On June 9, 2017, the shareholders of oil major ExxonMobil enjoyed an incredible milestone. The company paid a quarterly dividend of 77 cents per share.

This dividend payment was larger than the one ExxonMobil paid to shareholders at the same time as the year before, and marked the 35th consecutive year ExxonMobil increased its dividend payment.

When you consider how the brutal competition of capitalism makes it difficult for most companies to even pay dividends – let alone steadily increase them for years year – you realize 35 consecutive years of dividend raises is an impressive accomplishment.

Because of dividend records like this, many investors view the dividends paid by ExxonMobil and its Big Oil peers such as Chevron, Shell, and BP (British Petroleum) as sacrosanct… income streams you can count on during retirement. Big Oil has paid reliable dividends for so long that many investors see their Big Oil shares like they would grandma’s ring or the family farm.

And you read it here first: If Big Oil companies want to be seen as steady dividend payers for years into the future, they are going to need to become Big Green. They are going to have to get into solar, wind, and hydroelectric energy in a big way.

I know many will view my suggestion as ludicrous. But after you review the data and facts as I have, I’m confident you’ll agree.

An Unstoppable Trend in the World’s Biggest Business

The business of providing energy to power our cars, trucks, airplanes, factories, and homes is the biggest business in the world. And it’s changing in a big way.

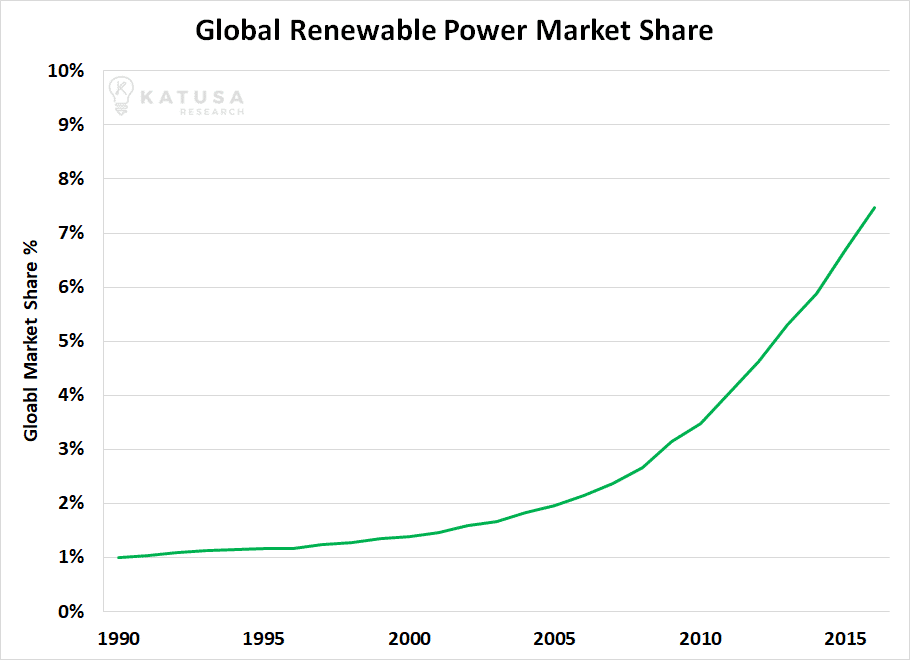

In the year 2000, renewable energy (solar, wind, hydro, etc.) provided 1.4% of the world’s power. Since then, renewable energy’s share of the global power market has increased to 7.5%. It’s a stunning share increase of more than 400%.

The chart below shows the global market share of renewable power since 1990.

Renewables are grabbing more market share because they are getting cheaper. As I’ve written many times in the past few years, the cost of renewable energy sources like solar and wind power have plummeted in the past decade. In many areas, unsubsidized solar and wind power is now cheaper than power generated by burning fossil fuels. Plus, the political pressure to move from fossil fuels to renewables is incredible. It’s not going away.

The world isn’t going to stop using oil for a long time. There will money to be made in oil for a long time. However, the best days of fossil fuels are in the past. The world’s largest oil companies know it. But that doesn’t mean Big Oil has to shrivel up and die. Smart oil executives don’t see themselves as just in “the oil business.” They see themselves as being in the “energy business.” If that energy comes from oil, natural gas, solar, or wind, then so be it. Smart oil executives know the transition from dirty energy to clean energy will be the biggest strategic shift in their market in the coming decades.

