Weekend Update:

In other news on Marketslant.

Fla Devastation as Irma Makes Landfall- Live Stream

Gold Trade Recommendation - Analyst

PETRODOLLAR BREAKDOWN: Big Moves In Gold & Silver Ahead

James Rickards on the End of Financial Complacency

In Irma's Wake 'It Looks as if There's No Sea'

Solar Flare May Stop NK Missile Test Saturday

After The Hurricanes: America Can't Afford To Rebuild

Reports Confirm North Korea Can Survive An Oil Embargo

NWO: China Sponsored North Korea is a Nuclear Power

The Era of Complacency Is Ending

Jim Rickards for The Daily Reckoning

Physicists say a “subcritical” system that’s waiting to “go critical” is in a “phase transition.” A system that is subcritical actually appears stable, but it is capable of wild instability based on a small change in initial conditions.

The critical state is when the process spins out of control, like a nuclear reactor melting down or a nuclear bomb exploding. The phase transition is just the passage from one state to another, as a system goes from subcritical to critical.

The signs are everywhere that the stock market is in a subcritical state with the potential to go critical and meltdown at any moment. The signs as elevated price-to-earnings (P/E) ratios, complacency, and seasonality — crashes have a habit of happening around this time of year.

The problem with a market meltdown is that it’s difficult to contain. It can spread rapidly. Likewise, there’s no guarantee that a stock market meltdown will be contained to stocks.

Panic can quickly spread to bonds, emerging markets, and currencies in a general liquidity crisis as happened in 2008.

For almost a year, one of the most profitable trading strategies has been to sell volatility. That’s about to change…

Since the election of Donald Trump stocks have been a one-way bet. They almost always go up, and have hit record highs day after day. The strategy of selling volatility has been so profitable that promoters tout it to investors as a source of “steady, low-risk income.”

Nothing could be further from the truth.

Yes, sellers of volatility have made steady profits the past year. But the strategy is extremely risky and you could lose all of your profits in a single bad day.

Think of this strategy as betting your life’s savings on red at a roulette table. If the wheel comes up red, you double your money. But if you keep playing eventually the wheel will come up black and you’ll lose everything.

That’s what it’s like to sell volatility. It feels good for a while, but eventually a black swan appears like the black number on the roulette wheel, and the sellers get wiped out. I focus on the shocks and unexpected events that others don’t see.

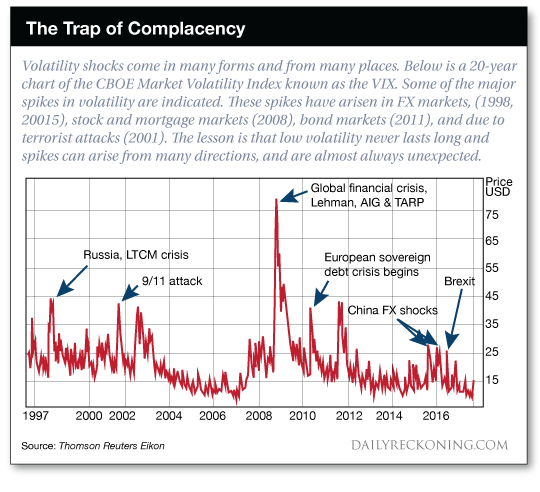

The chart below shows a 20-year history of volatility spikes. You can observe long periods of relatively low volatility such as 2004 to 2007, and 2013 to mid-2015, but these are inevitably followed by volatility super-spikes.

During these super-spikes the sellers of volatility are crushed, sometimes to the point of bankruptcy because they can’t cover their bets.

The period from mid-2015 to late 2016 saw some brief volatility spikes associated with the Chinese devaluation (August and December 2015), Brexit (June 23, 2016) and the election of Donald Trump (Nov. 8, 2016). But, none of these spikes reached the super-spike levels of 2008 – 2012.

In short, we have been on a volatility holiday. Volatility is historically low and has remained so for an unusually long period of time. The sellers of volatility have been collecting “steady income,” yet this is really just a winning streak at the volatility casino.

The wheel of fortune is about to turn and luck is about to run out for the sellers.

Here are the key volatility drivers we have considered:

The North Korean nuclear crisis is simply not going away. In fact, it seems to be getting worse. It appears North Korea has successfully tested a hydrogen bomb last weekend.

This is a major development.

