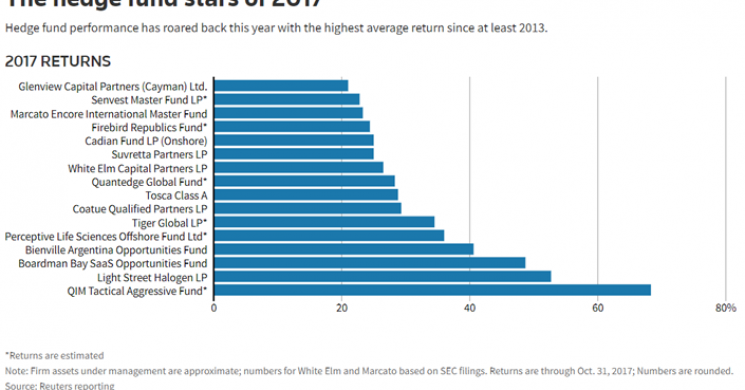

A year ago, hedge funds seemed to be written off for dead. Things aren’t as grim today with the industry turning in its best performance in at least four years—and we’re still in a bull market. Significant pressure to evolve remains, but it’s worth pausing to gawk at some impressive numbers: The 20 percent club – hedge fund stars of an industry rebound

More recent big money news from me and around Reuters:

- Multi-manager hedge funds hook investors with returns recovery

- Leucadia adds $100M to Folger Hill bet as hedge fund stabilizes

- Distressed debt funds turn activist to rescue U.S. energy bets

- Billionaire investor Ackman loses bitter ADP proxy battle

- Breakingviews: Bill Ackman is losing his touch

- Short seller Kerrisdale targets Woodford-backed Prothena

- Third Point takes stake in mall-owner Macerich

- Activist TCI calls for shareholder vote on removing LSE chairman

- Bridgewater paid off employee after relationship with top exec: WSJ

- Trial of ex-NYC union head, Platinum co-founder winds down

- San Francisco fund manager gets 2-1/2 years for fraud conspiracy

- Icahn subpoenaed by U.S. on biofuels dealing

- Draining the dark pools? EU trading rules face uncertain launch

- Hedge funds throw in the towel on bullish U.S. bond bets

- U.S. investors target 'buyback stocks' in bet on Trump tax plan

- Sterling climbs as political risks ease

- Gold investors hold their nerve as stock markets fly

- As Hang Seng hits highs, Chinese step up buying HK stocks

- U.S. fund investors snap up international stocks: Lipper

Lawrence Delevingne Reporter | Reuters @ldelevingne lawrence.delevingne@tr.com

Read more by MarketSlant Editor