By John Lee

January 25, 2018

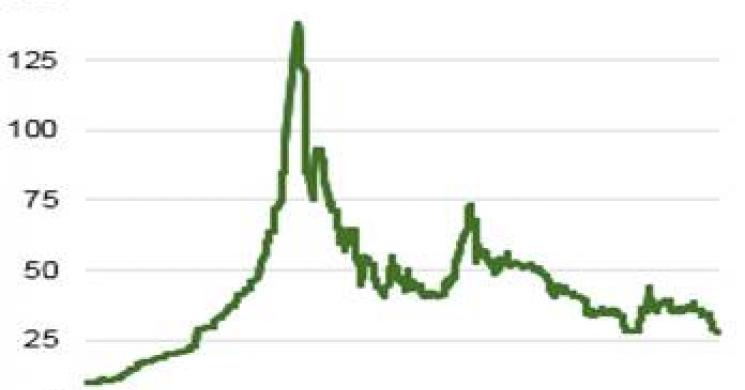

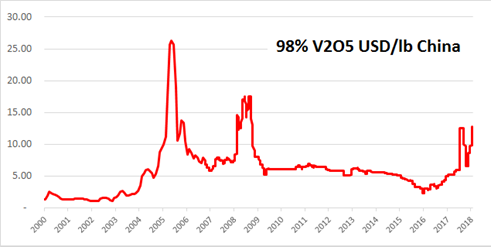

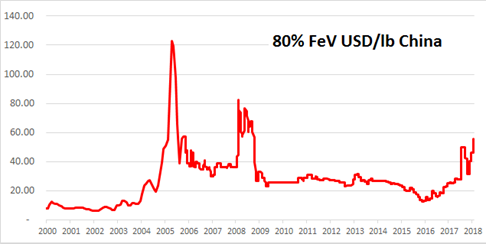

- Current vanadium pentoxide (V2O5) price at US$12.8/lb, 8-year high.

- Bank of Montreal Research forecasts significant further upside to global vanadium pricing as the market adjusts to lower Chinese shipments.

- The considerable upside of vanadium mining company valuations can be seen when compared with other e-metal (i.e. cobalt) mining company valuations.

Current vanadium pentoxide (V2O5) price at US$12.8/lb, 8-year high

Source vanadiumprice.com

According to Ferroalloynet.com Dec 26, 2017:

The Chinese V2O5 flake supply is extremely tight. Suppliers decline to sell at low price; and as some of V2O5 flake producers have signed long-term supply contracts, especially when the output is small, ferrovanadium and vanadium-nitrogen producers have little access to raw materials. V2O5 flake in Panzhihua is generally supplied to Pangang. There is little material available for other buyers. Tranvic and Jianlong are supplying material only for regular customers. Hongjing is seeing small output and makes no delivery. In the northern area, Jinzhou Guangda and Jinxin have suspended production. They have some inventories of V2O5 flake, but they are unwilling to sell.

According to Metal Bulletin, Jan 4, 2018:

The Chinese vanadium market may swing toward a deficit this year, underpinned by revised standards for the tensile strength of rebar products and a ban on vanadium slag imports, sources told Metal Bulletin. The new standard proposes eliminating 335MPa-tensile strength rebar and replacing it with 600MPa-tensile strength rebar, which has greater earthquake resistance. This means producers will have to add greater quantities of vanadium to the production mix. The overall consumption of vanadium in crude steel varies widely across the world. It averages 37 grams per 1,000 tonnes (g/kt) in China, far less than the 73g/kt in Europe and the 93g/kt in North America, Metal Bulletin has learned.

Mainstream BMO Commodities Research noted on Jan 9, 2018:

We see a situation where over the coming months Chinese exports of ferrovanadium could drop sharply on the back of increased domestic demand and raw material constraints. Chinese pricing has already moved sharply higher over 2018 to date, but we would see significant further upside to global pricing as the market adjusts to lower Chinese shipments. This is not important for the battery sector yet given it accounts for only a tiny proportion of overall vanadium demand, but should vanadium redox flow batteries become the method of choice for storing intermittent energy this could create further demand pressures over the coming years.

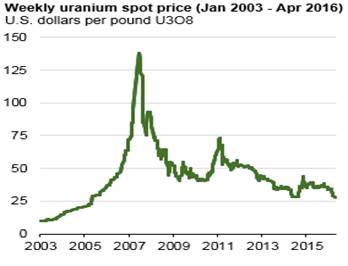

The current vanadium situation reminds me of silver in late 2003, when the US treasury’s silver inventory ran out and the silver price went from $5/oz to $15/oz by early 2016. The same story can be told about the uranium price, which went from $25 in 2006, when US stockpiles were depleted, to $120/lb by mid 2017

There are limited vanadium supplies available, despite rising prices. It’s entirely conceivable, in my view, for the vanadium price to challenge its 2005 high of over $25/lb. Incidentally, that is also when Chinese rebar standards were upgraded to a higher vanadium intensity.

