Stocks Rally, With No Basis In Reality

Via Dennis Slothower and Outsiders Club

Stocks rallied strongly on Monday given a number of political and geopolitical events converging this week, as President Trump completes his first 100 days in office ahead of this Saturday.

The stock market is hoping this week the GOP Congressional leaders can agree on a bill to repeal Obamacare. Wouldn’t it be great if the GOP had been sandbagging a much better bill all along?

The President wants a bill that cuts corporate income tax down to 15% by this Wednesday but can he come up with a bill that doesn’t send the deficits up by another $2 trillion? If it’s not revenue-neutral will the President get the votes needed to pass it? Most think not.

Also, regarding the budget, the President is adamant about funding a border wall but the Democrats have threatened to shut down the government, so what does the President have to give away to get this in the budget? Does he have to keep Obamacare?

The investment bankers gapped the market open today, setting the highs for the day with the news that it looks like Marine Le Pen might lose the French election, lessening the risk of the EU and the Euro breaking apart.

Over the weekend we saw the victory of pro-European Union centrist Emmanuel Macron, who took an edge in winning the French presidency by winning the first round of voting and qualifying for a May 7th runoff alongside nationalist leader Marine Le Pen.

Macron, 39, who was a former French Minister of the Economy and investment banker, won 24% of the vote representing a more centrist viewpoint. Marine Le Pen won 21.3% of the vote representing a more nationalist perspective and a view of leaving the EU.

The mainstream parties, represented by François Fillon, the French Republican winning 20% of the vote and Jean-Luc Mélenchon, the socialist who took 19.6% of the vote, were both knocked out of the election, but it is thought a large percentage of their voters will support Emmanuel Macron, though the Republicans could swing towards Le Pen.

Stocks Detached from Economic Data

Meanwhile, the odds of the next rate hike have jumped to 69% for June. No one is expecting the Fed to raise rates in May but that may change this week if the President is successful in getting his bills passed in Congress in his first 100 days.

Momentum rules the stock market detached from economic reality.

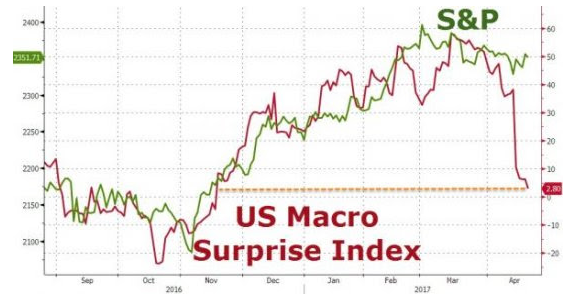

This last week was the biggest drop in U.S. Macro data in six years, as housing starts, car sales, retail sales, a drop in inflation, deteriorating jobs report, etc., have detached investors from economic reality.

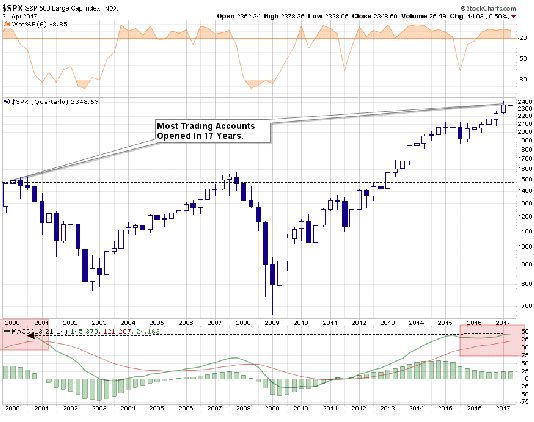

In fact, Charles Schwab, the investment brokerage firm, announced that the number of new brokerage accounts has soared 44% during the first quarter of 2017, the fastest pace the company has seen in 17 years!

In other words, not since the highs of the stock market in the first quarter of 2000, when the public bought at the top of the market, has the public been this enamored with the stock market.

Meanwhile, commodity prices continued to sink today. Gold fell $11.6 to close at $1,275 while crude oil prices fell 39 cents at $49.23 a barrel.

While investors are anticipating much better earnings from the energy sector, they take note that the energy stocks within the S&P 500 allocation have a P/E ratio of 132.66 times earnings ratio, according to the latest data from Zacks. I think the S&P 500 has already factored in any earnings improvements in energy.

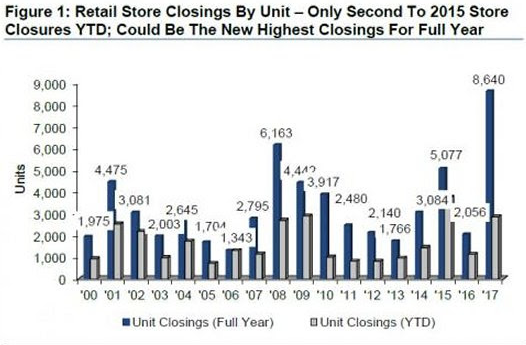

While the investment bankers are trying to get us to focus on the French elections and what may or may not happen this week within Donald Trump’s first 100 days, investors need to be aware that it was also reported over the weekend that 8,640 retail stores are now in the process of being closed!

Amazon is one thing, but a developing recession is another matter that people just aren’t recognizing while the investment banks continue to pump stocks. Beware of chasing stocks purely on the basis of momentum.

Read more by The Hound