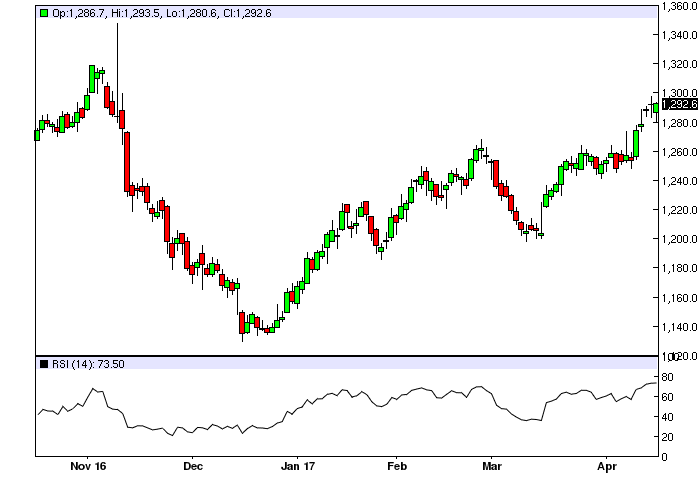

Gold is up on the day after taking a beating this morning as someone dumped about 10k contracts. More on that later. For now..

Gold may 'sky-rocket' on weak dollar and rising geo-political tensions

Bullion has risen 11% this yearvia Tom Eckett and investmentweek.co.uk

Gold's strong run could continue as the US dollar weakens and investors seek safe-havens in the face of increasing geo-political risks, according to Prestige Economics.

The price of gold bullion has risen 11% this year as investors look to the commodity as a refuge from the uncertainty surrounding US President Donald Trump's political and economic policies.

Gold bullion rose 0.8% to $1,296 per ounce on Monday, its highest level since 9 November, but has since fallen back. Bullion is currently trading at $1,287 per ounce.

Jason Schenker, founder of Prestige Economics told Bloomberg: "Gold is going higher here. We see a gradually weakening dollar on trend.

"Although we expect two more rate hikes this year - September, December - and four rate hikes next year, what we also think is that a lot of that is priced in."

US equity funds see biggest outflows since Brexit vote

Markets are responding to geo-political tensions across the globe, especially military actions from the US.

Last month, investors went into risk-off mode as opposition from his own party meant Trump failed to pass his healthcare reform bill in Congress, prompting a fall in the US equity markets.

Meanwhile, this month, the US bombed Syria and the Islamic State in Afghanistan,while Trump said he was willing to consider a military strike on North Korea after a ballistic missile launch by the country failed.

Furthermore, in a survey conducted by Bloomberg last week, analysts were the most positive on gold since December 2015.

Schenker added: "If we get weak Q1 GDP numbers, equities are going to take a big hit, the dollar is going to take a big hit and gold is going to sky-rocket."

Read more by Soren K.Group