DOW(n) Jones?

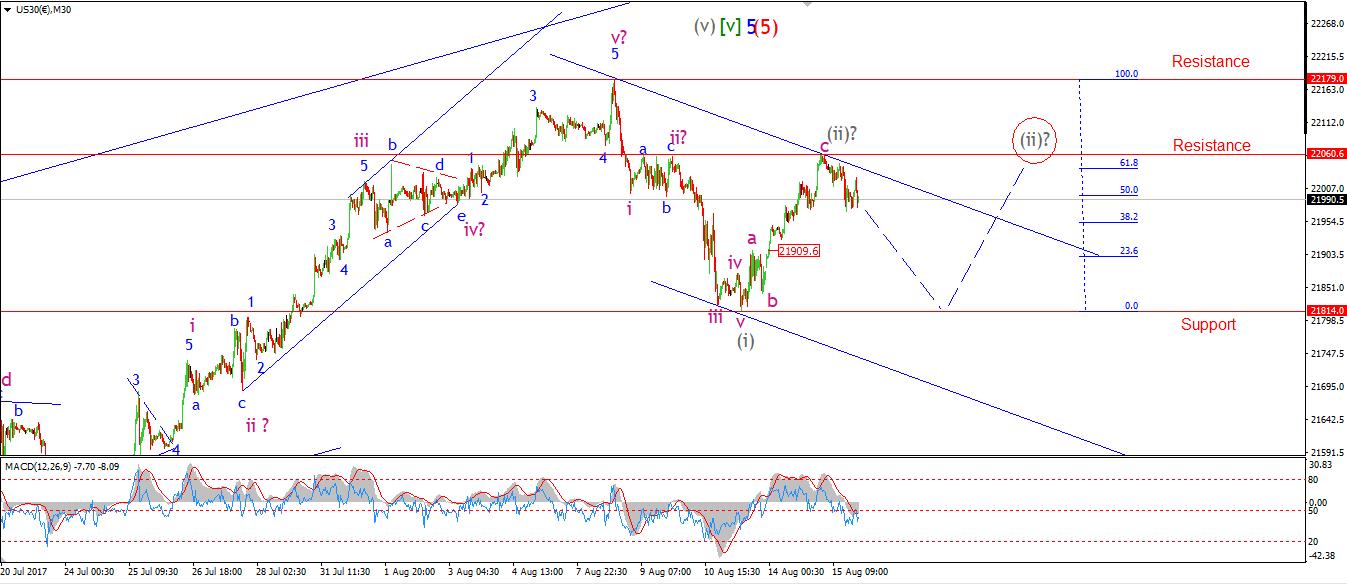

My Bias: market topping process ongoing Wave Structure: Impulsive 5 wave structure, possibly topping in an all time high. Long term wave count: Topping in wave (5) Important risk events: USD: Building Permits, Housing Starts, Crude Oil Inventories, FOMC Meeting Minutes.

Written Last Night

The rise in wave (ii) grey has stretched the limits of the corrective rally interpretation. With that in mind I have shown an alternate idea for wave (ii) grey.

This involves a flat correction three wave structure, The price would decline again into support and then rally to meet resistance. Lets see how this works out.

On the 4hr chart you can see that 21498 is the initial support, This is the low of the previous wave (iv) grey. A break of that level will be a far bigger confirmation of a turn into the bear market.

For tomorrow; Watch for todays high to hold, labelled wave (ii) grey at 22060 on my chart - (22023 cash). If the price again declines in a five wave structure, That will signal wave (iii) has begun.

Gold Holds?

