The S&P 500 index is up more than 14% in 2017, and for the first time in 3-decades the large cap index did not retrace more than 3% during the year. Volatility is subdued despite the nuclear standoff between the United States and North Korea, and a Federal Reserve that will likely increase rates in December. Stocks have run up quickly, and despite robust earnings there is a catalyst on the horizon that could be the impetus for the next stock correction. One way to take advantage of a correction in equities is by investing in gold bars or gold coins

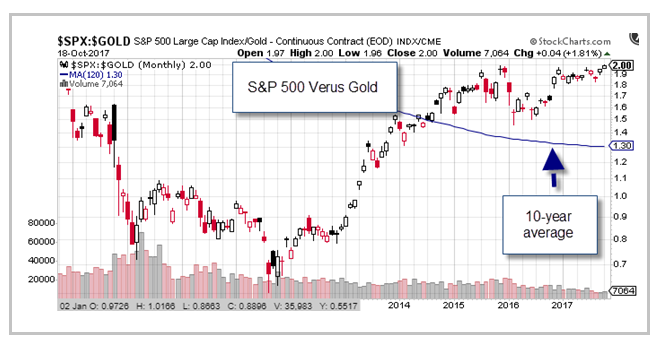

Stocks prices have run up sharply since the November 2016 election and over the past 5-years have outperformed the yellow precious metal by more than 300%. The chart of the S&P 500 index shown as a ratio relative to the spot price of gold, shows that the ratio has soared favoring stock prices as investors sentiment surged to a new all-time high. In fact, the consumer confidence has recently surged to a 13-year high. The University of Michigan index finally recently broke out improving to the highest level since early 2004.

The chart of the ratio between the S&P 500 index and spot gold prices are near 10-year highs, and are 55% above the 10-year average. A correction in stocks, which is a 10% or more contraction in prices, would likely be met with large rally in gold prices to reach the same 10-year average ratio between the S&P 500 index and gold prices, which was last seen in 2014.

With stock prices climbing it’s only a matter of time until a correction takes hold. When that time comes, you want to be prepared and one of the best ways to generate gains during volatile market conditions is to purchase bullion products or gold coins.

What is difficult to determine is the timing of when stocks will start to correct. If you listen to market pundits you will hear all sorts of opinions, but what is clear is that investors have been holding on, despite record low volatility and the lack of any meaningful correction in the past 12-months.

What seems clear is there is a plausible reason that stock investors are not willing to sell yet. The most likely reason is that investors are not willing to sell until they determine if there will be a new tax rate. With the administration and congress working hard to get a tax cut in place before year end, investors will potentially hold their stocks until year end. In fact, Warren Buffet told Becky Quick of CNBC in a recent interview that he was not going to sell until at least 2018, because he did not want to pay hundreds of millions of dollars in taxes that he would forego if a new policy was put in place in 2018. Unfortunately for stock investors, once the calendar turns to 2018, most investors will attempt to take profit, and will not hold on for another year.

Nobody has a crystal ball, but it seems obvious that a correction in stock prices is in the cards, as the calendar flips to 2018. Make sure you have a diversified portfolio that will allow you to take advance of rising gold prices, which will help you add gold bars or gold coins to your portfolio.

Good Investing

Treasure Coast Bullion Group

Read more by Treasure Coast Bullion Group, Inc - Staff Writer