GOLD bullish at 3 degrees of trend!

GOLD

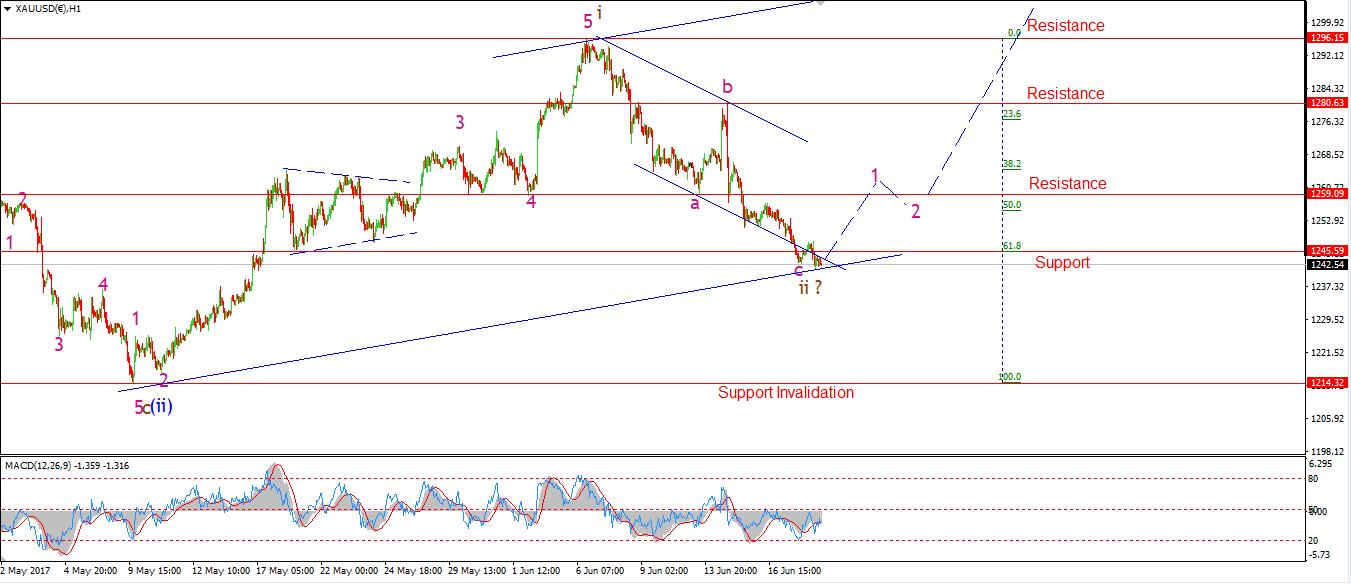

30 min

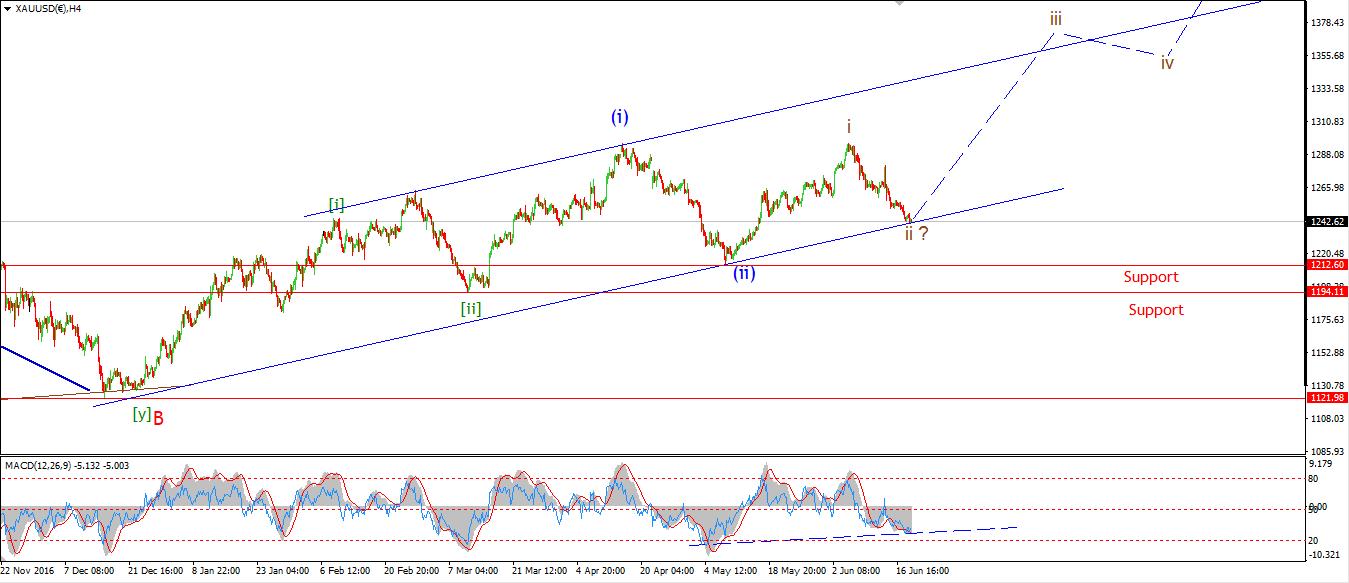

4 Hours

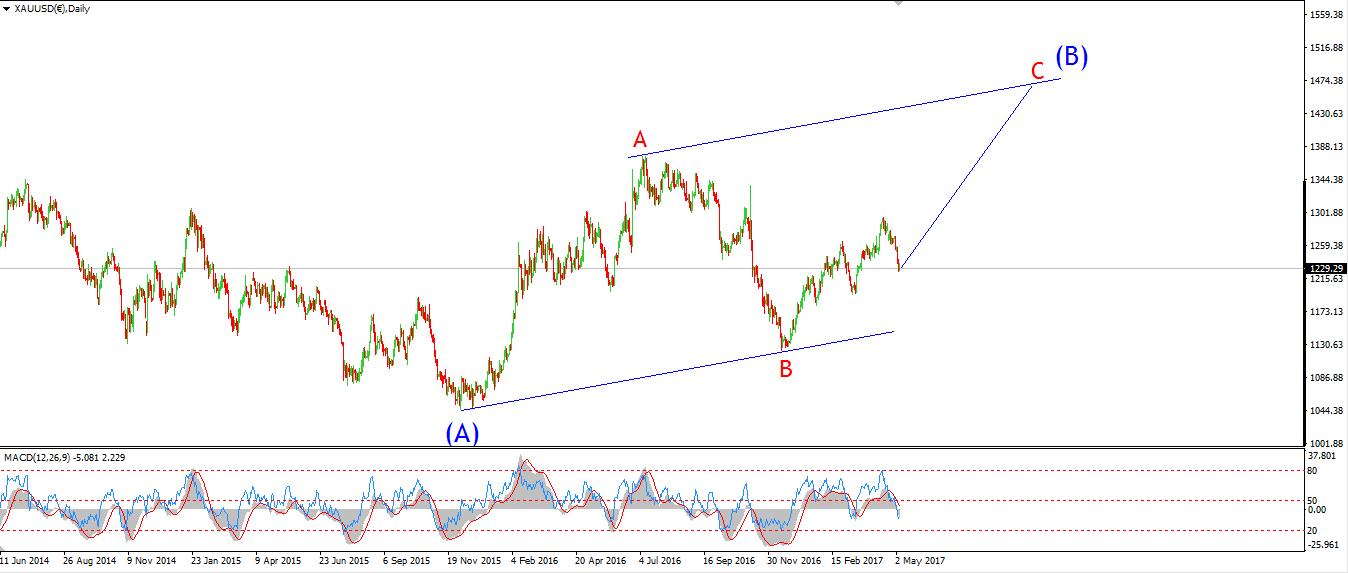

Daily

My Bias: Long towards 1550 Wave Structure: ZigZag correction to the upside. Long term wave count: Topping in wave (B) at 1550 Important risk events: USD: Existing Home Sales, Crude Oil Inventories.

Downside momentum in GOLD has now flatlined after todays sideways action. Wave 'ii' brown is now likely complete at the lows of the day of 1241.23.

Remember this market has now completed a rally and decline to higher lows at three degrees of trend over the last six months. I believe we are now on the cusp of a serious acceleration higher in the GOLD price.

The momentum situation is very bullish again on all three charts. And this setup coupled with the bullish wave count should make even the most skeptical onlooker sit up and take notice.

Wave 'iii' brown will begin with a break of 1259.09 and a correction to a higher low. I have shown that possible rise as waves '1' and '2' pink.

For tomorrow; Look for signs of a turn higher, And an Elliott wave buy signal off the lows.

