Gold flirts with first 3-session skid in a month as dollar strengthens

via marketwatch.com

Gold futures traded slightly lower Friday, on track to notch a third straight decline and a weekly price drop, despite a stretch of trade fraught with the type of political drama that would ordinarily have offered a boost to precious metals that thrive on uncertainty.

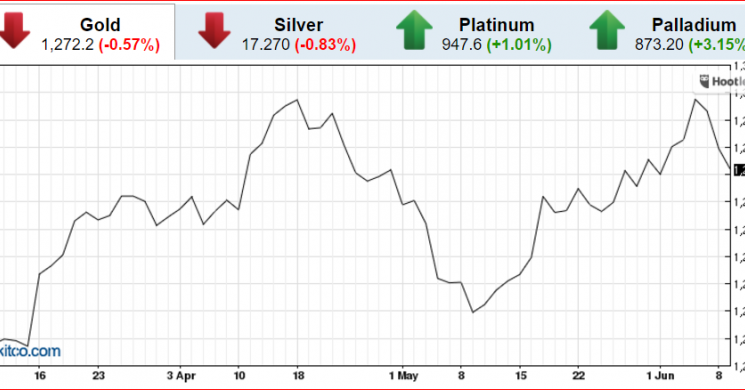

Prices on gold for August delivery GCQ7, -0.47% were $3.10, or 0.2%, lower at $1,276.40 an ounce, and looking at the longest skid since the three-session period ended May 5. A weekly decline of 0.3% was in sight, according to FactSet data.

Current Prices HERE

Friday’s moves in metals come after the U.K. parliamentary elections late Thursday delivered a stunning result: a hung parliament, in which neither Conservative nor Labour Party holds a parliamentary majority. U.K. Prime Minister Theresa May, who called the so-called snap election mid-April to strengthen her political base heading into negotiations with the European Union, as Britons aims to exit from the trade bloc, has been under pressure to resign after Thursday’s failed election gambit. Now, May will attempt to form a minority government, where her Conservative Party would need to rally outside support in each parliamentary vote.

The election results came after early polls had indicated that May’s party would beef up its majority and follows the equally shocking Brexit vote that happened less than a year ago.

Against that backdrop, however, gold has dipped into the red, with the dollar, as measured by the ICE U.S. Dollar Index DXY, +0.23% strengthening 0.5%. A stronger dollar can provide a headwind for gold, and other commodities priced in the currency, making it more expensive to buyers using other monetary units. The buck has gained 0.8% on the week, setting up for its best weekly gain since the period ended March 31.

Some strategists are pegging gold’s slump to the market’s focus on the Federal Reserve’s two-day policy meeting that will wrap June 14, where a dollar-supportive rate increase is expected. Wall Street is pricing in a 99.6% chance of a lift to benchmark rates in June, which would follow the European Central Bank’s decision on Thursday to keep its rates steady.

Jim Wyckoff, senior market analyst at Kitco, said the late-week rally in the dollar has been the biggest driver of trade in precious metals, with investors keying in on the Fed’s policy meeting.

“Focus is now turning to next week’s [Fed policy setting committee] meeting on Tuesday and Wednesday, at which time the Federal Reserve is expected to slightly raise U.S. interest rates, Wyckoff said. “Bottom line from a markets and trader perspective: Gold is seeing normal profit-taking and some chart consolidation after hitting a for-the-move high earlier this week. I look for more upside next week,” he said.

Investors also further digested Thursday’s highly anticipated Senate hearing featuring Federal Bureau of Investigation Director James Comey, whose May 9 firing by President Donald Trump as the intelligence official probed Russia’s ties with officials in the president’s administration, has created a political firestorm.

Meanwhile, July silver SIN7, -0.68% gave up 8 cents, or 0.5%, at $17.335 an ounce, on track for a 1.1% weekly decline.

In exchange-traded funds, SPDR Gold Trust GLD, -0.65% was off 0.3%, the VanEck Vectors Gold Miners ETF GDX, -1.82% traded 0.4% lower, while silver ETF, iShares Silver Trust SLV, -0.96% was down 0.5%.

Read more by Soren K.Group