We are happy to announce the addition of a well respected technical analyst to our growing list of Soren K. Group of Contributors.

New Gold Contributor

Alongside George Gero the 30 year veteran of the pits who has his finger on the flows in Gold, and Enda Glynn who we feel is the best Elliot Wave analyst out there, we are happy to have asked Michael Moore for his occasional insight into Gold. And he has agreed.

Michael is one of the few true technicians left who publish a newsletter that people covet. His work is in tradition of the late Peter Beutel, who we had the honor of working with for years. His subscription list includes a broad, deep clientele from billion dollar hedge funds, to banks, to old floor types. He is one of those guys who makes his money on his objectivity and talent.

We are subscribers, and cannot post his work here. But he has given us permission to reach out to him for a taste of his perspective. We knew him as an energy analyst from our floor days, but found out recently he covers Gold.

Basically, we will be looking at his stuff as subscribers, and when something catches our eye, we will give him a call and see if he cares to comment on it. We noted gold failed yesterday at $1259, an area key for our momentum buy indicator. So we looked at his stuff as well as Enda's EW analysis.. Here is what we found

Moor Analytics

Here are a couple support resistance numbers for Gold today (partial list for this one post)

As to Michael's short term bias:

We are still in a bull leg, and as long as we settle above $1214.19 that will keep us bullishly biased. A Break below that number will start a bear leg in all likelihood. The technical numbers tell the rest.

Long term macro view? He would not give us permission to divulge. That is something he is well known for in small circles. Calling bigger moves are his forte and align just fine with our own propensity to buy wings in options. It is interesting to note his ultimate dip to buy is in the $1217 area, not unlike the EW analysis we follow. Sadly, that was our own final straw to not be long speculatively.

We recommend giving Mike a call if you are looking for some straight forward daily tech work. We have no financial stake in this recommendation. We just want to support independent analysis in a world of co-opted marketing materials portraying themselves as "research"

Email: MoorMoorMichael@aol.com

Call: (646) 708 4612

Enda Glynn: GOLD breaks resistance, bullish setup in play.

via bullwaves.org

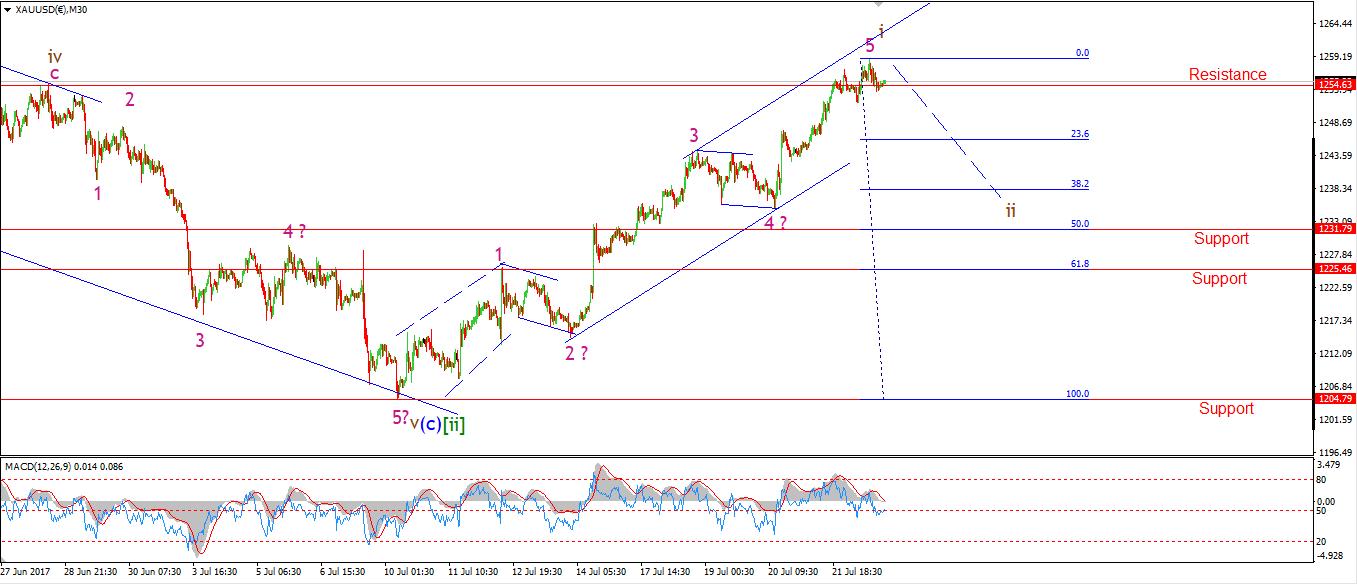

GOLD has spent the day hovering around the resistance/support level at 1254.63. Today's high reached 1258.75, This is a solid break of resistance and adds weight to the bullish case from here.

