Source: Michael J. Ballanger for Streetwise Reports 11/02/2018

Precious metals expert Michael Ballanger discusses recent moves in the stock market, as well as with precious metals equities.

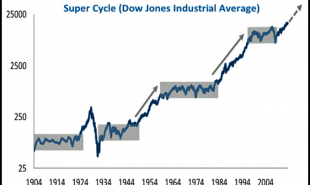

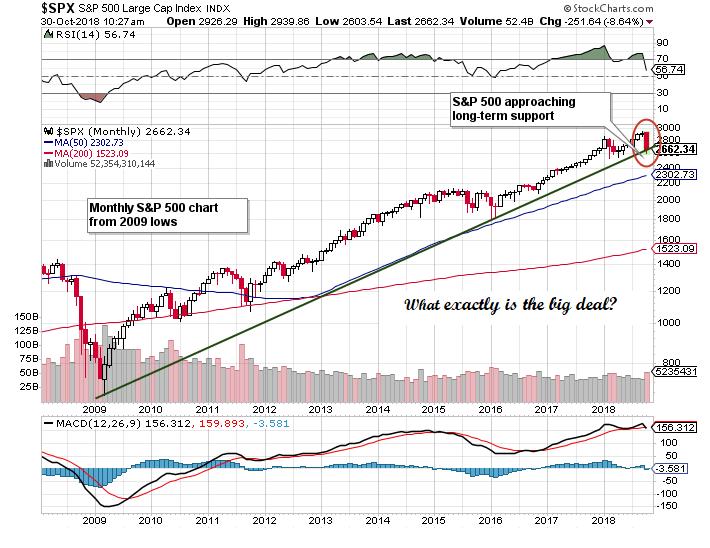

The best news I could ever impart upon the world of gold and silver owners would be that the Great Intervention Bull Market of 2009–2018 in common stocks has ended and that the world is going to gravitate back to the traditional safe havens used by savers for over 5,000 years, precious metals. However, it is probably premature to pop the cork because one glance at the monthly chart of March 2009–October 2018 reveals a much more sanguine picture than the one shown beside it. Compare the 10-year monthly chart to the 2-year daily chart; two distinctly different messages are conveyed.

In the first chart, the events of the past four weeks look ugly, and if you were a buyer at the September highs, it IS ugly. If, however, you were a long-term investor that accumulated in the period after the March 2009 lows, it is not exactly Armageddon. I therefore believe that the jury is definitely out on the direction of the stock market looking out to 2019 BUT—and this is important—we MUST rally in November. We are right at that 10-year uptrend line that sits right around S&P 2,625–2,650, so it absolutely MUST grab in the next two weeks. Failing to honor the 10-year uptrend line would be the market's final verdict and one which I will respect by reducing risk across the board to an even greater degree than I have been doing all summer. Conversely, it would also be a clear signal for the managed money monkeys to look to alternatives (like gold and silver) as a way of capturing alpha. Ergo, the next two weeks are critical. In the meantime, I am carrying larger-than-normal cash reserves as I await the return of Judge Market from chambers with the verdict.

Which of these two charts is Chairman Powell seeing?

Fed Chairman Jerome Powell has been raising rates for the better part of two years and has recently indicated that he intends to increase rates once more in 2018 and as many as three more times in 2019. President Trump has been openly critical of these policy moves because the stock market performance has been a big part of his presidential legacy scorecard as proven by his numerous tweets celebrating the new highs seen countless times since his election in 2016. I contend that the Fed has its eyes on the 10-year chart and that is exactly what YOUR eyes should be on. The Fed's mandate under Powell will not change due to a stock market 10% off the highs; it might change with negative GDP growth, a faltering CPI, or rising unemployment—MIGHT. The problem with the politicization of Fed policy and stocks lies in the incredible rise to power of the financial elite led by the banks, whose campaign contributions cover both parties in the U.S. and the leading parties abroad. These banks have been instrumental in taking the markets down right before the mid-term elections giving rise to Trump's criticism of the Fed thus deflecting the onus of blame from tariffs and sex scandals to the policy-makers. As the voters head into the booths on November 6, the vast majority of Trump supporters won't give a hoot about the Dow Jones Industrial Averages and small minority that do will have the Fed to blame rather than Trump.

