Source: Clive Maund for Streetwise Reports 03/31/2018

Technical analyst Clive Maund takes a close look at the COT reports to see what they mean for silver and gold.

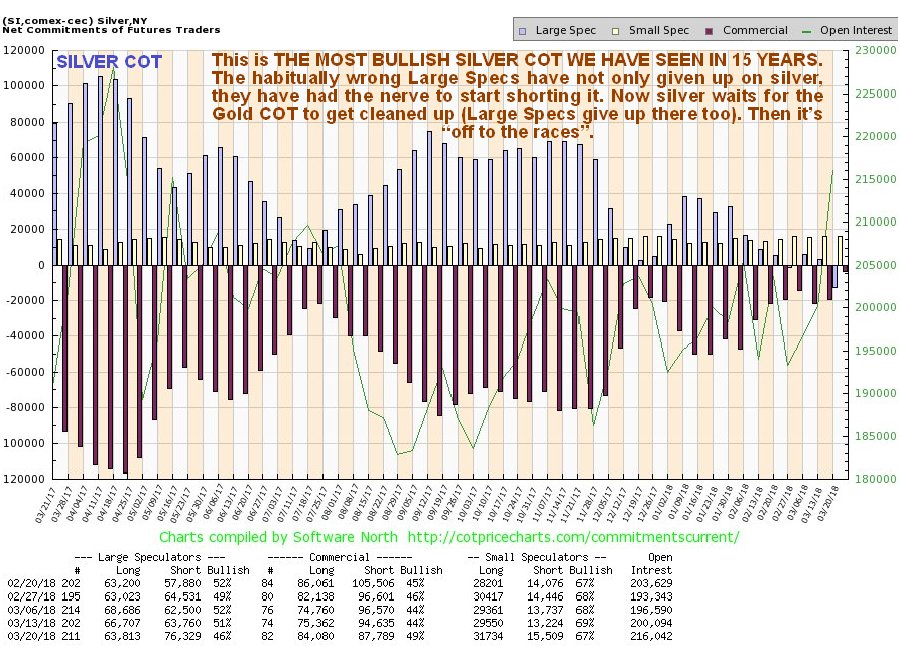

It is understood that precious metals investors are getting fed up with the action in the sector, as gold and silver backed off sharply yet again from resistance last Wednesday, yet this is nothing to be concerned about as both remain well above recent support levels. We know that COTs for silver are more bullish than at any time in history, or at least the past 15 years, so no problem there.

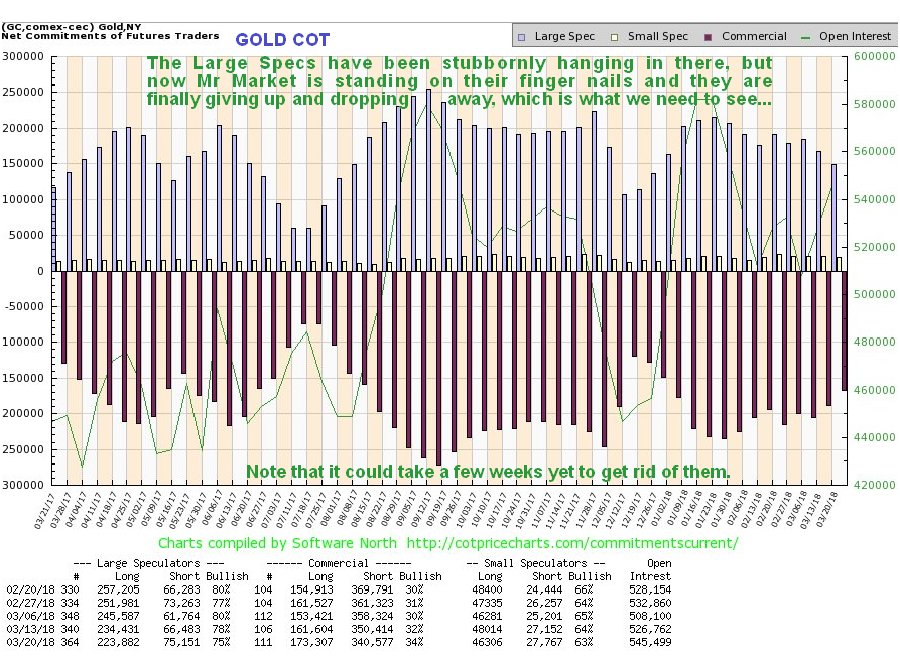

Such is not the case, however, for gold, where there has still been an uncomfortably high level of Large Spec long positions, but here there is good news, as their positions have been declining in recent weeks as they finally start to give up and throw in the towel, and since Mr. Market definitely does not like the Large Specs making off with a profit, it seems logical to suppose that when they finally admit defeat, which may now be happening, THEN gold and silver will take off higher, and when they do, silver, which is being held in restraint by this adverse gold COT thing, is probably going to take off like a high-speed train, leaving all the mumblers and grumblers and those of little faith standing on the platform watching it pull out without them—and giving them even more to moan and groan about. Let's make sure that we are not among them, and are instead comfortably seated on the train. This we do by accumulating the best stocks on down days, LIKE RIGHT NOW, while most other would be investors are whinging and whining about gold and silver refusing to go up.

Now we will look at the latest COT charts (new ones will be available at the weekend, which will be most interesting) for gold and silver, to see how close we are to the decks being cleared for the new bull market.

We'll start with silver as its COT situation is very clear and requires little explanation.

Silver's latest COT shows that, for the first time since the site started 15 years ago, the habitually wrong Large Specs have not only given up on silver, they have actually started going short, THIS IS AS FLAT OUT BULLISH AS IT GETS, and anyone who truly understands this is not going to get ruffled by down days like last Wednesday; on the contrary they will see them as an opportunity to accumulate further before the great bull market starts.

Click on chart to pop-up a larger, clearer version.

Gold's COT is a different story—the Large Specs are still too confident, still have too high long positions—ideally they should be driven out before the next big bull market starts, and the good news is that this now seems to be happening, as their positions have reduced over the past several weeks, and the impact of gold's drop of the past few days, which unfortunately we won't be able to see until the end of next week (because in this age of instant communication, Big Money holds back their publication by three days to disadvantage the little guy), may be substantial and result in them dropping to levels that are more definitely bullish and set the stage for a new bull market. Note that this could yet take several weeks, and this time should be used to build positions across the sector, taking advantage of short-term weakness and misplaced doubt and vacillation among the majority of investors. You should shovel the best silver stocks on board as fast as fast as you can, because they are not going to be on offer at these silly prices for much longer.

Click on chart to popup a larger, clearer version.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure: 1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.

CliveMaund.com Disclosure: The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stoc kmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Read more by MarketSlant Editor