Keeping it Real

Stocks at about 9 am this morning.

End of Day. Problem solved!

Are you joking?! This is ok to our government?

On average things are ok to the guy with a foot in hot coals and the other on dry ice too.

Update Feb 6: we have broken $1330 in spot on the back of a complete lack of buying during the chaos of the past 2 days. I suppose we should be thankful that Gold didn’t rally during the onset of panic. It would only get punished that much more.. remember election night?

All this means to us is an inability of the government to be able to implement their “normalization” of the balance sheet.... YET. Translation: using short term rate hikes to offset increased debt ain’t gonna cut it for the stock market. We say yet, because the experiment will not end until they are satisfied or you are broke. In the end, a permanent monetization of our debt will likely occur.

That could manifest itself in issuing 100 year bonds, or just 30 year bonds with increasing taxes on citizens both directly, and by debasing the dollar so you can’t do anything but buy American. Which is fine if you have open market economics. But we won’t.

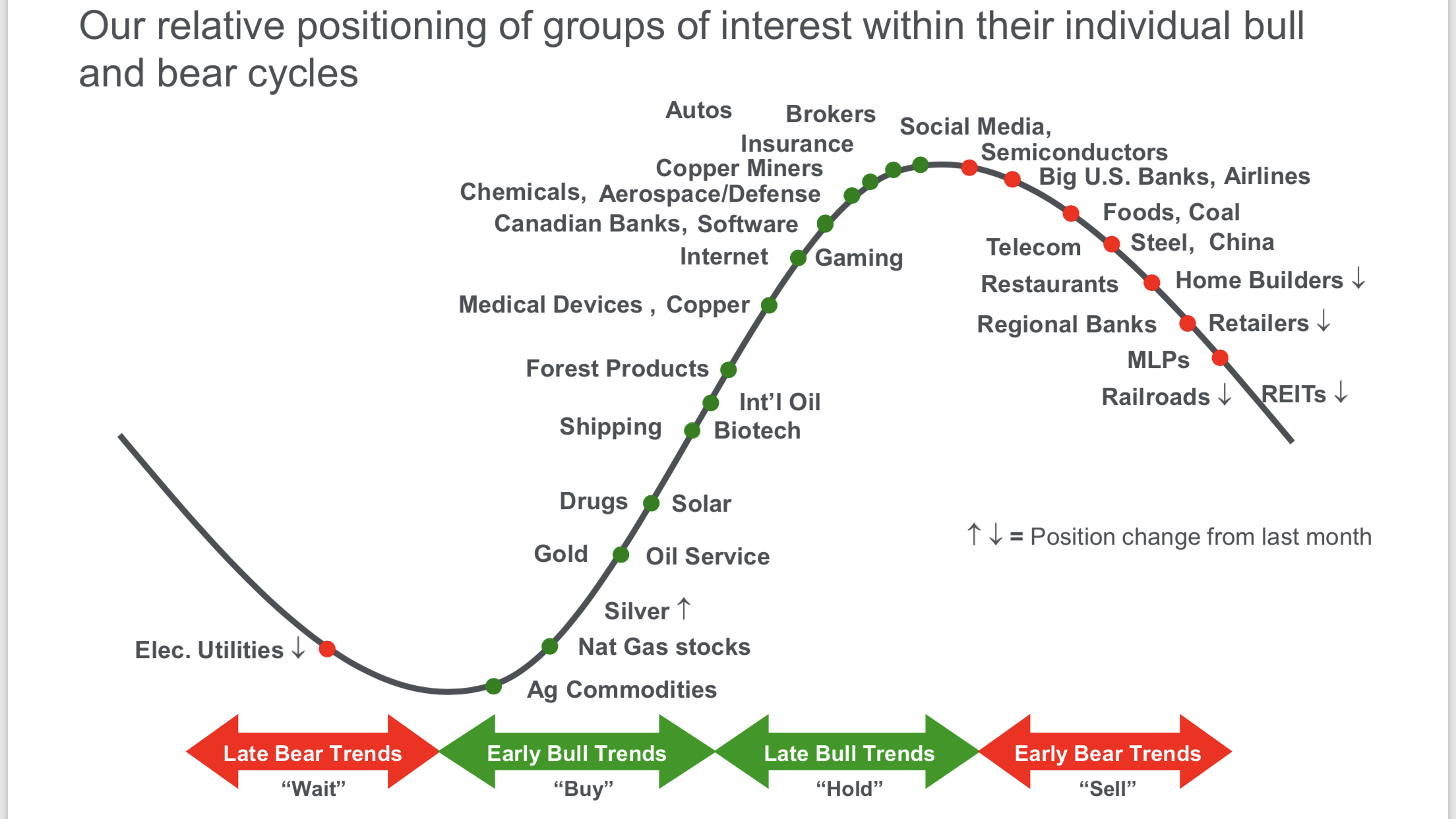

We will be captive clients for US companies that will be able to raise prices in weakened USD terms to just under what a foreign substitute would cost. MAGA! Or rather MACompaniesGA. You have to be long a hedge for the coming 1970s inflation repeat. Here are some charts updating calls in this same post a couple days ago for the trading community, based on our systems.