Investing in a vanadium mining company can be a way to participate in the vanadium bull market. The majority of vanadium production comes from China, and there are no primary vanadium mines in North America today. The most advanced permitting stage vanadium project in North America is the Gibellini primary vanadium project, operated by Prophecy Development Corp. (OTCPK:PRPCF) (TSX: PCY, Frankfurt: 1P2N), of which I am the chairman. Gibellini is located in the mining friendly state of Nevada, where the majority of gold production in the United States takes place.

In the last ten years, Gibellini received approximately $20 million investment in drilling, engineering, feasibility, and permitting.

Prophecy's goals are to develop Gibellini into the first primary vanadium mine in the United States and offer the best leverage and a direct investment vehicle—one that reflects vanadium prices.

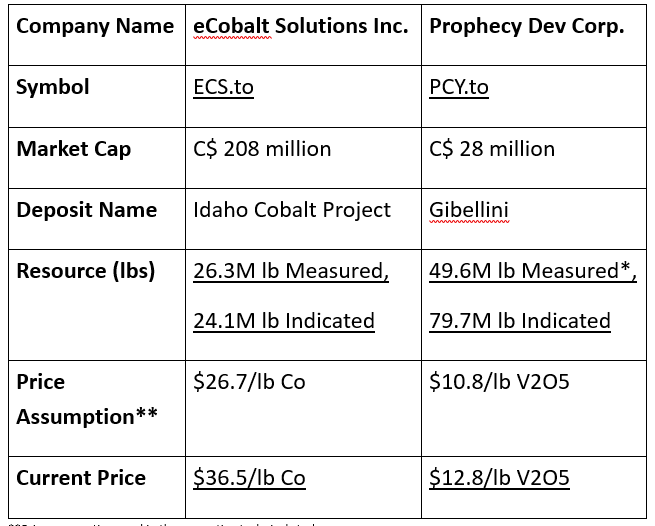

Here I have made a valuation comparison of two preproduction-stage mining companies: Prophecy (vanadium) and Ecobalt Solutions Inc (TSX: ECS) (cobalt).

I chose Ecobalt because most vanadium is produced in China and there are no primary vanadium mines in North America to compare Gibellini with; and Cobalt is a key ingredient in lithium batteries, akin to vanadium’s being a key ingredient of vanadium batteries. A growing market uses vanadium. In other words, both cobalt and vanadium can be seen as electric metals related to energy storage space.

** Price assumption used in the respective technical study

*(1) The Qualified Person for the estimate is Mr. E. J. C. Orbock III, RM SME, an Amec Foster Wheeler employee. The mineral resource estimate has an effective date of 10 November, 2017.

(2) Mineral resources are reported at various cut-off grades for oxide, transition, and reduced material.

(3) Mineral resources are reported within a conceptual pit shell that uses the following assumptions: mineral resource V2O5 price: $10.81/lb; mining cost: $2.21/ton mined; process cost: $13.14/ton processed; general and administrative (G&A) cost: $0.99/ton processed; metallurgical recovery assumptions of 60% for oxide material, 70% for transition material, and 52% for reduced material; tonnage factors of 16.86 ft3/ton for oxide material, 16.35 ft3/ton for transition material, and 14.18 ft3/ton for reduced material; royalty: 2.5% net smelter return (NSR); shipping and conversion costs: $0.37/lb. An overall 40º pit slope angle assumption was used.

(4) Rounding, as required by reporting guidelines, may result in apparent summation differences between tons, grade, and contained metal content. Tonnage and grade measurements are in US units. Grades are reported in percentages.

As vanadium currently trades at over $12.8 a pound, the Gibellini resource base translates into a lot of dollar value in the ground in a mining friendly jurisdiction.

The considerable upside of vanadium mining company valuations can be seen when compared with cobalt mining company valuations with cobalt bull market ahead of vanadium bull market by 2 years.

John Lee, Chairman of Prophecy Development.

Qualified Persons

The resource information contained in this article was reviewed and approved by Christopher M. Kravits, CPG, LPG, a Qualified Person within the meaning of NI 43-101. Mr. Kravits is a consultant to Prophecy and is not independent of the Company in that most of his income is derived from the Company. Mr. Kravits serves as its Qualified Person and General Mining Manager.

Read more by MarketSlant Editor