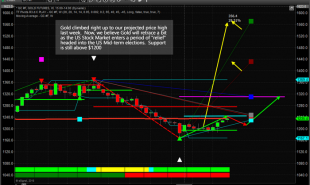

The popular gold-based exchange traded product, “GLD”, is testing the Down trendline from its 2011 peak.

I think most participants would likely characterize recent markets as exciting — or, at least, interesting. That’s because, despite historically depressed volatility indices, there has certainly not been a lack of movement. Stocks are soaring, bond yields are jumping, the U.S. Dollar is plunging and oil prices are climbing. And that is to say nothing of the new crypto-currency asset class which, depending on what time you look, is either melting up…or crashing.

One of the few assets not partaking in this wild ride is precious metals — somewhat ironic given the level of passion and excitement that the asset class usually incites. In reality, the price of gold, as measured by the popular exchange traded product, the SPDR Gold Trust (ticker, GLD), began the year smack dab in the middle of basically a 2-year trading range. And the GLD hasn’t moved more than about 10% above or below that mid-point during that time. You can say essentially the same thing for the price of silver, as determined by the iShares Silver ETN (ticker, SLV).

Gold bugs might just get their opportunity to finally move the needle here soon, however. At least, they have a potential catalyst close at hand, based on the chart of the GLD. How so? The fund is presently testing the Down trendline stemming from its 2011 all-time high. Should the GLD be successful in breaking out above that trendline (presently near ~127), it may open the way for further, perhaps considerable, gains in the near-term.

It is a similar chart story with the SLV as it too is testing its own post-2011 Down trendline near 16.25 after bouncing off of its post-2008 Up trendline in December.

So, after drifting through multi-year doldrums following a potential longer-term bottom in early 2016, precious metals finally have a chance to join in the excitement of the rest of the world markets. If GLD and SLV are able, again, to overcome their respective long-term Down trendlines, they could be off to the races in putting in that long-awaited next up-leg following their 2016 rallies.

Of course, the developing potential breakdown in the U.S. Dollar Index may well serve as a tailwind for precious metals in their attempted flight higher. If the DXY cannot hold or reclaim its recent lows, it runs the risk of potentially meaningful further losses. If so, there’s no guarantee, but such a development would presumably aid in the precious metals’ breakout attempt.

If you are interested in the Premium version of our charts and research, check out “all-access” service, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

Read more by MarketSlant Editor