Tape Watching:

The USD is under pressure right now on an hourly basis, but Gold is struggling to react positively. Right before the hourly push by the Yen and Euro , Gold managed to spike up for a brief time only to get smacked down as it approached $1310.50 in spot. This bolsters our feel that the risk from here is lower if a breach of $1306 hits on the hourly. If it happens that should be good for a trade down to $1298. That is not to ignore the upper band indicator that says Gold is a buy above the $1313 area in spot.

Gold Holds its hourly pattern...

While the Yen strengthens against the USD....

And the Euro follows suit...

The feel here is, if Gold cannot move higher while the USD is weaker, then the easier, more volatile path may indeed be lower. Watch for Gold to over react to any dollar strength for the remainder of the day.

Understanding the Macro Trade

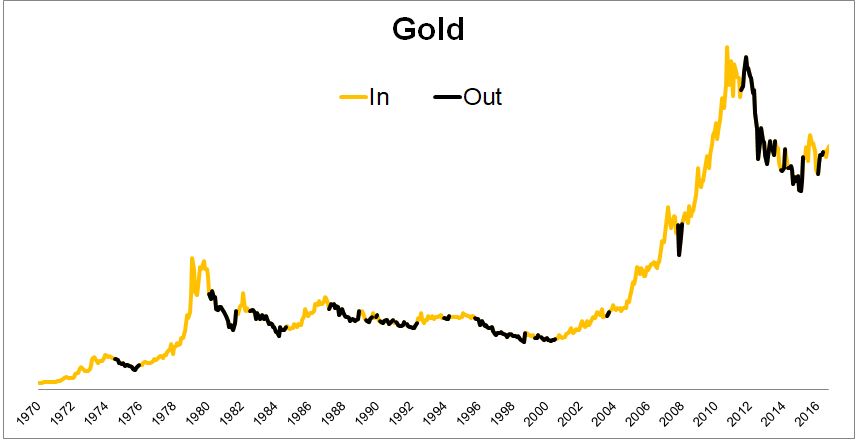

This is all for trading and sentiment. If you want a simple indicator to help you decide if you should own Gold for a 6 month to 2 year "trade" , there is nothing more refined than using simple moving averages. Gold trends more than any other product on earth. And we count sideways as a trend too. Absent fundamentals that matter, a government that can steer investment away from it and no required filings and transparency by central banks, look to the moving average.

As recently stated by Michael Batnick, Gold is a buy when it closes a month above its 12 month moving average. And right now we are closing in on the second month where Gold is above that average, yet still close enough for a good risk reward trade.

Monthly Gold - 12 Month MA comes in at $1248.2

Buy it at month end if we are above $1248.20. Put in a sell stop if we are below the Ma 30 days from now. Put in a financial fail-safe stop for intraday moves if you are trading with leverage and walk away.

Going back to 1970, the average monthly return for gold following a close above the 12-month moving average is 1.47%. The average monthly return following a close below the 12-month moving average is -0.15%.

In fact, sell it short if we settle below that MA on a monthly basis. Just do not tell your Gold bug friends.