Trump's Tax plan was released. States were balking at the potential phase out of homes eligible for incentives. That could be the lead in to more states with high income tax and budget woes losing their wealthy tax base, like New Jersey. But corporations are certainly going to be happy if it passes. Middle class seems to get a break overall.

A visual summary of the new tax brackets:

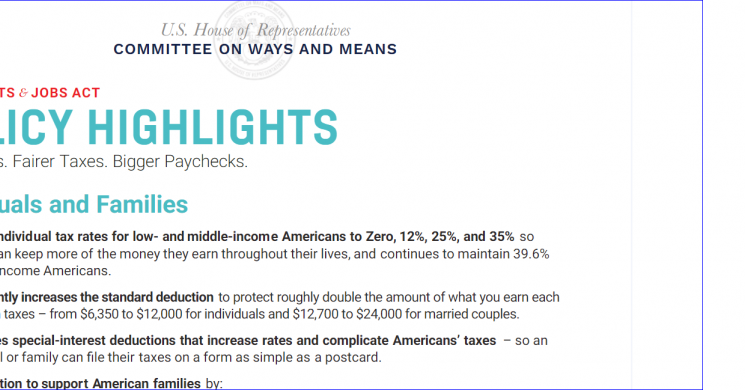

Here are the highlights from the cover pages

363297702-Trump-Tax-Plan by Soren K. Group on Scribd

Here are the most notable changes per Zerohedge:

- Lowers individual tax rates for low- and middle-income Americans to Zero, 12%, 25%, and 35%; keeps tax rate for those making over $1 million at 39.6%

- Increases the standard deduction from $6,350 to $12,000 for individuals and $12,700 to $24,000 for married couples.

- Establishing a new Family Credit, which includes expanding the Child Tax Credit from $1,000 to $1,600

- Preserving the Child and Dependent Care Tax Credit

- Preserves the Earned Income Tax Credit

- Preserves the home mortgage interest deduction for existing mortgages and maintains the home mortgage interest deduction for newly purchased homes up to $500,000, half the current $1,000,000

- Continues to allow people to write off the cost of state and local property taxes up to $10,000

- Retains popular retirement savings options such as 401(k)s and Individual Retirement Accounts

- Repeals the Alternative Minimum Tax

- Lowers the corporate tax rate to 20% – down from 35%

- Reduces the tax rate on business income to no more than 25%

- Establishes strong safeguards to distinguish between individual wage income and “pass-through” business income

- Allows businesses to immediately write off the full cost of new equipment

- Retains the low-income housing tax credit

And here is the Full Document:

Tax-Bill-Text by Soren K. Group on Scribd

Read more by Soren K.Group