Weekend update

- Fla Devastation as Irma Makes Landfall- Live Stream

- Gold Trade Recommendation - Analyst

- PETRODOLLAR BREAKDOWN: Big Moves In Gold & Silver Ahead

- James Rickards on the End of Financial Complacency

- In Irma's Wake 'It Looks as if There's No Sea'

- Solar Flare May Stop NK Missile Test Saturday

- After The Hurricanes: America Can't Afford To Rebuild

- Reports Confirm North Korea Can Survive An Oil Embargo

- NWO: China Sponsored North Korea is a Nuclear Power

UPDATE: Gold Opens Lower than Forex Implies - in Danger Zone

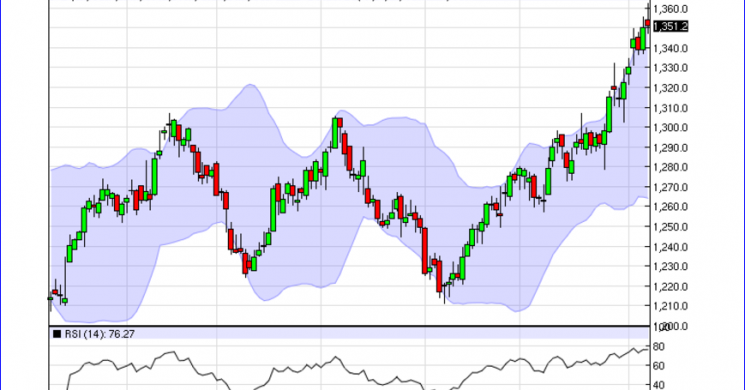

This is the chart that kept us from buying into Friday's open and more concerned about the close. Gold is lower now than the Forex market implied. To us that is a problem tied to technical and momentum traders who will sell into weakness. Under $1348 Basis December on an hourly close implies $15- 30 downside risk on our system.

Last Sunday night we started putting out an indicative call based on FX behavior. The Yen had opened significantly stronger against the USD, and we handicapped Gold as expected to come in around $1335. [See UPDATE:Spot Gold Opens $1335+ In Line with Expectations for reference].

Lucky enough to be right, but not without some experience trying to price things in the dark, here we are again.

Gold settled $1351 and change on Friday after a strong week ended on a poor day. Concerns were raised if Gold spends any time under $1348 that day. Gold did hold nicely, but now we are set up for a poor showing for Sunday night. The market, based on Yen behavior looks to be softer by $3 to $7 this opening round at 6 pm. What happens after that we do not know.

- that story here: Below $1348, Gold Could Fall Out of a Bunk Bed'

Here is where markets are right now as of this writing: (dots next to markets mean they are still closed)

Starting with Spot Gold on Friday's close 15 minute chart for perspective.....

FOREX OPEN

The FX market is open and both the Euro and the Yen are pointing to a stronger dollar and a weaker Gold open.

The Yen is weaker against the USD gapping higher on the 5 minute chart implying more yen are needed to buy a USD.

Meanwhile the EURO is also showing a (less) negative implication for Gold as it currently trades .....

On Friday Morning during the rally we wrote:

An hourly close below $1348.00 basis Dec futures ... alerts us to a correction of another $15 to $30. Only if we break below and back above (pick a time frame) will more short covering possibly reenter.

Basis for our concern lies in how the 4 hour spot chart didn't get much time to breathe. Below $1348 and Gold could fall out of a bunk bed. A dip to buy for investors. A dip to sell for algos and momentum longs.

Putting more emphasis on the Yen relationship to Gold as a safe haven asset ( how the Yen is "safe" we don't see but then again we don't see how a 2% bond yield on a country with a debt ceiling problem, permanent monetization, of its debt as a very scary alternative, and eventual credit downgrading in its future is safe either)... This implies Gold opening $3 to $7 lower. The problem with that is it would open below an important level that could trigger some profit taking regardless of what the FX market does the rest of the night.

So watch how Gold behaves if the Yen reverses. If Gold doesn't keep pace on a turnaround, it could be on its own under the weight of algos and too many longs with too little patience.

December Gold Chart

Interactive Dec. Chart HERE

Dip buyers may get an opportunity on the open and through the night here

Read more by Soren K.Group