With the December's jobs report due at 830am ET on Friday morning, here is a quick recap of Wall Street consensus expectations, courtesy of RanSquawk:

PREVIEW: December Jobs Report

- Nonfarm Payrolls Exp. at 190K (range 160K-230K)

- Unemployment Rate Exp. at 4.1% (range 4.0%-4.2%)

- Average Hourly Earnings (Y/Y) Exp. at 2.5% (range 2.4%-2.7%)

- Average Hourly Earnings (M/M) Exp. at 0.3% (range 0.1%-0.4%)

The US is expected to have created 190K job in December (range 160K-230K), down from last month’s 228K but higher than the 2017 average so far which stands at 174K. While labor market fundamentals appear solid, some banks such as Goldman expect a deceleration from the pace of job gains in October and November, which benefitted from a sharp employment rebound in hurricane-affected states. They also expect a modest drag from winter storms around the December survey period.

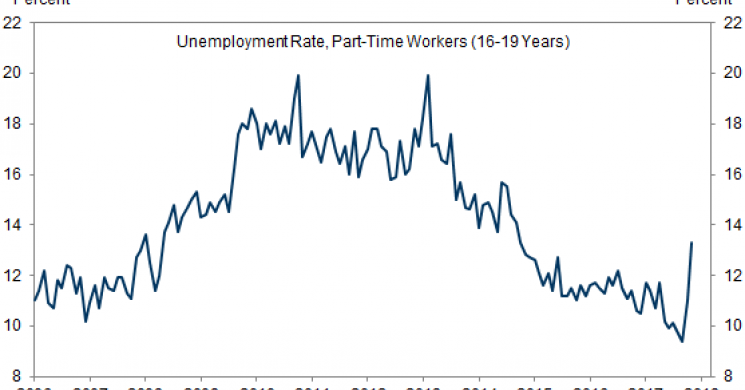

The unemployment rate is expected to remain at 4.1%, the lowest level since February 2001. Here, Goldman again differs from the consensus and expects a 0.1% decline in the unemployment rate to 4.0%, reflecting a reversal of the November spike in youth unemployment – which may have resulted from an earlier-than-usual household survey period.

November Unemployment Rate Would Have Rounded Down to 4.0% Were It Not For the Sharp Rise in Youth Unemployment

As has been the case recently, the market may be focusing on wage components for signs of inflation. Average hourly earnings are expected to increase at a faster monthly pace in December, rising 0.3% M/M (Prev. 0.2%), keeping the Y/Y figure at 2.5%.

* * *

Arguing for a stronger report:

Manufacturing-sector surveys. Manufacturing sector surveys were mixed in December, but most remain at solid or elevated levels. Our manufacturing employment tracker rose 0.2pt to 58.9, reflecting a sharp rise in the Dallas Fed employment subindex and an uptick in the Markit PMI measure, but a pullback in the ISM employment component. Manufacturing payroll employment rose 31k in November and has increased by 20k on average over the last six months.

Holiday transportation hiring. Transportation and warehousing payrolls have seen elevated growth in December in recent years (see Exhibit 1), often followed by softer growth or outright declines in January and February. This phenomenon reflects a combination of the secular shift toward online holiday sales and the slow evolution of the BLS seasonal factors. Given this and given indications of strong holiday shipments, expect tomorrow’s report to show above-trend growth in this category.

Exhibit 1: Expecting another Strong December for Transportation Jobs

ADP. The payroll processing firm ADP reported a 250k increase in December private payroll employment, above consensus expectations of +190k. The report likely received a sizeable boost from the post-hurricane rebound in nonfarm payrolls over the last two months – an input in the ADP model. Additionally, winter weather during the payrolls reference week likely weighed more heavily on the BLS measure, suggesting scope for nonfarm payroll growth to undershoot ADP in December. The main takeaway from the ADP report is that the underlying trend in job growth likely remains firm. “Some employers remove workers no longer with the company from the payrolls reported to ADP,” writes High Frequency Economics, “the Labor Department stops counting those workers as soon as they stop getting paychecks.”

