Last week I had the opportunity to attend the Young Presidents Organization (YPO) parliamentary intelligence forum in Washington, D.C. More than 200 members of parliaments from as many as 60 European countries joined us to hear from such dignitaries as Congressmen Robert Pittenger (R-NC) and Mike McCaul (R-TX), chairman of the Homeland Security Committee.

While in D.C., I was very honored to be invited into the epicenter of power and decision-making. That includes the Senate Press Office, pictured above, and the west front of the U.S. Capital facing the National Mall, where every president since Ronald Reagan in 1981 has been inaugurated.

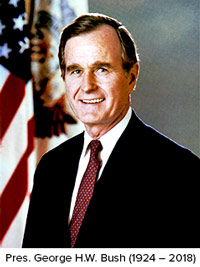

It was there that George H.W. Bush took the oath of office, exactly 200 years after George Washington did. Newly arrived to Texas from Canada, I remember watching Bush’s inauguration on TV and being moved by his testament to freedom: “We know how to secure a more just and prosperous life for man on Earth,” he said, “through free markets, free speech, free elections and the exercise of free will unhampered by the state.”

The memory was made all the most poignant by the flags flying at half-staff, and the fact that I was standing in the same building where, just 24 hours earlier, the former president’s remains lied in state.

Remembering the 41st President

The life of George Bush, son of a U.S. senator and father of two governors and a president, stands as a case study in sacrifice and service. On the same day that he graduated from high school in 1942, he enlisted in the United States Navy. The country’s youngest Navy pilot at the time, Bush went on to receive the Distinguished Flying Cross after completing a bombing mission despite his plane being engulfed in flames from Japanese fire.

And from there it only gets more interesting.

Founder of a successful oil and gas company, congressman in the House of Representatives, ambassador to the United Nations, special envoy to the People’s Republic of China (before the U.S. had diplomatic relations with the Asian country), director of the Central Intelligence Agency (CIA), two-term vice president—Bush was and remains to this day perhaps the most qualified and well-equipped chief executive ever to set foot in the Oval Office.

As the 41st president, he oversaw the collapse of the Soviet Union and reunification of Germany, putting him at odds with U.K. Prime Minister Margaret Thatcher and French President Francois Mitterrand, who favored a divided Germany. His decision to push back Iraqi forces from Kuwait, arguably the greatest defining moment of his one-term presidency, was both a military and political success.

American voters ultimately denied him a second term, however, once they felt his pledge to create “no new taxes” went unfulfilled. As part of a compromise with the Democratic-controlled Congress, Bush agreed to raise taxes to help reduce the national deficit. The episode is a reminder of a time when politicians’ duty to country trumped duty to party, even if it jeopardized reelection.

That deep sense of duty sustained him for the rest of his 94 years. Bush was involved in a number of charities and humanitarian efforts, most notably the Bush Clinton Coastal Recovery Fund. The fund— spearheaded in cooperation with his former political rival and, some might say, unlikely friend Bill Clinton—raised tens of millions of dollars for families impacted by 2005’s Hurricane Katrina.

On behalf of everyone at U.S. Global Investors, I extend my gratitude and sympathy to the Bush family. May George Herbert Walker rest in peace and remain firmly in our memory.

Stocks Hit on Renewed U.S.-China Trade Concerns

On a very different note, global stocks last week plunged on concerns that trade negotiations between the U.S. and China are not running as smoothly as initially thought. The S&P 500 Index is not only having one of its worst quarters in years, but it could also end up in the red for the year for the first time since 2008.

Adding to the uncertainty was news of the arrest in Canada of the chief financial officer (CFO) of Chinese tech giant Huawei. Although no charges have been filed yet, the company has long been investigated by U.S. authorities, and more recently it’s been suspected of violating economic sanctions against Iran. The CFO, Meng Wanzhou, faces extradition to the U.S.

The name might not be known to most Americans, but Huawei is the world’s second-largest manufacturer of smartphones following Samsung, and the largest supplier of telecommunications equipment. Meng is not only a top executive but also the daughter of the company’s founder, Ren Zhengfei, a former officer in the People’s Liberation Army who has close ties to the Communist Party of China.

Imagine a foreign power arresting the daughter of Steve Jobs, and you might get some idea of how big a deal this is.

President Donald Trump has levied much of his criticism on China for “unfair” trade practices and stealing intellectual property from the U.S. As I told you back in March, China’s J-31 stealth fighter jet is believed to be a knockoff of Lockheed Martin’s F-35. (A 2014 whitepaper on Huawei, in fact, states that the tech firm got its start in 1987 by “reverse-engineering foreign products and using that as the foundation to develop more complex technologies.”) But America’s beef with Huawei, and its Hong Kong-listed rival ZTE, go back further than the start of this administration and rest on suspicions their phones and other telecomm products might be used for espionage.

