Gold Tumbles Below Key Technical Support As 5Y Yields Spike To Six-Year Highs

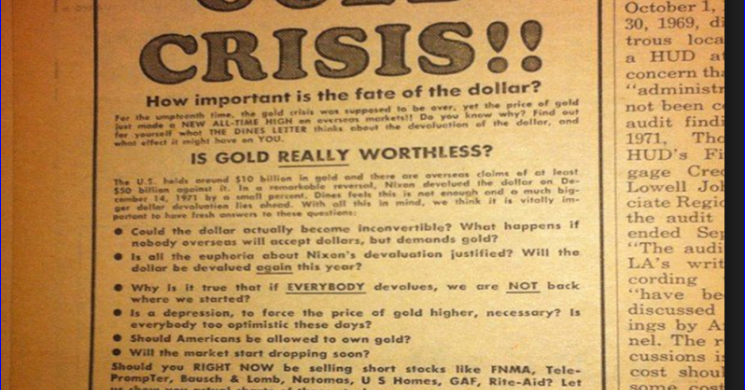

Cover photo from tomorrows MSM Gold article

As one commenter stated:

Typical end of year smack down. Just like the last 3 years gold must appear to have been a bad investment for the year. It'll still end the year up about 10% though.

Though that does nothing to comfort bulls, especially with yields rising and competing for money. With the USD moving largely sideways, this reeks of EOY final puke-age by funds who must fold positions. As we stated earlier: We are in a bear leg with an $1800 target. So this does not surprise us

via zerohedge.com

For the second day in a row, precious metals are being pounded as gold joins silver back below its 200-day moving-average...

Knocking gold back to 3-week lows...

All of which is odd given the chaos in the dollar... Two days of collapse in gold as the dollar goes nowhere...

And Treasury yields are surging - woith 5Y back at its highest since April 2011...

EDIT- SKG: The last of the funds need out, and as the Dec contract rolls off, they sell.. only to buy back in Feb on fresh allocations after redemptions and bonuses are satisfied. Just Sayin

Read more by Soren K.Group