Retail seasonality. The timing of the November and December establishment surveys will likely weigh on retail job growth in tomorrow’s report, as the early Thanksgiving (the 23rd) probably shifted the timing of holiday retail hiring into November from December in the payrolls data. Retail job growth was firm in the November report (+19k, a 10-month high), and December retail job growth has been flat or negative in each of the last three similar calendar configurations (-11k on average).

De-Escalation? Koreas Agree To Hold High-Level Talks Next…

North Korea is on a roll: just hours after that in a diplomatic victory for the Kim regime the US and South Korea…

* * *

Arguing for a weaker report:

Winter weather. Snowstorms during the survey period in the eastern half of the United States likely weighed on payroll growth in tomorrow’s report. However, banks do not expect a particularly pronounced impact, as the storms were generally not severe and many concluded early in the survey week. Here Goldman's population-weighted snowfall dataset was 1 inch above normal (survey week to survey week, see Exhibit 2), implying a payrolls drag from winter weather of between 10k and 20k in tomorrow’s report.

Exhibit 2: Winter Storms during the Survey Week Likely Weighed on December Payroll Growth

Neutral factors:

Service-sector surveys. While service-sector employment surveys declined on net in December – led by a drop in the Richmond and New York Fed measures – and Goldman's non-manufacturing employment trackers remains close to a 3-year high (-0.5pt to 54.9). Similarly, the Conference Board labor market differential – the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get – edged down but remains near a 16-year high (-0.2pt to 20.5). Service sector payroll employment rose 159k in November and has increased 138k on average over the last six months.

Jobless claims. Initial jobless claims averaged a new cycle low during the four weeks between the November and December payroll reference periods (236k). However, the year-to-date downtrend in continuing claims began to reverse in mid-November, and the most recently reported level is 18k above its October average. While the underlying pace of layoffs remains low and that labor market slack continues to decline, extracting the signal from the jobless claims data is not as clear-cut as it has been for most of the year.

Job availability. The Conference Board’s Help Wanted Online (HWOL) report showed a 4.9% increase in online job postings (mom sa), adding to the 3.0% rebound in November. While positive at the margin, limited weight is placed on this indicator, in light of research by Fed economists that suggests the HWOL ad count has been depressed by higher prices for online job ads. The Conference Board is currently reviewing its methodology accordingly.

Job cuts. Announced layoffs reported by Challenger, Gray & Christmas pulled back 4k to 39k but remain at the upper end of their year-to-date range. On a year-over-year basis, announced job cuts declined 2k.

* * *

Average hourly earnings likely increased 0.3% month over month and 2.5% year over year. This December’s payroll survey period is typically associated with above-average wage growth (the pay period ends on the 16th). Additionally, wage growth in Florida has not fully rebounded following hurricane-related distortions (+1.5% yoy in November after +0.7% in October and compared to the pre-hurricane three-month average of +2.8%). A further unwind of these effects – specifically a normalization of the workweek – could provide an additional boost to average hourly earnings growth in tomorrow’s report (or in coming months).

Tomorrow’s employment report will be accompanied by the annual revision to the household survey, with potential revisions to the last 5 years of seasonally adjusted household data. These revisions are typically minor, often producing small changes to the month-to-month profile of the unemployment rate that leave the quarterly trends intact.

Market Reaction

The initial market reaction is often dependent on the headline. A number higher than expectations often leads to USD strength and higher yields and vice-versa for a lower than expected number. However, as markets digest the components of the report and evaluate how this will impact Fed policy, the impact on markets can change. Higher than expected hourly earnings should keep the Fed on their hiking path although it’s unlikely that markets will begin to price in a rate hike this month. The Fed median forecast was for three rate hikes in 2018, markets are currently pricing in just 2 rate hikes this year, so a strong report could see markets begin to reprice and come into line with the thinking on the Fed. ING don’t expect the Fed to diverge from their ambition to hike three times this year, given the possibility of 3% GDP growth, as well as a hawkish rotation in regional voters.

Source: RanSquawk, Goldman Sachs

Read more by Soren K.Group