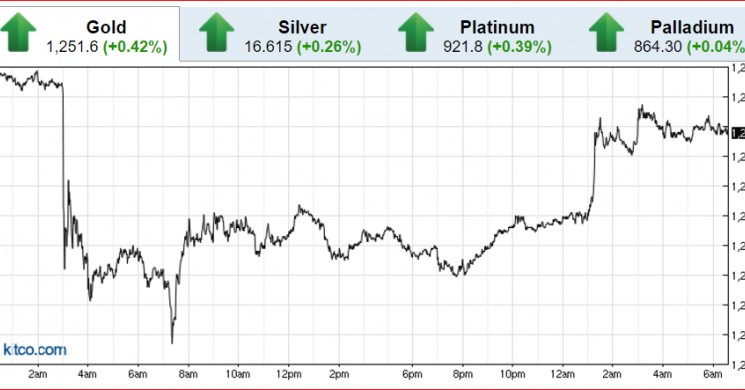

Could it be that the seller during London hours now known as "fatfinger" covered this morning? Gold is $15.00 off the lows made yesterday and someone got hurt.

We do not know who bought, but we can say that the catalyst was Draghi's speech. He turned hawkish after extolling the virtues of easy money only a week ago. This caused the EURO to spike hard vs the USD. It also triggered a sell-off in bonds. Here are the related market moves.

The EURO rallied on Draghi's rhetoric

German Bond yields spiked as well

So that all makes sense in context. But who got hurt if anyone? Based on yesterday's activity we can narrow it down to a couple things that happened.

Yesterday was almost definitely a commercial laying off metal after a large Fund or player hit his bid on size. The Dealer probably sold a little extra to surf the sell-off. That Fund was possibly getting out ahead of the Draghi, FOMC, Japan jawboning 48 hours. We are pretty confident of that.

Peter Hug also noted the selling was a commercial yesterday. He also noted the move was out of proportion to the other things going on:

Gold took a solid hit at the Asian close, but no new fundamentals presented themselves to justify the 1% drop. It appears a large commercial order hit the market at the close and pushed gold to the next support level we outlined last week at $1,237. Equity markets appear to be set for a higher open and the dollar is somewhat stronger but both factors are likely not responsible for the drop. Full story here

Today's buying was not necessarily the same player who sold. But let's say itwas for this assessment. If a fund sold yesterday and bought today they may not have gotten hurt at all. in one possible scenario a fund that had been long from the $1220 area decided yesterday was a good time to sell with all the jawboning coming. After Draghi reversed his tone from last week, that player may have just said "Screw it, let's get back in" for whatever reason.

Look for movement this morning when Yellen speaks.

She is scheduled to take part in a discussion on global economic issues at London's British Academy. Ahead of that, the dollar slipped 0.5 percent against major currencies. She will likely reiterate the central bank's positive views about the U.S. economy and the Fed's stance of raising interest rates once more this year, said OCBC analyst Barnabas Gan.

Right now spot Gold is $1250 last up about $5.00 from yesterday's physical market close. Live prices HERE

Read more by Soren K.Group