In the wake of the Trump Tax Bill being passed as well as Apple's recent fall from grace an interview with a self-described "unapologetic capitalist" perhaps laid out in front of us the path towards capital market problems that lie ahead. Here is an interview with Vespula Capital's CEO Jeff Tomasulo. In it he links in clear terms the "red flags" popping up in our frothy markets, the tax plan, the shortcomings of repatriated money, and Apple's played down but very real problems.

- Apple owners should seriously consider taking profits

- Corporate Tax reform does little to help non stock owners

- Repatriation of overseas money will mostly boost stocks, not people

- Bitcoin investments should be reserved for money you can afford to lose

Tomasulo on Apple, and the lack of analytical courage to say "Sell"

He (the Instinet analyst) came out and downgraded the stock, and this was one of the concerns going into 2007 or 2000... a lot of analysts didn't have, the backbone to say "Hey listen this is a sell." So, that's a warning to me, or red flag,that more analysts aren't coming out and saying, Hey listen this stock just had an 80% up move like we saw in Boeing. Maybe it's time to take some profits in this stock.

Since Jeff's interview on December 19th, Apple has stumbled, gapped lower, and is now struggling to get into that higher trading range. Apple is the most widely held stock among global institutional investors. This could be a hairy time to be among the lemmings.

Tax Plan and Repatriation of Capital

The lessons of history are not lost either as the new Tax Plan was being passed. If Apple is overvalued, it cannot be alone. As in 2007 and 1999 before, he contends the signs of a frothy market are once again upon us. Without being a Cassandra, Mr. Tomasulo calmly notes the parallels between then and now: the lack of analytical backbone warning of overvaluations, the repeated tax-bill based stock rallies and more sensible talk you can see for yourself in the video at bottom

Jeff on Last Month's Stock Rally

You know, I don't know how many times we could announce this tax plan (going to get passed), and the market rallies on it... We want stocks to, you know, kind of give us an opportunity to sell off. Take some of this froth off the top and give us an opportunity to buy some stocks.

Of particular interest was Jeff's recognizing the likely effect of repatriated overseas corporate money earmarked for stock buybacks.

You see with the repatriation, we hear that we're gonna have billions and trillions of dollars coming back from overseas, but the last time that we've had a repatriation, which was under George Bush I think in 2004, you saw the amount of buy backs by companies just increase by 90%. We saw on December 3rd when the Senate finally passed the tax bill, or their version of it, the next week I think there were like six or seven Dow stocks that announced buy backs.

And he hits the nail on the head in one sentence here without hyperbole

So, I'm very skeptical on how this (the tax plan and repatriation) is gonna affect, you know, jobs and growth.

And for good reason. We suspect Jeff is well aware of the disconnect between business and stock prices as a result of stock buybacks. He also believe he is advising investors accordingly.

Click the photo for highlights of Jeff's Reuters interview with subtitles.

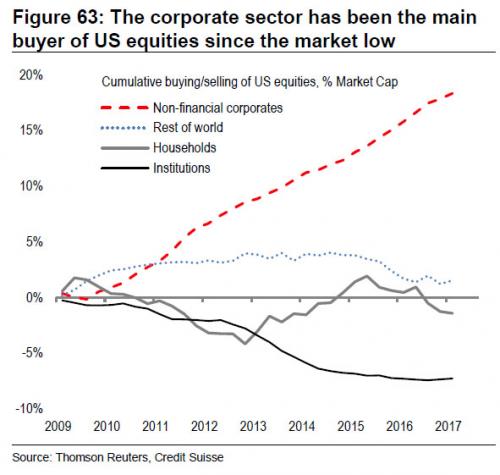

Blogs like Zerohedge and Marketslant have been pointing this out for years. Monetary policy (and now fiscal) have encouraged malinvestment of capital that supports stock prices but not their businesses and consequently their employees. Yes, stock buybacks support the working man with a 401k to some extent, but how many US middle class citizens even have one these days? The single largest source of stock buying has come from corporate buybacks since 2008.

And just when those stock buybacks slowed in the wake of rising interest rates, we got fiscal stimulus in the form of Tax Reform, and repatriated capital to boost them further. This benefits those who hold the most stock and are paid in their company's equity - company executives.

Jeff Tomasulo's Full Interview HERE

Good Luck

Read more by Soren K.Group