Source: Michael J. Ballanger for Streetwise Reports 04/08/2019

Precious metals expert Michael Ballanger discusses movements in the gold and silver markets in the last week, as well as two companies on his radar screen.

The past week was an exercise in total lockdown for both gold and silver as the price managers have succeeded, at least for now, in herding investor behavior into a cacophony of complacency, where the maddening jumble of Fed Governors, CNBC commentators, newsletter tweet, podcasts, and email blasts have done their utmost to create the illusory effect known as "Goldilocks." The economy is running not too hot, not too cold, but somewhere in the vicinity of "room temperature." Humans that are seated in areas in that temperature range are rarely, if ever, stimulated to action; air conditioning units and furnaces are never summoned while comfort and safety permeate the room. That reflects the prevailing action in stocks and in the metals as gold had an approximate $8.00 range on the week versus the week prior where volatility exceeded $32.00 for that week.

The rudder steering the HMS Goldprice since the start of Q4/2018 has been "fear" and despite how harshly the global central bankers have stomped on the stimulation pedal, it has been the unbelievable move in the stock markets globally that have served to calm the nerves of an investor class that a mere three months prior was ready to hurl themselves off a bridge. In past times the stock market served as a barometer as opposed to a thermometer in its predictive powers over the economy. These days, stock price movements totally govern consumer spending habits as people defer major purchases when stocks are crashing with the opposite occurring when the markets are booming.

Accordingly, the price managers, well versed in the Lawrence Summers School of Behavioral Economics, have determined that the Fed Mandate needs stocks in its array of tools required to promote maximum full employment and price stability. While stock price manipulation may not be applicable in the mandate of price stability, rising stock prices affect the intentions of purchasing managers and personnel managers. Analogously, it is the muted behavior of gold and silver that convey to one and all that all is calm on the domestic front as to both inflation risk and stock market risk. Hence, gold just meanders.

This is why I totally despise this market environment; it not a real, free-flowing interaction between bulls and bears. While the day-to-day volatility is mere scenery to be used during the various acts within the trading-day play, the ending is unambiguous; it is pre-determined by the price managers and therefore without any hint of randomness. Furthermore, the longer it is allowed to continue, the greater the degree of moral hazard and the more precipitous the outcome when the curtain finally falls.

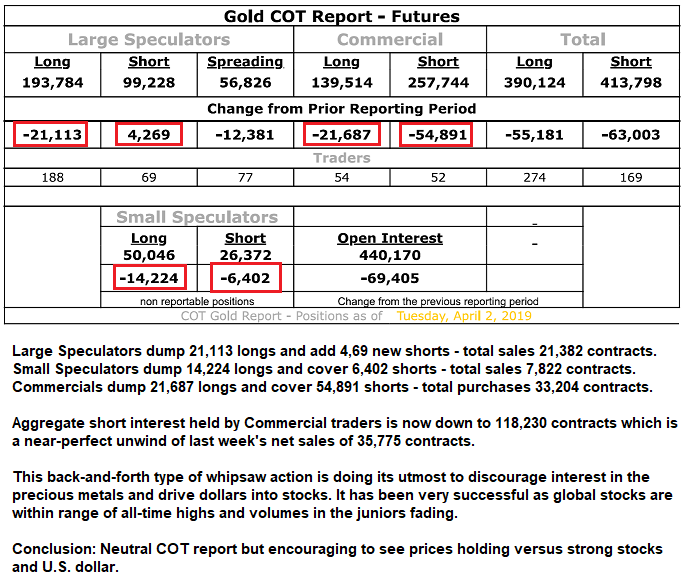

As you can see in the gold chart, everything on the surface appears tilted to the downside and it is my feeling that the set-up is one where the DUST and selected put options on the physical metals stand a superior chance of creating additional alpha rather than simply buying and holding those same metals and/or producers (or ETFs). However, the thing I have to keep in mind is that in the absence of any regulatory monitoring, the bullion banks could run a screen play against a bearish set-up in order to create the kind of upside volume into which they could reload some of the 33,204 net shorts that they covered last week. So, RSI, the moving averages, trendlines, and the MACD/Histogram combo are merely rumination, a condition where these superficial negatives continue to replay themselves over and over again for no apparent reason other than the confirmation of recency bias dominating one's actions.

For the record, I am trading from the short side of the metals via DUST:US and selected puts on the GLD. The position sizes are about a quarter of what I usually roll but rudderless ships are dangerous to follow and in the vernacular so commonly heard in the pork-belly pit, "Never short a dull market." What I mean by this is that I fully expect an intervention at any moment, especially if stocks begin to retrace their astounding move off the Christmas Eve lows but even more dangerous would be a short-lived downside gap in gold followed by enormous short covering by the Commercials just as the Large Speculators assess and react to those conditions exactly identical to the ones you see in this chart and ramp up THEIR shorts at the same time.

How many times have we seen this type of whipsaw behavior over the years? Far, far too many times have I donated discretionary capital to the Church of JP Morgan after which I curse, them first, me second, and vow to never be fooled again? When the bullion bank behemoths are lurking (as they are now), I keep positions smaller, stops tight, and stress-relief paraphernalia nearby. One must be prepared at every turn, you know.

COT Report April 5

It has been quite a while since I offered any comments on specific juniors explorco/develco issuers but the last two issues were Getchell Gold Corp. (GTCH:CSE; GGLDF:US) and Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX) and both are deserving of commentary.The former is a 100% exploration play in a very attractive Nevada neighborhood (north-central Getchell Trend) while the latter is developing a 70m/lb U3O8, 35m/lb V2O5 combined resource located in Colorado. Both issuers are in the midst of capital raises and at last glance, it looked as though GTCH was nearing its minimum CA$1,500,000 target while WUC is well-through its US$2,000,000 target and approaching the 50% over-allotment option amount of US$3,000,000. The reason for the interest in WUC is the widely anticipated Section 232 ruling whereby the current U.S. administration will impose quotas that will ensure that U.S. uranium production represents a minimum of 25% of domestic usage with imports not to exceed 75%. If this comes to fruition, companies such as WUC with domestic reserves are going to be re-rated immediately with higher valuations a virtual certainty.

When I put out my report late last summer, I was very clear that I would need to see $30/lb-plus uranium prices in order to get the developers really moving although as of this date, uranium resides at US$25.90, a far cry from the $30 level, which explains the corrective behavior in WUC since last year. Nevertheless, Section 232 is yet another potentially bullish jolt for this company whose share price peaked at $3.32 last fall into what was an across-the-board lift in the entire sector.

WUC is my first energy investment in years and I am participating in the current private placement, which offers a unit at $0.98 containing one share and one half-share purchase warrant exercisable at CA$1.70 for thirty-six months from closing date. If you have not yet expressed interest, the issue is about 70% through the over-allotment option so there may be an additional US$300,000 available as of the time of this missive. With the current market at $1.38 as of Friday's settlement price, the unit is priced at a 28.9% discount which is attractive by any and all measures but with Section 232 due to arrive on or about April 14, the lift could be substantial over the very near term. If 232 becomes a non-event, it will not detract from the longer-term outlook for a company trading at a US$40 million market cap (fully diluted) versus in ground metal value exceeding US$2.4 billion. This is precisely where the three-year purchase warrant kicks in and increases the notional size of one's share position by 50% which in a uranium bull could be one jewel of a "kicker."

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium & Vanadium. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Western Uranium & Vanadium Corp., companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Read more by MarketSlant Editor