Hourly: the damage is done- oversold. Not something to focus on now.

Daily: bad under $1320. Focus is on this chart for us.

Weekly: bad.

Monthly: still looks good.

End update

Original post: We asked you earlier today to pay attention. We hope you did

This broken bull flag is bad...

This non confirmation weekly close is worse..

While it may seem like Armageddon, and Gold May in fact be at the beginning of a precipitous drop, that isn’t a complete given though the cash market did trade there. We actually did not settle under $1330

Further, Gold is suffering as an ebb tide sinks all boats. Stocks will sink more over the next 5 years for sure. Gold, we feel idle about to present us with a nice buying opportunity.. all courtesy of the fed and its attempt to get ahead of this QE unwind it is starting. Normal balance sheets mean valuations matter.. and that means the world of the “real” asset will become more relevant.

To Wit

via George Gero

Just saying:

This post is basically a reminder of what we’ve been saying for the last 3 months here. If you’d like to catch up for the next leg of fireworks, be our guest.-Signed, Soren K

Writing on an iPhone from the road. Apologies to the spelling teachers and people looking for properly embedded links.

Here’s What We Said and How Gold Got Here

3 Days Ago:

The reality is- if the 60 minute bearishness doesn’t reverse in 48 hours, the daily will turn bearish and the Bullflag will be no more. The weekly will then kick in in a harsh way. And that will be all she wrote for anyone who bought gold above $1330 on margin. The good news is this won’t change a thing on the monthly. At least not until we get under last months open on the $1275 area. Then very long term speculators will start selling.

This Morning:

Moor Analytics:

NOTE: this is a time to have a sharp focus on Gold--although it is chopping around here a bit, it is within the $22-$23 zone around the macro solid line, so there is a good likelihood one of the breakouts/failures of the more minor projective moves could be the beginning of a much more major move.

And there you have it. As we alluded to in last week’s post, Gold has probably little resistance between $1375 and $1400. It also may have stacked buying in the $1330 area with nothing underneath it.

We barely tested the $1330 area a couple days ago and it was greeted with a brick wall of buying.

Now we are about to retest those lows. The time is now to pay attention to Gold’s behavior. We have 2 macro technical lines pitted in a war for dominance over gold. The dowmsloping lone we broke to the upside on, amd the line keeping a lid on rallies at the moment.

The Back Story

1- gold vol would increase in 90 days (oct)

https://www.marketslant.com/article/golds-1200-1350-range-due-large-breakout-analysis

2- the low was put in for now in mid December

https://www.marketslant.com/article/what-now-insights-1700-man-who-called-golds-low

3- At $1350 gold is acting overbought and could have a spike to $1400 or a swoon to $1330 quickly

4- the next 48 hours will tell of this is a bull flag or confirm that the market is overbought

https://www.marketslant.com/article/gold-brief-time-pay-attention-vince-lanci

5- there is a lot of buying in the $1330 area and that should be the line in the sand this week (various days before today)

https://www.marketslant.com/article/gold-put-fork-rally-under-1330-skg

Check, check, and triple check. All sound advice from our staff of writers; who also I might add gave solid levels on the way down mid last year.

The Path Ahead

Now we see if that $1330 buying moves its level lower or is there Sunday night. I don’t think it is there Sunday night. Barring an exogenous event a gap lower is on the table next week.

Don’t Fear The Fed

Silver lining. People are selling gold for the same reasons that stock is being sold: the fed is hawkish. Translation: easy money for stocks is ending as the fed prepares to normalize its balance sheet. Gold retreats because inflationistas are scared they won’t get dollar debasement.

Reality: bonds are telling you this is the beginning, not the end of problems. That the fed will keep raising rates but lag inflation thus keeping real rates low.this will slow the stock descent and prop gold. The fed can’t take away the punch bowl all at once. It will be paddled our slowly, keeping real rates just low enough to keep people on stocks.. with unintended consequences for Gold if the market is permitted to function as a free one.

Conclusion?

Buy dips in gold, sell rallies in stocks. Start buying Gold in the $1275 area. Be prepared to buy as low as $1150. Hold for 10 years. Preserve your wealth. The US ain’t normalizing it’s balance sheet easily.

Good luck. Professionals trade gold. People store wealth in it. No one invests in it. It’s money.

Read more by Soren K.Group