Investors Lose, ECB makes investors pay for bailout, ECB wants investors to double down on increasing systemic risk. Sounds Legit !

Just four days after Banco (Un)Popular chairman Emilio Saracho told his employees "don't panic" as a result of the company's crashing stock price, on Wednesday morning the ECB confirmed that the sixth largest Spanish bank was indeed on the verge of collapse and ordered it to be sold, which is what happened when Santander acquired the bank for €1.00 after Santander's equity and riskiest debt instruments were bailed-in, i.e. wiped out, imposing losses of about €3.3 billion on the bank’s securities holders.

by Fay Dress for the Soren K. Group

Grant's Daily notes that :

-

Banco Popular just failed, losing investors 3.3 billion Euro from stock and bond losses

-

Santander acquires Popular and will issue 7 billion Euro worth of new shares.

-

Seperately, the ECB warns that it cannot unwind its easy money policies just yet

We note that:

-

The ECB bankrolls the buyout with its easy money to Santander by printing money. They forced the deal

-

The losers in Banco Popular are wiped out and/ or get double the stock for the same company which is now part of an even bigger company with a duplicate portfolio of assets

-

Systemic risk just increased.

Investors get monkey hammered, The ECB orders Santander to buy Banco Popular and its portfolio, The ECB will bankroll the Santander Balance sheet with easy money. And now Santander will issue $7.8 billion in new shares. None of it in Gold.

Why is Gold in the Headline?

In case you think including Gold in the title is a bit forced, consider this:

The ECB will print more paper to keep Santander's balance sheet stable until they manage to float more shares to a gullible investing public. The ECB is not loaning Gold to these TBTF banks for bridge loans and balance sheet shore ups. It is no stretch to acknowledge that every one of these things does not involve a central bank using its gold as collateral to secure these bank problems.

Ask yourself after every western central bank deal how much Gold was used to finance it. The answer will be none.

Then ask yourself how much Gold was used to finance Russian Oil sales to China last month? That answer is$3.5 billion. Then ask yourself why the Saudis are accepting payment in Gold from china on their own oil sales. Then note that the Saudis are keeping that gold in Chinese vaults. These are our claims from industry sources in Russian Oil, Chinese Finance and Blockchain technologists. For now call it unsubstanttiated conjecture. But when it is finally acknowledged as fact the public will be up to their neck in worthless paper.

The Central banks will own Gold. The Chinese public will own Gold (only to be confiscated by their gov't later), and the western public will own iphones and Banco Popular shares.

But the Sell-side Bank Analysts Say It's Ok!

MIZUHO (Roger Francis)

- Deal is probably “excellent” for Santander in medium term, though it may weigh on earnings in the first or second year

- Takeover adds significant business to Santander in terms of SME-lending and credit-card clients albeit with considerable real-estate exposure and non-performing loans that are largely behind Popular’s capital writedowns

- Sees little impact on wider European banking sector as investors now recognize the situation poses no new dangers to the financial system

KEPLER CHEUVREUX (Carlos Garcia)

- Santander downgraded to hold vs buy and removed from Spanish top picks on risks from acquisition - it is only a sale after they fail

- Limited time for due diligence on Popular’s real-estate exposure and bad loans and other potential risks and costs involved in breaking up the joint ventures raises doubts on whether the measurement of risks has been adequate

- Combined entity will lose market share; Kepler says doubtful that Popular will be easy to integrate given its “different” risk management

- Kepler expects litigation for “mis-selling” will require reimbursement of amount invested, given that most of the Tier 2 is held by retail clients; would not rule out litigation from AT1 holders - Mis-selling is NOT to be confused with FRAUD

NATIXIS (Robert Sage and Alex Koagne)

- Santander’s acquisition of Popular in a deal approved by European regulators shows that weaker parts of region’s banking system are being addressed; fall in systemic risk is positive for wider industry

- Sees Popular as containing attractive retail/SME franchise with higher returns and margins - Risk? What risk?

- Santander will need to convince investors Popular’s non-performing assets are properly marked after the takeover - No they won't, the ECB will be the buyer if the public is not

- Rates Santander neutral with PT EU6

Put More on You Moron

via zerohedge

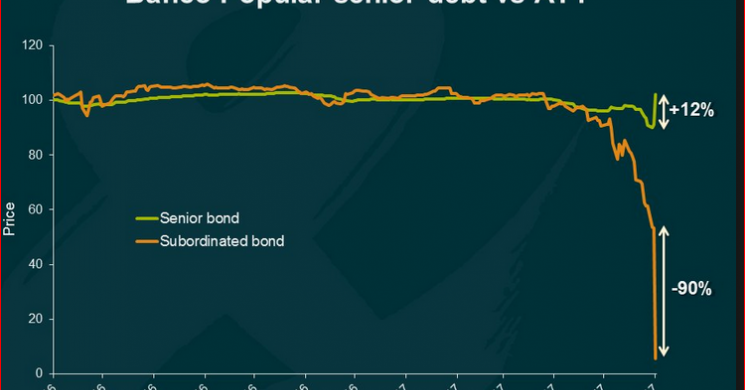

This transaction was bad news for the company's equity and holders of contingent convertible AT1 and AT2 holders, who have the distinction of holding the first major bank capital bonds to be bailed-in/wiped out under new EU regulations. While Banco Popular senior debt is 12 points higher this morning, the AT1 perps are trading at 5%, down 50 points. As Mint's Bill Blain notes, "we’ve not seen crashes like that since 2008."