Big Oil has ignored renewable energy for a long time. But we’re starting to see a shift in its thinking.

***For example, in 2016, the French supermajor, Total SA, acquired green energy storage manufacturer Saft for $1.1 billion.

***Statoil, Norway’s National Oil Company, partnered with Alterra Power Corp and the National Energy Authority of Iceland to drill the deepest geothermal well in history.

***And perhaps most significantly, the European oil giant Royal Dutch Shell is looking into buying Equis Energy, Asia’s largest green power producer. Equis Energy has put itself up for sale and Shell and a handful of large pension funds are evaluating it. There is no formal offer from Shell yet, but I believe Shell will make a bid. I think it’s a savvy business move. Buying Equis Energy would provide significant perpetual cash flow and dividend potential.

Equis Energy is a private company, so financial details are scarce. At the project level, Equis Energy has assets in Indonesia, Japan, Taiwan, Philippines, Thailand, Australia and India. Total operational green power capacity is 4.4 gigawatts. This is enough electricity to power over a million homes.

Furthermore, Equis Energy has a robust pipeline with an additional 6.7 gigawatts of development stage green power production capacity. Using industry average capacity factors and efficiency rates, Equis Energy likely generates between 10 to 12 terawatt hours (TWh) of green power.

Its reported that the purchase price being considered for Equis Energy is $5 billion. This yields an implied valuation of approximately $440 per MWh of green power production. Compared to industry averages, this is a high multiple.

Why Green Energy Offers Safety and Stability

Big Oil executives have to make multi-billion dollar capital allocation decisions that have 15 – 30 year time frames. Their projects are among the biggest and most expensive projects on Earth. They have to think very big and very long-term.

When it comes to investing $5 billion in an oil and gas project, oil executives face many unknowns. What kind of engineering challenges does the project present? How will electric cars affect future oil demand? How will developing nations like China and India affect future oil demand? How will plunging costs of solar and wind energy affect demand for natural gas (which is also used heavily in power generation). When you’re putting billions of dollars to work, the less unknowns, the better.

That’s why Shell is considering a multi-billion-dollar investment in green energy. Shell CEO Ben Van Beurden stated that the company has changed its mindset to a “lower forever” oil price environment. A lower forever mindset means less capital expenditures invested in expensive offshore oil projects or projects in remote areas with little infrastructure and far from refineries. These large conventional oil deposits are what currently move the oil production and cash flow needles for Big Oil.

Big Oil’s attraction to green energy is the long project life and cash flow stability which comes with it. The average life span of a wind or solar farm is 25 years. Owners of green energy projects can sell their power through guaranteed, multi-decade contracts called purchase power agreements (PPAs).

Backed by a PPA, the cash flow generation from a green energy asset can be easily modeled for its entire life. Then, a wind farm, for example, can be updated with newer and even more efficient wind mills and have another life of 25-30 years.

Big Oil doesn’t like taking big risks. Big Oil wants stability and the ability to pay its shareholders solid dividends every quarter. Compared to power generation projects, long life conventional oil projects carry massive price and project execution risk.

For example, Shell recently spent $5 billion drilling oil exploration wells off the coast of Alaska. The results yielded no oil and $5 billion vanished from Shell’s bank account, never to return. Not only that, the chances that the project would have been deemed economic at $50 oil are slim. Compared to that experience, buying Equis for $5 billion makes a lot of sense.

Historically, Big Oil stayed away from renewables because it cannibalized the fossil fuel business.

Big Oil now knows it either must adapt to the new reality or be left behind. There is no risk in cannibalizing the fossil fuel market. We know this because nearly every country in the world has signed agreements to lower carbon emissions. We now have car companies like Tesla and BYD building affordable electric vehicles. Utility companies like Duke Energy and Dominion Energy are building renewable power plants. Companies like Facebook, Microsoft, Google and Amazon are signing offtake agreements for green power generation.

Even Saudi Arabia is getting into the green energy business. Saudi Deputy Crown Prince Mohammed bin Salman wants Saudi Arabia to spend over $30 billion on the country’s renewable energy sector. It’s a brilliant plan for his nation. It is exactly what Saudi Arabia should be doing. In fact, Russia should follow Saudi Arabia’s lead. In 50 years, Saudi Deputy Crown Prince Mohammed bin Salman will be seen as the most visionary of all the Kings before him because he diversified the country out of its dependence on oil.