DOW JONES INDUSTRIALS

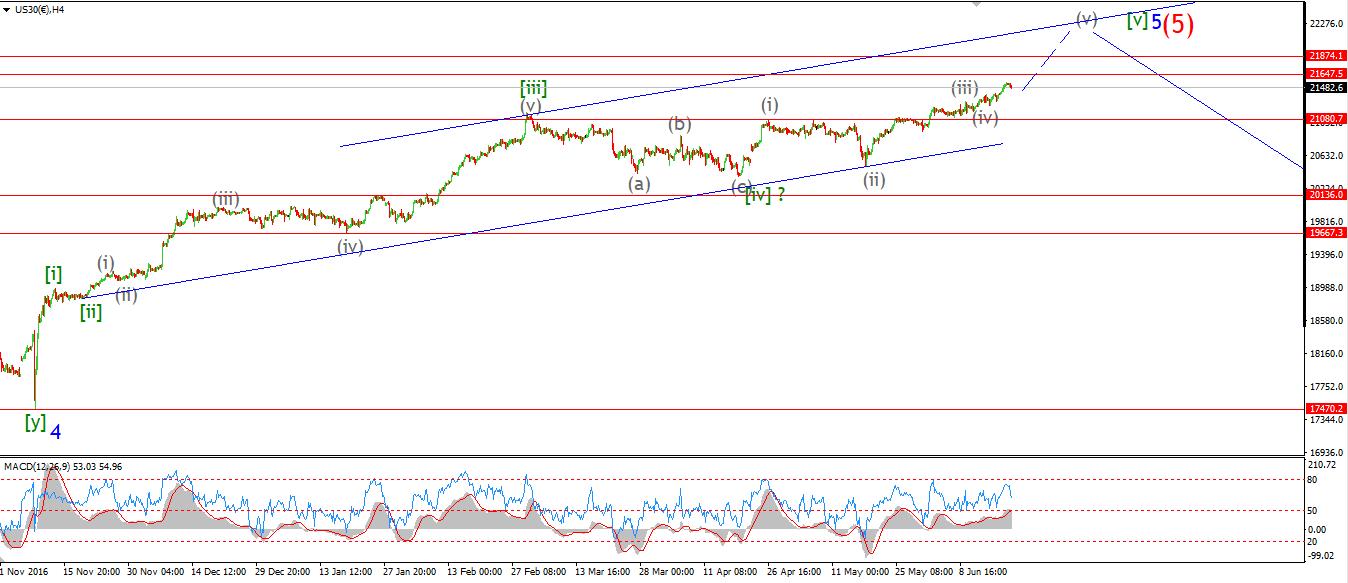

30 min

4 Hours

Daily

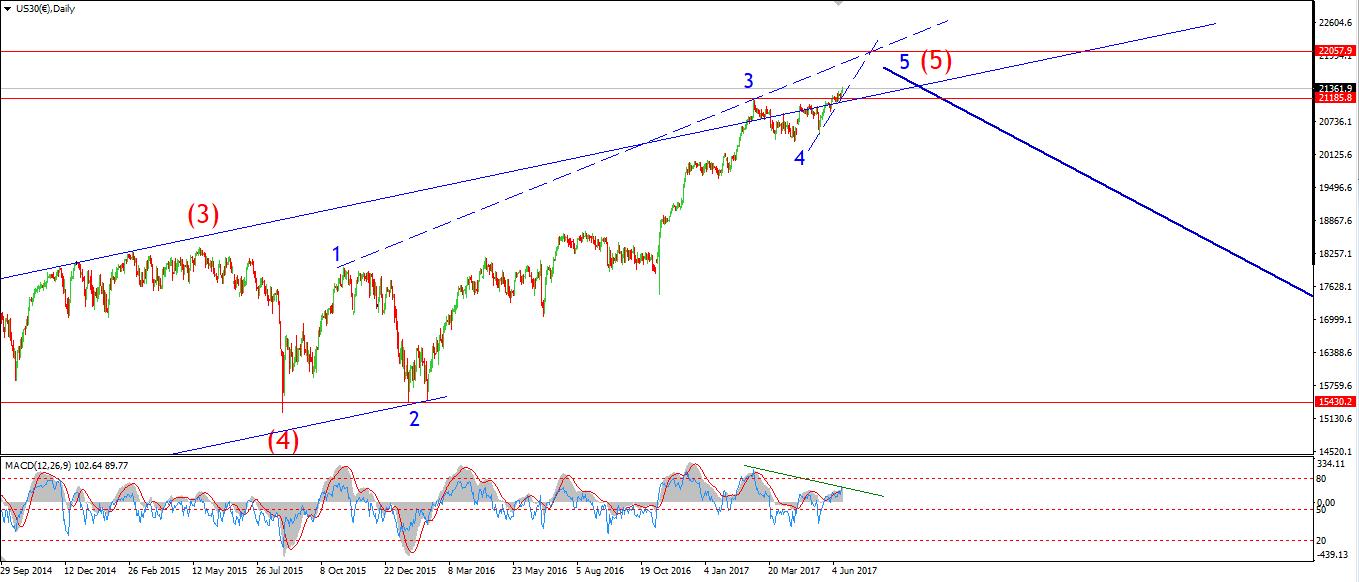

My Bias: market topping process ongoing Wave Structure: Impulsive 5 wave structure, possibly topping in an all time high. Long term wave count: Topping in wave (5) Important risk events: USD: Existing Home Sales, Crude Oil Inventories.

The DOW topped in wave '3' blue today at 21539. And wave '4' blue dropped back into the rising trend line as expected.

The low of the day so far reached 21464. As I mentioned last night wave '4' blue should not drop into the price territory of wave '1' blue. That level lies at 21407. I am watching the level at 21455, Which is the 100% projection of wave '1' blue. This level should offer support to the market.

For tomorrow; Watch for a higher low above 21455. This will signal wave '5' of 'iii' is under way. Wave 'iii' pink is projected to reach 21586.

Read more by Enda Glynn