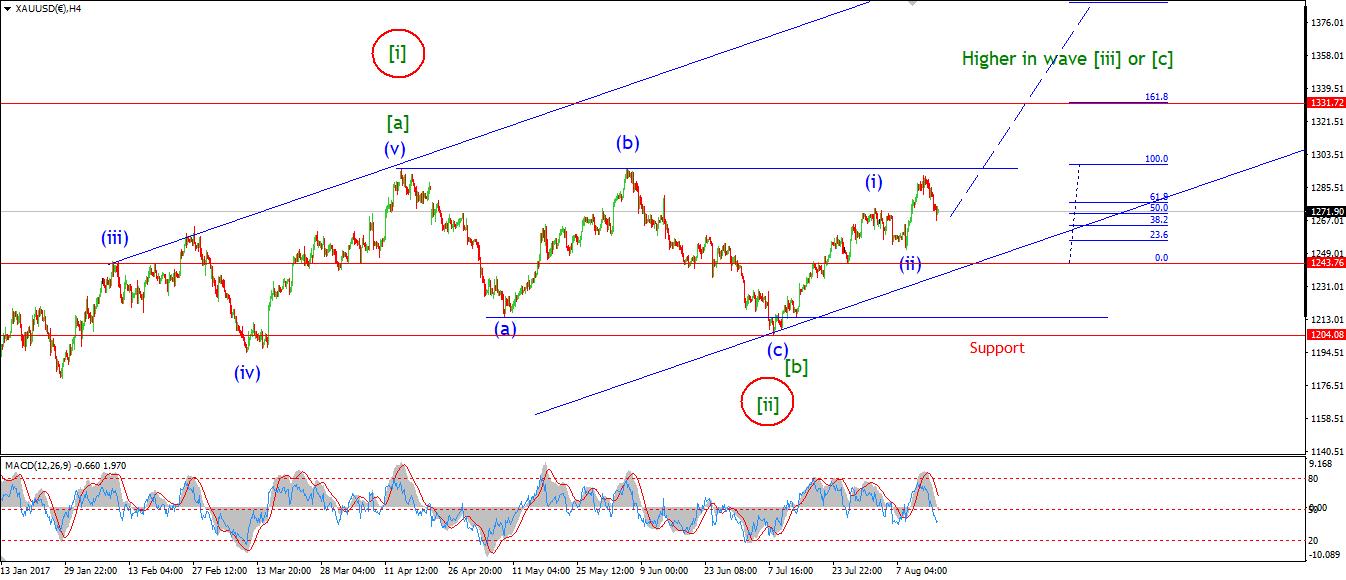

My Bias: Long towards 1550 Wave Structure: ZigZag correction to the upside. Long term wave count: Topping in wave (B) at 1550 Important risk events: USD: Building Permits, Housing Starts, Crude Oil Inventories, FOMC Meeting Minutes.

GOLD declined into the 61.8% Fibonacci retracement level today. Wave 'ii' brown did infact extend lower as suggested.

So far the bounce off todays lows looks to have halted the decline. If we get a break of the high of wave 'b' at 1285 it will signal wave 'iii' brown has begun.

Wave 'iii' is projected to reach 1332 at the 161.8% Fibonacci extension.

For tomorrow; Watch for 1267 to hold, and a rise into 1285 to signal a turn up again.

Fed minutes

Investors looking for clues as to the timing of the start of the unwind of the Federal Reserve’s $4.5 trillion balance sheet will be closely reading the minutes of the July FOMC meeting when they are published at 2 p.m. Eastern Time today. The minutes should also provide a guide as to how many policy makers agree with Federal Reserve Bank of New York President William Dudley that another rate rise may be needed before the end of the year. The dollar remained steady and the U.S. 10-year Treasury yield was at 2.282 percent this morning.

42-year low

Unemployment in the United Kingdom fell to 4.4 percent in the second quarter, the lowest since 1975, with basic wages rising 2.1 percent -- more than economists had forecast. While the Bank of England expects pay growth to remain below the rate of inflation for months to come, the outlook is for price rises to peak later this year. The British government has also published another Brexit position paper, this time on the Irish border, saying it wants no physical infrastructure on the 310-mile crossing.

Euro-area growth

The euro-area economy expanded 0.6 percent in the second quarter, in line with expectations, as continued growth in Germany and a strong Spanish performance showed the recovery has spread across the region. Italian growth extended into a tenth quarter, while the Dutch economy expanded by 1.5 percent in the period, the most since the end of 2007. The euro currency remained broadly unchanged at $1.1735 following this morning’s data.

Fed minutes

Investors looking for clues as to the timing of the start of the unwind of the Federal Reserve’s $4.5 trillion balance sheet will be closely reading the minutes of the July FOMC meeting when they are published at 2 p.m. Eastern Time today. The minutes should also provide a guide as to how many policy makers agree with Federal Reserve Bank of New York President William Dudley that another rate rise may be needed before the end of the year. The dollar remained steady and the U.S. 10-year Treasury yield was at 2.282 percent this morning.

DOW JONES INDUSTRIALS

My Bias: market topping process ongoing Wave Structure: Impulsive 5 wave structure, possibly topping in an all time high. Long term wave count: Topping in wave (5) Important risk events: USD: Building Permits, Housing Starts, Crude Oil Inventories, FOMC Meeting Minutes.

The rise in wave (ii) grey has stretched the limits of the corrective rally interpretation. With that in mind I have shown an alternate idea for wave (ii) grey.

This involves a flat correction three wave structure, The price would decline again into support and then rally to meet resistance. Lets see how this works out.

On the 4hr chart you can see that 21498 is the initial support, This is the low of the previous wave (iv) grey. A break of that level will be a far bigger confirmation of a turn into the bear market.

For tomorrow; Watch for todays high to hold, labelled wave (ii) grey at 22060 on my chart - (22023 cash). If the price again declines in a five wave structure, That will signal wave (iii) has begun.

GOLD

My Bias: Long towards 1550 Wave Structure: ZigZag correction to the upside. Long term wave count: Topping in wave (B) at 1550 Important risk events: USD: Building Permits, Housing Starts, Crude Oil Inventories, FOMC Meeting Minutes.

GOLD declined into the 61.8% Fibonacci retracement level today. Wave 'ii' brown did infact extend lower as suggested.

So far the bounce off todays lows looks to have halted the decline. If we get a break of the high of wave 'b' at 1285 it will signal wave 'iii' brown has begun.

Wave 'iii' is projected to reach 1332 at the 161.8% Fibonacci extension.

For tomorrow; Watch for 1267 to hold, and a rise into 1285 to signal a turn up again.

Read more by Enda Glynn