An atomic weapon has to hit the target to destroy it. A hydrogen bomb just has to come close. This means than North Korea can pose an existential threat to U.S. cities even if its missile guidance systems are not quite perfected. Close is good enough.

A hydrogen bomb also gives North Korea the ability to unleash an electromagnetic pulse (EMP). In this scenario, the hydrogen bomb does not even strike the earth; it is detonated near the edge of space. The resulting electromagnetic wave from the release of energy could knock out the entire U.S. power grid.

Trump will not allow that to happen, and you can expect a U.S. attack, maybe early next year.

Another ticking time bomb for a volatility spike is Washington, DC dysfunction, and the potential double train wreck coming on Sept. 29. That’s the day the U.S. Treasury is estimated to run out of cash. It’s also the last day of the U.S. fiscal year; (technically the last day is Sept. 30, but that’s a Saturday this year so Sept. 29 is the last business day).

If these two legislative fixes are not done by Sept. 29, we’re facing both a government shutdown, and the potential for a default on the U.S. debt. Time is short and my estimate is that one or both of these pieces of legislation will not be completed in time. This will certainly trigger a volatility spike and produce huge profits for investors who make the right moves now.

Even if the budget CR and debt ceiling get fixed under Trump’s new deal with Chuck Schumer and Nancy Pelosi, that simply postpones the day of reckoning until December 15. That’s only three months away and will be here before you know it. Markets tend to discount the future so a train wreck on December 15 will start to show up in market prices today.

Congress has to pass two major pieces of legislation. One is a debt ceiling increase so the Treasury does not run out of money. The other is a continuing resolution so the government does not shut down.

Both bills could be stymied by conservatives who want to tie the legislation to issues such as funding for Trump’s wall, sanctuary cities, funding for Planned Parenthood, funding to bailout Obamacare and other hot button issues.

If the conservatives don’t get what they want, they won’t vote for the legislation. If conservatives do get what they want, moderates will bolt and not support the bills. Democrats are watching Republican infighting with glee and see no reason to help with their votes.

If these two legislative fixes are not done by Sept. 29, we’re facing both a government shutdown, and the potential for a default on the U.S. debt. Time is short and my estimate is that one or both of these pieces of legislation will not be completed in time. This will certainly trigger a volatility spike and produce huge profits for investors who make the right moves now.

Other sources of volatility include a planned “Day of Rage” on Nov. 4 when alt-left and antifa activists plan major demonstrations in U.S. cities from coast-to-coast. Antifa are neo-fascists posing as antifascists; hence the name “antifa.” Based on past antifa actions in UC Berkeley and Middlebury College violence cannot be ruled out. This could be unsettling to markets and be another source of volatility.

Finally, another monster hurricane could be bearing down on U.S. shores, just after Hurricane Harvey devastated Houston and other parts of Texas and Louisiana.

Hurricane Katrina struck at the very end of August in 2005 and Superstorm Sandy hit the Jersey Shore in October 2012. Both did enormous damage and unsettled markets for a time. Now we’re facing two major hurricanes almost at once.

Other wild cards include domestic terror and cyber attacks.

Finally, we are entering an historically volatile time of year. Many of the greatest stock market crashes of all time have occurred in September or October including the Black Thursday (Oct. 24, 1929) and Black Tuesday (Oct. 29, 1929) crashes that started the Great Depression, and the Black Monday (Oct. 19, 1987) crash, in which the stock market fell 22.61% in a single day. From today’s levels, a 22.61% drop would mean a loss of 4,900 Dow points in a single day.

Don’t rule it out.

None of these scenarios are far-fetched or even unlikely. The war with North Korea is coming. Washington, DC dysfunction is a fact of life and we’ve had several government shutdowns in recent years. Social unrest is spreading and in the headlines every day. Hurricanes and terror attacks happen with some frequency.

It has been nine years since the last financial panic so a new one tomorrow should come as no surprise.

In short, the catalysts for a volatility spike are all in place. We could even get a record super-spike in volatility if several of these catalysts converge.

The “risk on / risk off” dynamic that has dominated most markets since 2013 is coming to an end. From now on it may just be “risk off” without much relief. The illusion of low volatility, ample liquidity, and ever rising stock prices is over.

The safe havens will be the euro, cash, gold and low-debt emerging markets such as Russia. The areas to avoid are U.S. stocks, China, South Korea and heavily indebted emerging markets.

It looks like a volatile and bumpy fall ahead.

Read more by Soren K.Group