Closing out a big week in the markets, we see the US markets rotating a bit lower after a number of news events. Some of these were very positive and others were negative. The take away from last week can be condensed into the following:

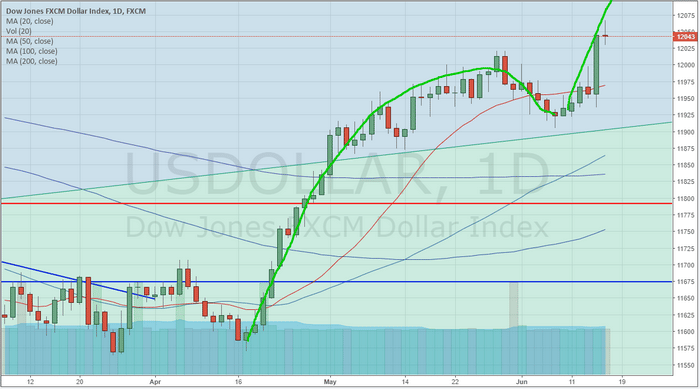

_ The US Dollar strengthened all week and shot up above $120 near the end of the week

_ Crude Oil tanked on Friday – falling nearly 3% to just below $65.00 ppb

_ EURUSD fell nearly 2% on QE concerns in Europe as well as trade issues that are mounting

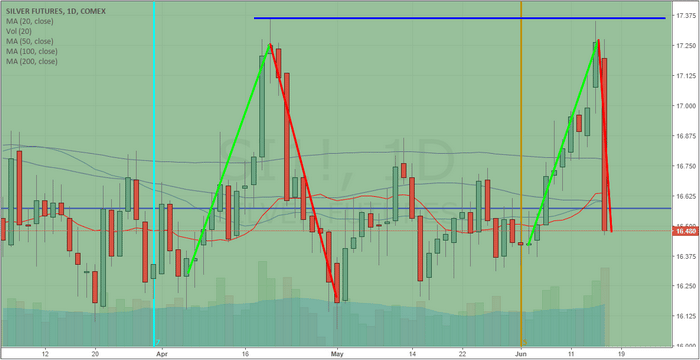

_ Silver rotated lower on Friday (-4.5%) as new tariff announcements between the US and China hit

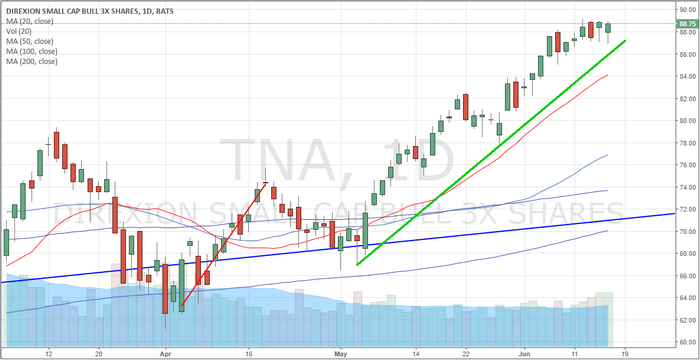

_ US Small Caps held up quite well throughout most of the week ignoring these news events

_ The NQ closed higher for the week while the ES (flat) and YM (lower) were mixed to lower overall

_ China appears to have already entered a downward economic cycle and we'll have to watch to see how deep this move can actually go before getting too far ahead with our analysis.

When we take into consideration the currency and commodity moves last week, there are two things we can assume headed into this week and beyond.

First, the US Dollar strength will create certain levels of havoc for emerging markets and foreign manufacturing firms, yet the strong US dollar will likely act as a magnet for global investors to continue to pile into the US Equity market rally.

Secondly, the downward rotation in Oil and Metals may create some broad economic pressures in foreign markets that could play out over the next few weeks as fantastic opportunities for skilled investors.

Lower Oil prices puts pressure on foreign oil suppliers, foreign currencies and many emerging markets. The supply glut throughout the world right now is something that will not likely vanish any time soon. This extended pressure on foreign markets may present a potential for some bigger price moves in ETF and certain global markets over the next few weeks or months.

Gold and Silver, on the other hand, appear to be running what we have termed a “rope-a-dope” pattern. Our analysis shows the Metals are poised for a bigger upside breakout move – but this move would likely coincide with some bigger news event that creates broader concern in the global markets. The move high last week started us thinking that this could be a new upside leg forming to create a new near-term price high. But Friday's pullback was just enough to neutralize the momentum of the upside move (for now). We would not be surprised to see another upside move early over the next few weeks as this pullback may be reactionary in nature and not fundamental.

There are so many dynamics at play right now with trade issues, economic fundamentals, Fed/Central Bank moves and commodities moves all rotating in broad ranges. Our recent analysis has been almost perfect in terms of the Oil moves, the Metals moves and the US Majors price advance. As of right now, nothing has really changed with our analysis and we believe most of the price swings this week were purely reactionary in nature.

Our continued belief is that the US market is really the only game on the planet with a strong US Dollar and a strong/growing economy. Oil pricing concerns will likely result in emerging market and currency issues that could continue to drive investment into the US markets. Gold and Silver will likely continue to play the “rope-a-dope” congestion pattern with a slightly upward price bias until some massive news event sends it skyrocketing higher. US Blue Chips and Small Caps will likely resume their upward trends quickly by taking out recent price highs and stunning the shorts/top-callers again. When you get down to the bottom line of these big news weeks, after all the dust settles – most of the time the core economic fundamentals are the real momentum of the markets. These news events are ripples in price caused by an external force. They go away after a short period of time and the fundamentals kick back in to drive future price moves.

Assuming nothing big hits the news wires to cause any further external events, we believe the US markets will quickly begin to recover their previous trends (higher) and oil will continue to drift lower (to near $60 first, then lower) while Gold and Silver begin to form a new price base for another attempted move higher (again). World leaders are attempting to do all they can to keep the train on the tracks and are stunned at the growth and success of the US economy/markets. Their biggest issue is that they may become second or third tier economies in comparison to the US. All of these dynamics, which are actively playing out right before our eyes, currently are driving capital into the US in an effort to avoid what appears to be a bottomless pit of economic uncertainty in many other nations. This, we believe, is the core dynamic at play in the global markets and we are watching for any signs that some new contagion may set in to change this dynamic.

Our suggestion is to take advantage of the opportunities that are currently available to skilled traders and try not to be too greedy. As we learned, recently, from the EURUSD price drop – these events can unfold very quickly and foolish trading can sometimes put you in very risky positions. We believe it is more suitable for skilled traders to take advantage of larger swing trading opportunities right now and to avoid the high-risk trades. There will be lots of time for those types of trades when the global economic environment settles down a bit more.

53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Read more by TheTechTrader