The US Federal Reserve is one of the only central banks to attempt to raise rates consistently over the past few years, has possibly learned a very valuable lesson – no good comes from raising rates to the point of causing another market collapse. The news that the US Fed will leave interest rates where they are, temporarily, is good news for a number of reasons.

First, this allows the markets to shake out weaker players and weaker components of the corporate world. Where corporate debt levels are concerned, interest rates are tied to debt repayment liabilities and refinancing costs. Firms that are unable to manage at current interest rates certainly would not be happy about rising rates. This allows these corporations to either struggle to resolve their debt issues or collapse under the weight of their own debt. This will also play out in the foreign markets as well.

Second, it allows the housing market and private debt markets to shake out some of the “at risk” consumers. We authored an article a few months ago about how foreclosures and pre-foreclosures were starting to increase in nearly all markets. At the time, many people in the real estate field shrugged off these increases as par for the course. With the decreasing foreign investment in real estate and the increasing pressures on the local consumer markets, we saw a dramatic slowdown in housing starts and sales activities recently. This is because the demand side of the market is falling much faster than the supply capacity.

The uncertainty in the foreign markets, global central banks, and foreign investments have prompted many people to pull out of the local markets – even the hot markets. The at-risk consumers that were trying to sell near this top suddenly found the buyers were just not there or ready to make the commitment. This put the at-risk consumers in a difficult position as they could not flip their houses as easily as they could 6 months ago.

Yet, in the global equity markets, investors can sell or buy with much faster transaction times – at the click of a mouse button in most cases. This allows equity investors to pull capital away from risky investments and migrate that capital into more secure investments in a matter of minutes or hours – not weeks or months. And that is exactly what has been happening over the past 30+ days in the global markets.

Capital is repositioning for the next phase of this market; where the US economy is strong, housing continues to weaken and at-risk consumers continue to feel the pressures of the US Fed interest rate policies. Where foreign consumers attempt to deal with their own version of “central bank hell” and asset devaluations in an attempt to find more secure investment vehicles for their capital. Money market funds, investment funds and, of course, the US value/blue-chip equities are looking very promising right about now.

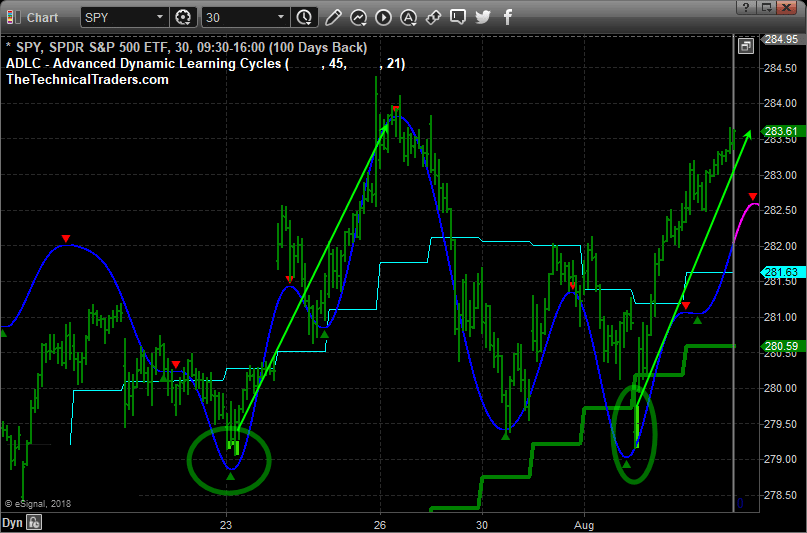

This Daily SPY chart shows our recent ADLC indicator (price cycle turning points) and our oversold extreme price levels shaded with lime green. When these two things align the market tends to rally for 1-3 days with strong momentum. During pre-market last week, we told our followers that the big gap lower in price was going to be bought and price should rally for 2-3 days, which is exactly what has unfolded thus far.

Global capital will continue to rush into the US markets as long as the US Fed does not do anything to derail things. Our research team believes the US Fed may even decrease the interest rates by 0.25% before the end of the year depending on how much pressure is placed on the economy by these “at risk” participants.

We will continue to keep you updated as to our findings and we want to urge you to visit www.TheTechnicalTraders.com/FreeMarketResearch to read all of our most recent research posts. You really owe it to yourself to understand what is happening in the global markets right now and how we have continued to stay 30~60 days ahead of these moves for our valued members. There are so many opportunities setting up in the markets for traders it is almost hard to understand the dynamics at play right now. If you want a dedicated team of researchers and traders to help you navigate these markets, then visit www.TheTechnicalTraders.com to learn how we can provide you with even more detailed daily research and support.

Chris Vermeulen