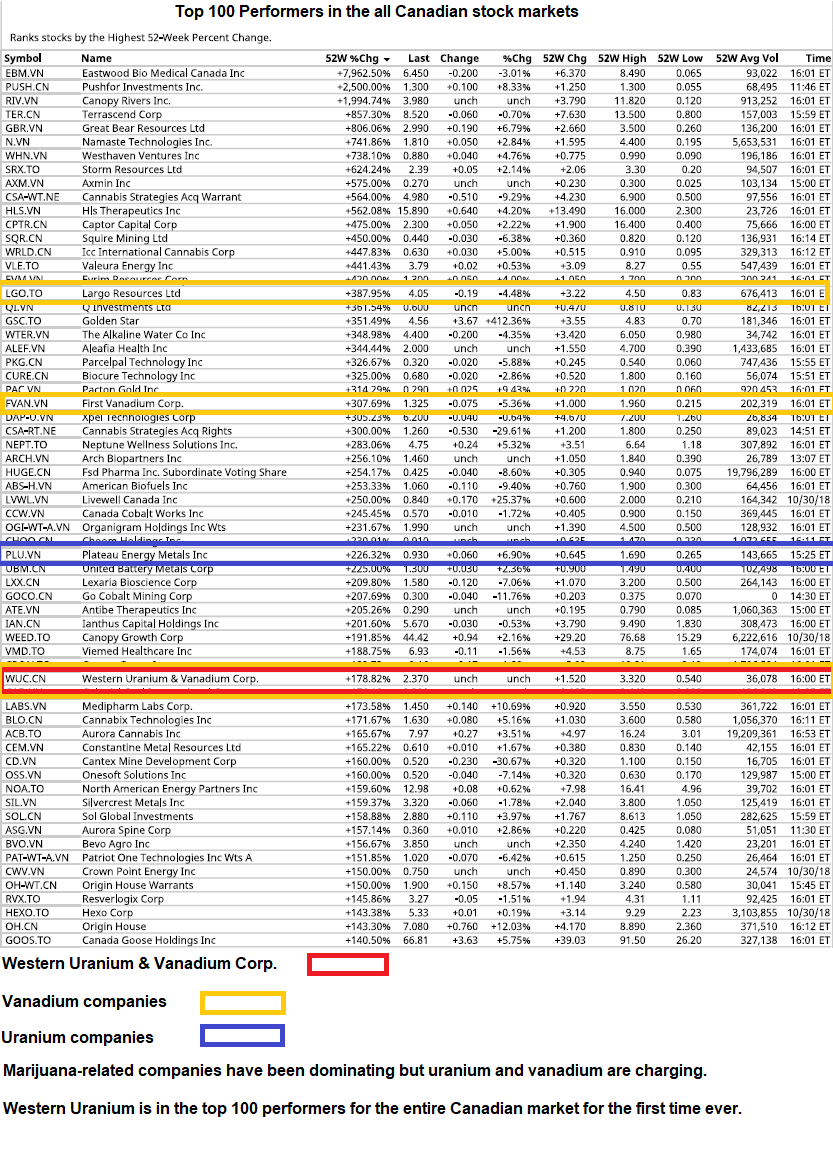

Turning to Canadian markets, would it surprise you to learn that as of tonight's close, a handful of uranium and vanadium companies have popped on to the "Top 100" list for performance over the past 52 weeks. Pot deals still dominate but have slipped noticeably since the legalization event on the 17. If you notice the 52-week highs for the last year, most of the pot deals are WELL off the highs. Notice, too, that the only gold and silver deal of any import is none other than our pick from August, Great Bear Resources Corp. (GBR.V), which I added in the $2.30 range and which went out for the month at $3.15.

