Source: Jack Chan for Streetwise Reports 05/15/2018

Technical analyst Jack Chan updates his gold and silver charts.

Our proprietary cycle indicator is up.

Our proprietary cycle indicator is up.

The gold sector is on a long-term buy signal. Long-term signals can last for months and years and are more suitable for investors holding for long term.

The gold sector is on a long-term buy signal. Long-term signals can last for months and years and are more suitable for investors holding for long term.

The gold sector is on a short-term sell signal. Short-term signals can last for days and weeks, and are more suitable for traders.

The gold sector is on a short-term sell signal. Short-term signals can last for days and weeks, and are more suitable for traders.

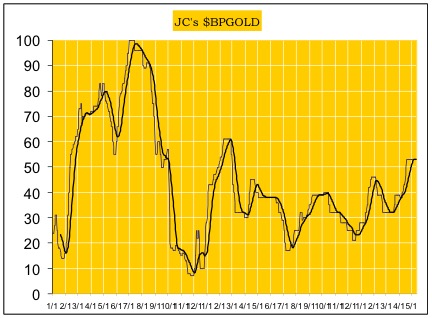

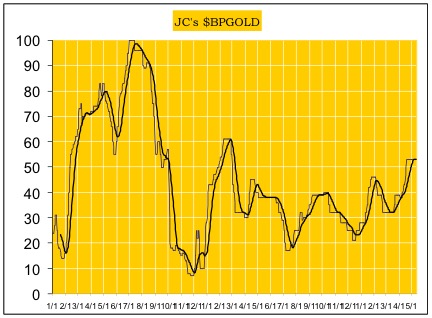

Speculation is in bull market values.

Speculation is in bull market values.

A massive multiyear bottoming pattern in progress.

A massive multiyear bottoming pattern in progress.

Silver is on a long-term buy signal.

Silver is on a long-term buy signal.

SLV is on a short-term buy signal, and short-term signals can last for days to weeks, more suitable for traders.

SLV is on a short-term buy signal, and short-term signals can last for days to weeks, more suitable for traders.

Speculation has a long way to go before becoming frothy.

Speculation has a long way to go before becoming frothy.

Summary The precious metals sector is on a long-term buy signal. Short term is on mixed signals. The cycle is up. COT data is supportive for overall higher metal prices. We are holding gold-related ETFs for long-term gain.

Jack Chan is the editor of simply profits at www.simplyprofits.org, established in 2006. Chan bought his first mining stock, Hoko Exploration, in 1979, and has been active in the markets for the past 37 years. Technical analysis has helped him filter out the noise and focus on the when, and leave the why to the fundamental analysts. His proprietary trading models have enabled him to identify the NASDAQ top in 2000, the new gold bull market in 2001, the stock market top in 2007, and the U.S. dollar bottom in 2011.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.