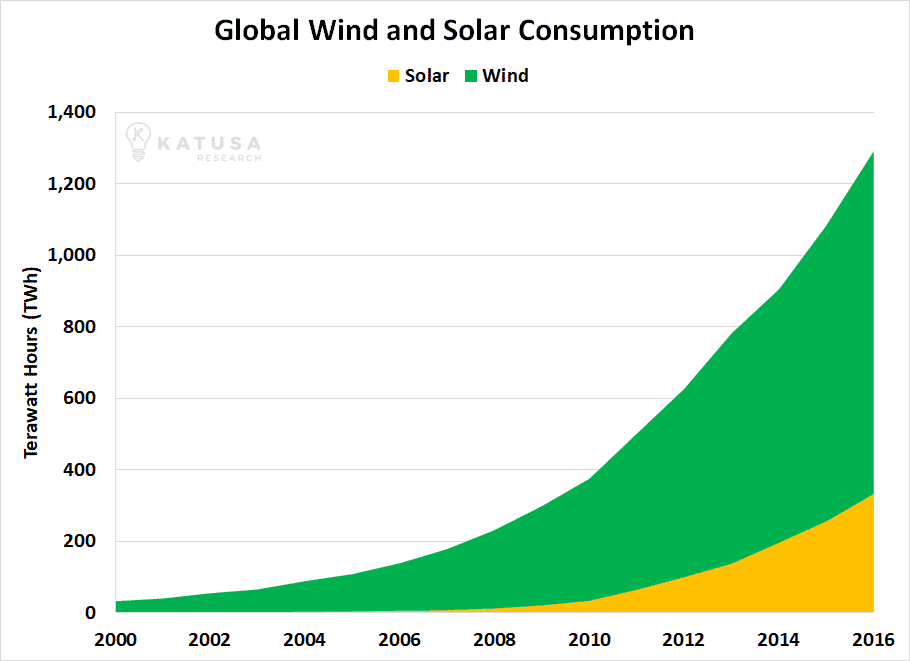

With or without Big Oil’s involvement the green energy revolution will happen. The chart below shows the increase in global wind and solar power consumption from 2000 to 2016. The increase in global green power consumption is over 750%. It’s a strong trend that will not reverse.

Right now, Big Oil controls about 17% of the world’s oil and gas production and less than 1% of the world’s renewable energy production. If Big Oil companies want to maintain their status as elite dividend payers – and avoid getting swept under the fossil fuel rug – they must begin acquiring renewable power assets. Big Oil needs to become Big Green.

Regards,

Marin Katusa

P.S. In the July issue of Katusa’s Resource Opportunities, my team and I put together a watch list of oil companies to buy at alligator prices. The correction we foresaw in these companies is happening at a rapid rate which means they’re becoming very attractive. Subscribers will have the chance to buy these great companies at fantastic valuations. To come on board as a subscriber and get the names of these companies on our target list, click here.

Disclosure

Neither Katusa Research nor Marin Katusa own shares in the companies mentioned in this article.

No members of the Katusa Research Team have received any commission or other compensation to feature any company mentioned in this newsletter nor are they party to any financial arrangement regarding the securities of such companies or any person who has any interest in such securities. The information contained in this publication is not intended and does not constitute individual investment advice and is not designed to meet your personal financial or investment situation or needs. Neither Marin Katusa nor Katusa Research are registered broker-dealers or financial advisors. Never make an investment based solely on what you read in an online newsletter, including this newsletter, especially if the investment involves a small, thinly-traded company that is not well known. Past performance is not indicative of future results. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks, it is possible to lose your entire investment. Information contained in such publications is obtained from public sources believed to be reliable, but its accuracy cannot be guaranteed. Further, the views expressed herein are of Katusa Research as of the date hereof, are subject to change and the Katusa Research Team does not undertake any obligation to update such information or views. None of the members of the Katusa Research Team shall be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. The information in this publication reflects the current opinion of the publisher, is subject to change, and may become outdated. The publisher undertakes no obligation to update any such information.

Unauthorized Disclosure Prohibited. The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Katusa Research reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report

Read more by Marin Katusa