Source: Bob Moriarty for Streetwise Reports 01/15/2018

With shares of Novo Resources on a rollercoaster since the summer, Bob Moriarty of 321 Gold discusses the company's latest moves.

Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX) shareholders have been on a wild rollercoaster ride since early July when the stock snoozed at about $0.80 a share. A video posted on YouTube of prospectors locating gold nuggets at surface at Purdy's Reward acted as a catalyst to propel Novo higher to $8.83 in the first week of October for a 1000% increase in just over three months.

While the price of shares skyrocketing brought a lot of attention to Novo, there has been more disinformation, misinformation, absurd conspiracy theories and simply stupid comments posted on chat boards than any stock I have ever followed.

One industry "expert" estimated on the basis of a single sample that Novo might have something ten times bigger than the entire Witwatersrand. In November when Novo announced that the large diameter drilling wouldn't work and later released an additional two assay results, the same "guru" changed his tune to suggest that he couldn't possibly come up with an idea of the economics of the project.

I was dumbfounded at both statements. There have only been about 6 billion ounces of gold ever produced so saying that a project could be 20 billion ounces is akin to suggesting that the moon "might" be made of green cheese. And given that the Vits grade is estimated at between 8 and 15 g/t and Vits thickness is under half a meter, you don't have to understand very much to be able to say that if they can mine at a profit in South Africa at a depth of 15,000 feet or almost 4 km, you ought to be able to make money mining higher grade, same thickness but at surface. For months we had almost daily reports on Novo from this writer but hopefully he's now gone quiet.

Novo has released only five assays total from four samples. In early August the company reported results from a single bulk sample that they split so there are two results but from only one sample. One split showed 87.76 g/t or 2.82 ounces a ton and the other showed 46.14 g/t or 1.48 ounces. Those results should have been a red flashing light to investors. If you split one sample into two batches and one shows a grade almost twice as high as the other, you know you are going to have a giant problem getting an accurate measure of grade due to the nugget effect.

Quinton Hennigh made it clear that he wanted to try the large diameter reverse circulation drill but that it was only a test. No one knew if it would work or not. And in November he reported that it did not work but they were happy with trenching to determine grade and diamond core drilling to determine structure.

Investors have a hard time coming to grips with the concept of stock prices going both up and down. If a project is good, the share price "should" go up every day and if it doesn't, it's "proof" of either a conspiracy to manipulate price or the property was a heap of crap in the first place.

Huh? How does that work? As Rick Rule has said many times in the past, every great project with a big advance will have a 50% decline and it's no big deal. Nothing released by Novo since July was anything other than exceptional yet investors fell all over themselves running for the exits.

In late December Novo began to release the trench results. There were three assays from three samples. The first was 15.7 g/t, the second was 17.7 g/t and the third, taken from 40 cm above the basal contact was 1.3 g/t. Those investors who had not already broken one or both legs in the rush to exit stumbled to the door to sell in the hopes of capturing the biggest loss they could while they still could.

If you average the first two samples, you come up with 16.7 g/t over 40 cm on top of the basal contact which makes a great marker. That's twice the grade of gold being mined at a profit today in the Vits. Except it's at surface in Karratha which is a whole lot cheaper to mine. And 40 cm is an average of Vits thickness.

In their ignorance, investors took the 1.3 g/t assay as being negative. That's pretty stupid. First of all, drilling is aimed at determining two things. As all mining engineers know, there are only two kinds of rock, ore and waste. It's just as important to know where the waste is than to know where the ore is. So an uneconomic assay sample is not bad news, it's exceptionally important to know what is not ore. And actually, with gold at $43 and change a gram as I write, 1.3 g/t rock is worth $56 a ton. At surface that's also economic but if the sample had shown no gold at all, it was still important information for Novo to know.

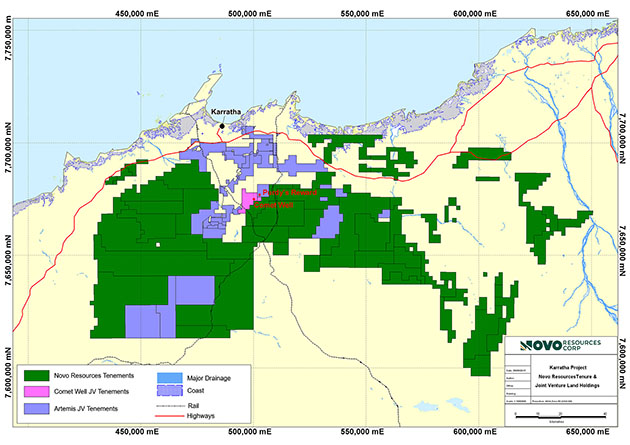

The summer sun bakes Western Australia now and will for another month or so. Work has stopped at Purdy's for now. Novo has applied for their Plan of Work and already has some approvals including permission for a 10,000-ton bulk sample. Novo expects to begin work at their 80% owned Comet Well by the end of February.

There has been a lot written and said about the processing plant at Radio Hill all of which is nonsense. It's a plant designed for sulfide ore. Purdy's is not sulfide ore, it's nuggety gold and Radio Hill can't possible process it. Lenigas keeps talking about putting in a gravity circuit but even that is a giant problem. There isn't a gravity plant in the world today capable of handling ore of this grade. As I have been saying for months, this is a unique deposit and has to be approached in a unique way with new thinking.

What Radio Hill does have that might be valuable to the JV is water for processing and a permitted tailings pond. But anyone saying all you have to do is truck the rock over to Radio Hill and run it through the existing plant is blowing smoke. An entirely new gravity circuit built around jigs and a big sluice box would work but it will take months to put together.

Novo is not sitting on their hands. The company is talking to the native corporation as I write and having a royalty agreement in place for Comet Well is a high priority. Fifteen to twenty bulk samples have been sent to Nagrom and by the end of January results should start coming out.

While it would have been nice to be able to determine gold quantity and grade with the large diameter drill, it's not mandatory. We know it's nuggety gold, the variation in grade from the first two assays show how difficult it is to measure even within the same sample. Quinton is holding out a belief that somewhere there will be small gold in the system easier to drill but I hold no such hope. What I do know is all of the gold samples so far have been exceptional grades that are economic for certain. You don't have to be able to measure it, you can mine it.

I feel bad for the investors who were buying at $9 and sold in a panic but I've been trying for five years to give a more balanced view of Novo and the Pilbara. Anyone writing off the company and the project is making a giant mistake. I've seen identical gold spread over 135 km at least and that's good enough for me.

I own a lot of Novo and they are an advertiser and I am biased.

Novo Resources NVO-V $3.39 (Jan. 15, 2018) NSRPF $2.73 OTCQX 148 million shares Novo Resources website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure: 1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Novo Resources. Novo Resources is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Read more by MarketSlant Editor