Now that we have a clear five wave pattern in place off the low, And the upper trendline is within spitting distance! It is likely that wave 'i' brown is complete. The next move to expect is a three wave selloff in wave 'ii brown,

For tomorrow; I will be watching for the beginning of a three wave decline in wave 'ii' brown.

The 50% retracement level lies at 1231.79. And the 61.8% retracement level lies at 1225.46, This is also the high of wave '1' pink which adds further support.

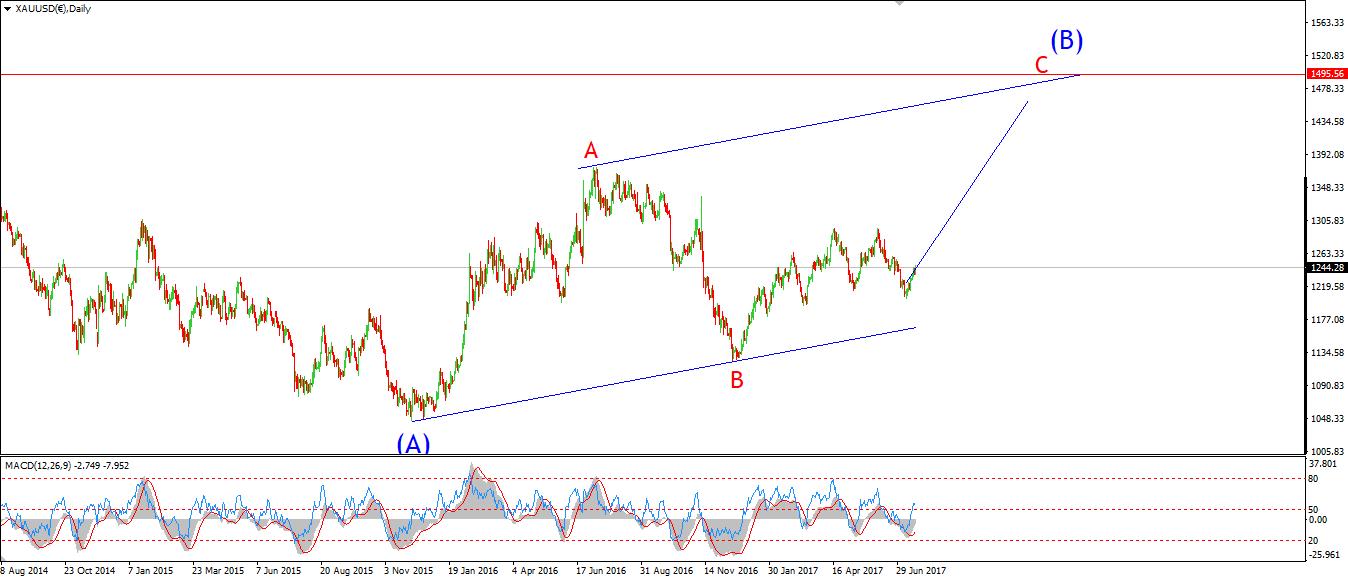

1225 has acted as a point of oscillation for the price over the last 6 months. This level should act as major support as wave [iii] green develops in the coming weeks.

30 min

4 Hours

Daily

My Bias: Long towards 1550 Wave Structure: ZigZag correction to the upside. Long term wave count: Topping in wave (B) at 1550 Important risk events: USD: CB Consumer Confidence.

Technicals Applied

- Currently we want to buy on a settlement above $1256 or a trade above $1259. These are right at both Moor's and Glynn's resistance levels. Worth noting

- Conversely, we should be short below $1259 with a $1231 target

- Moor and Glynn using different disciplines see the $1217 area as important. We did too, but not as a level to buy. Our mistake

- Moor and Glynn see similar upside targets. Glynn's EW analysis is less time centered, while Moor's is more so. But it is important to note that both see $1294 area as one area a smart long would sell first time up.

Last Defense Against Manipulation

As much as it pains us to say being slaves to the world of statistical analysis: Technicals matter. If you subscribe to manipulated markets as we do, then they matter just as much. For technicals are a reflection of market participation sentiment and bias. Where fundamentals fail, technicals succeed. If for no other reason because everyone else is looking at them, one must consider them, even if to make a decision ignore them.

They are risk reward generators, not crystal balls. Be short under $1259 or be long above it. Or do both. But $1259 is important to us... today.

Good Luck

Read more by Soren K.Group