In 2012, after investigating Huawei and ZTE, the House Permanent Select Committee on Intelligenceconcluded that the two firms could be seeking to “undermine core U.S. national-security interest.” Committee members recommended that the U.S. block any mergers and acquisitions involving the companies and that all U.S. governmental agencies not use their equipment. Earlier this year, officials with the CIA, National Security Agency (NSA), Federal Bureau of Investigation (FBI) and Defense Intelligence Agency (DIA) testified before the Senate Intelligence Committee that Huawei and ZTE’s phones posed a security risk to American consumers.

In any case, Meng’s arrest last week rattled investors, convincing many of them that U.S.-China trade talks are deteriorating rather than improving. We saw a knock-on effect among a number of Huawei’s suppliers, including lens-maker Sunny Optical (down almost 5.5 percent last Thursday), data networking firm Inphi (off 9.25 percent) and California-based NeoPhotonics (down more than 16 percent).

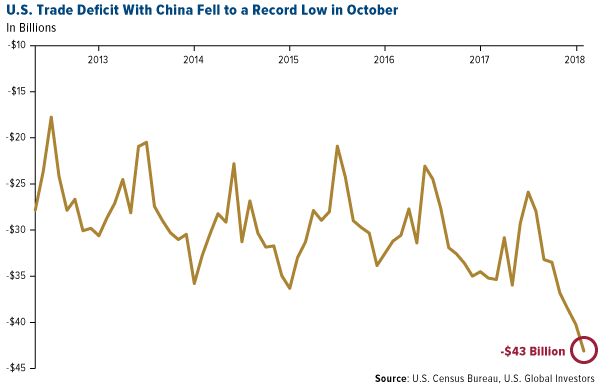

U.S. Trade Deficit Just Widened Even More

Speaking of trade, the U.S. deficit with the rest of the world tumbled to a 10-year low in October.According to Zero Hedge, the “trade deficit was $55.5 billion in October (worse than the $55.0 billion expected and well down from the $54.6 billion revised print for September)… underscoring continued fallout from the trade dispute with China.”

As for the U.S.-China trade deficit—the difference between exports and imports—that measure widened to a new all-time low of $43.1 billion in October, down from $40.2 billion a month earlier. The fall in net exports is expected to weigh heavily on fourth-quarter gross domestic product (GDP) growth.

The trade report comes at a time when additional tariffs on goods coming into the U.S. are increasingly to blame for stock volatility this year. A new analysis by Bank of America Merrill Lynch suggests that worries about tariffs have trimmed some 6 percent off domestic stocks in 2018 alone.

What’s more, tariffs could be costing American households more than most realize. Last month a study conducted by consulting firm ImpactECON and commissioned by Koch Industries—an opponent of Trump’s trade policies despite its billionaire chief executive brothers, Charles and David, being top Republican donors—estimated that tariffs would cost each U.S. household nearly $2,400 in 2019, or $915 per person. GDP growth could be reduced 1.78 percent next year, with losses close to $2.8 trillion between now and 2030, if current trade actions were allowed to stay in place, the study says. As many as 2.75 million American workers “are likely to become unemployed” in 2019 “if all trade actions are implemented concurrently.”

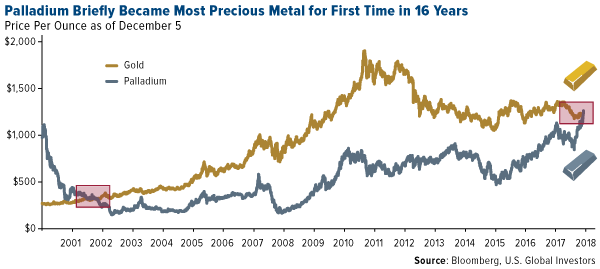

Gold Price Rises on Weaker-Than-Expected Jobs Report

Speaking of employment, the U.S. added 155,000 jobs in November, falling far short of expectations. The U.S. dollar pulled back slightly as a result, prompting gold to trade at a five-month high of more than $1,255 per ounce. Earlier in the week, the price of palladium briefly overtook gold’s on tightening supply and increased automobile demand. (The silvery white metal is used to manufacture catalytic converters). But if economic uncertainty continues to weigh on the dollar, we could see gold lift even higher and safely retain its spot as the most valuable precious metal.

As I reminder, I recommend that investors maintain a 10 percent exposure to gold in their portfolio—half of that in gold coins, bars and jewelry; the other half in high-quality gold mining stocks, mutual funds and ETFs. Remember to rebalance at least once a year.

For more on gold, and other market updates, I encourage you to subscribe to our award-winning Investor Alert newsletter. Subscribing is FREE!

--

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 09/30/2018: Sunny Optical Technology Group Co.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.