Market Wrap: Gold Steals Bitcoin’s Thunder

Via T3 Live

Bitcoin’s been the talk of the town for the past few months after hitting a string of record highs.

But beaten-down gold was the belle of the ball today thanks to the Fed and a lousy CPI report.

This afternoon, tThe Fed raised rates by 25 basis points, as expected.

However, two Federal Open Market Committee Members, Neel Kashkari and Charles Evans, voted against the decision.

The Fed also slightly softened its language about the Labor Market. They previously expected the labor market to strengthen further, but now merely expect it to “remain strong.”

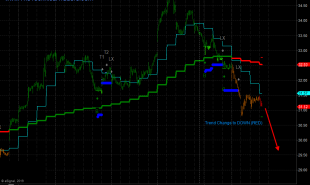

Gold got a big rip off the announcement, rising 1.3% today, and gold mining stocks absolutely ripped.

The Vaneck Vectors Gold Miners ETF (GDX) rose 3.5% today, and the Junior Miners(GDXJ) did even better.

The Fed’s dot plot for 2018 implies that they expect to raise rates three times in 2018, in-line with its prior expectatoins.

On a positive note, the Fed slightly increased its 2018 GDP forecast, and it now expects an unemployment rate of just 4.0% in 2020.

Despite a string of tepid inflation readings, including today’s weak Consumer Price Index report, the Fed said it expects inflation to “stabilize” around its 2% target in the “medium term.

The CPI rose 2.2% in November, matching economists’ expectations.

However, the core number, which excludes volatile food and energy costs, was up just 1.7%, missing the 1.8% consensus.

Judging by the big pop in gold today, and the big drop in strong rate/dollar assets today, it looks like nobody buys the Fed’s argument that inflation will magically bounce back at some point down the road.

Bank stocks, which have been ripping lately, got spanked pretty hard.

The S&P Financials ETF (XLF) fell -1.2% and the S&P Regional Banking ETF (KRE) dropped -1.1%.

The S&P 500 and Dow Jones Industrial Average both set all-time highs near the open today, but sold off throughout the day.

The S&P finished off -0.1%, while the Dow managed to squeeze up 0.3%.

Unusually, the small cap Russell 2000 rose 0.6% today. Typically, the Russell does better when the dollar is strong.

The VIX fell as low as 9.65 this morning, but it rose back over 10 after the equity market close. To be fair, that’s still awfully low from a long-term perspective.

Now, the big question is whether the market can keep its mojo amid a possible rotation towards weak dollar/rate assets like gold/precious metals, Treasuries, and real estate and utilities stocks.

I’d keep a close eye on the key tech stocks like Apple (AAPL), NVidia (NVDA), Facebook(FB), and Netflix (NFLX).

They’ve led the post-election charge, and if they give up the ghost, maybe the market’s ready to take a serious break.

I’d also watch Bitcoin, which fell -2.6% today.

There’s obviously an obsession with crypto currencies.

This morning, I opened up the App Store on my iPhone, and came across this page of trending apps:

As you can see, as of 4:23 a.m. ET, 5 of the 7 fastest-trending app were Bitcoin/crypto related:

Coinbase (Bitcoin/crypto platform) GDAX (Bitcoin/crypto platform) Cryptocurrency (general term) Blockfolio (Bitcoin/crypto platform) Kraken (Bitcoin/crypto platform)

If Bitcoin actually falls hard, that could be a sign that risk tolerance is abating, and that could affect risky assets across the board.

But let’s not get excited.

We’re still near all-time highs, and stocks weren’t all that bad today.

Read more by Soren K.Group