gold and stocks on the data. And buy Gold on the actual hike in rates. Welcome to the 1970s.

“Buy the Dip” is no longer exclusive to stocks. It may soon become Gold’s mantra

Good Luck

VBL

Vince has 27 years’ experience trading Commodity Derivatives. Retired from active trading in 2008, Vince now manages personal investments through his Echobay entity. He advises natural resource firms on market risk. Over the years, his expertise and testimony have been requested in energy, precious metals, and derivative fraud cases. Lanci is known for his passion in identifying unfairness in market structure and uneven playing fields. He is a frequent contributor to Zerohedge and Marketslant on such topics. Vince contributes to Bloomberg and Reuters finance articles as well. He continues to lead the Soren K. Group of writers on Marketslant.

Read more by Soren K.Group