The mechanics: in the first use of Europe's newsly adopted bail-in mechanism, Popular would see shares resulting from the conversion of its riskiest debt and Tier 2 instruments wiped out, imposing losses of about 3.3 billion euros on the bank’s securities holders. Concurrently, Popular would be acquired by Spain's biggest bank, Santander for a nominal €1.00. To fund the deal, Santander will raise €7 billion through a rights offer to bolster Popular’s balance sheet, it said in a filing. The lender will acquire Popular for 1 euro after its stock and shares resulting from the conversion of its riskiest debt and Tier 2 instruments were wiped out, imposing losses of about 3.3 billion euros on the bank’s securities holders.

CoCo-nut

A multi-billion dollar bank failure in the midst of a rip roaring bull market and growing economy? An odd sighting to be sure.

Today’s announcement that Banco Popular Espanol SA will be absorbed by the sounder Banco Santander under the auspices of the European Central Bank for considerations of €1 harkens back to March 2008, Bear Stearns and J.P. Morgan.

Such opportunities for wistful bearish reminiscence are rare these days. In the U.S., a total of five banks failed in 2016 compared to 140 in 2009, according to the Federal Deposit Insurance Corporation. Total cost to the government’s Deposit Insurance Fund in 2016 totaled $9.6 million, according to estimates from Bankrate.com. In 2009, such failures cost taxpayers more than $38 billion.

Much unlike the tense days of that Bear Stearns and J.P. Morgan shotgun wedding, asset prices and economic growth are on the upswing. Riding a 13% advance in the past year, the Stoxx 600 Index now sports a dividend yield of 3.29%. Amazingly, the Bloomberg EUR High Yield Corporate Bond Index has rallied to yield a paltry 2.24%.

GDP growth in Spain (the home nation of both banks) has matched or exceeded 3% in each of the last eight quarters. Germany saw its IFO (Institute of Economic Conditions) Business Climate Index rise to the highest level on record in May, reflecting “euphoric” sentiment according to the group’s president.

Fueling these evident good times is a central bank that is most determined to generate inflation in the price level, via negative nominal interest rates and undertaking €80 billion in monthly asset purchases.

Today, Bloomberg reported the ECB has lowered its forecasted level of CPI inflation through 2019, ahead of a policy decision tomorrow. The article paraphrased the bank’s thinking: “they must be extremely cautious in communicating and implementing any exit from monetary stimulus.” (Some member nations are taking a less than gracious view of the generosity cum largesse from Brussels, for more see “Sturm und Draghi” from the May 11th Almost Daily Grant’s).

Amidst those calm seas, Banco Popular has managed to run the ship aground. In order to shore up their sickly balance sheet, the acquiring Santander will issue a €7 billion rights offering to shareholders. Banco Popular’s equity and junior debt are wiped out, to the tune of €3.3 billion.

Among the securities being zeroed out are the Banco Popular contingent convertible bonds. One issue of those so-called CoCo securities, carrying an 11.5% coupon and perpetual maturity, changed hands around 53 cents on the euro yesterday, and above 93 cents on the euro less than a month ago (May 10). Today it fetched just under three cents on the euro, for a yield to worst of 404.22%.

That harsh outcome has generated little consternation for other holders of these complex debt/equity hybrids.

Bavarian behemoth Deutsche Bank’s 7.125 coupon CoCo debt (featured in Grant’s, February 12 2016; click here to read) securities have barely budged off their highs, finishing today at 101.4 cents on the euro from the 102.3 highs reached in mid-May. Recall that in early 2016, Deutsche Bank shares sold off sharply amidst fears it would be forced to write down its CoCo bonds to help recapitalize its balance sheet. Banco Popular realizing that worst-case outcome was no problem for Deutsche Bank hybrid holders this time.

Likewise, the Markit iBoxx EUR Contingent Convertible Liquid Developed Markets AT1 Index has also shown little reaction, finishing today weaker by 0.06 to 130.39. The index has rallied by about 26% from its June 2016 interim lows and sits within a rounding error of its high water mark reached on May 29th. By comparison, the Stoxx banks equity index has retreated by more than 7% from its early May highs.

More such workouts may be coming down the pike; local and EU regulators are considering liquidation options for Italian banks Banca Popolare di Vicenza SpA and Veneto Banca SpA, according to the local newspaper Corriere della Sera.

We personally added small silver when it was trading $17.00- ish in coin form. We are praying for a Gold pullback to add to our portfolio there. Interestingly, one of our writers has decided to sell his cars because "Ownership of a car is a liability. Control of a car is better." His reasons are that cars are becoming a service industry etc.

Consider that in your calculus when you 'own' GLD.

Good Luck

Read more by Soren K.Group