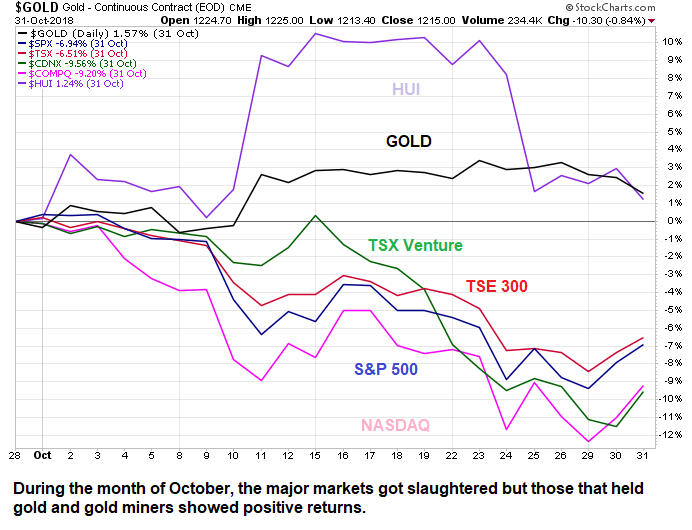

The month of October went out like a lion with stocks rallying hard but Thursday's solid performance and Friday morning's blow-out NFP (jobs) number. AAPL's weakness dominated the day as the final "FANG" bit the dust. I expected the market to bounce during the first three days of the month as pension fund flows are invested but AAPL's crushing 7.3% drop has now eliminated the leadership that piloted the markets for the better part of the summer and fall. Looking back at the performance rankings for the October, it is interesting that holders of gold bullion and gold mining shares enjoyed a positive performance while virtually everything else suffered declines of 6.5–9.2%, numbers that can quickly eliminate bonuses and terminate careers.

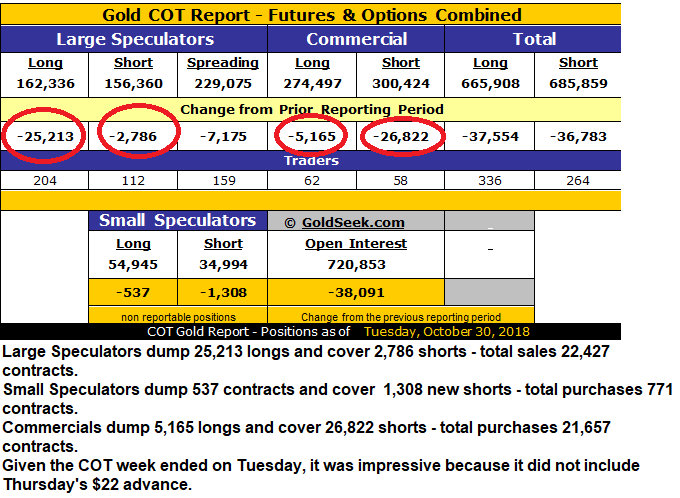

Once again, and in honour of an ancient financial tradition, gold and silver fulfilled their respective roles as "precious" metals, accordingly defined as "objects of great value; not to be wasted or treated carelessly." As we head into the final eight weeks of 2018, there are a great many managers of other people's money who are paying attention—and it couldn't happen at a more opportune time. Tonight's COT report shows that the Commercials were covering shorts into weakness while the Large Spec algobots continued to pile and add shorts/dump longs also into weakness. As long as the Large Speculators continue to carry such a paltry number of longs (13,194 futures only; 5,976 futures and options), the gold price should continue to trend higher through year-end. It is imperative to remember that major declines in gold have occurred when the aggregate long positions held by Large Speculators exceed 300,000; we are nowhere near that figure today and won't until $1,400 is tested by year-end.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Read what other experts are saying about:

[NLINSERT]

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Great Bear Resources and Western Uranium and Vanadium. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: Bonaventure Explorations Limited is owned by me and my wife and has earned consulting fees from Western Uranium & Vanadium in the past. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Uranium and Vanadium, companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Read more by MarketSlant Editor