Answer: An Asian Bretton Woods type set up is coming

From Reader @silvercoin

At the time of agreement of Bretton Woods, 1944, The United States controlled two thirds of the worlds gold and insisted that the act rest on the gold standard. THAT was total power of the world financial system. 2011, U.S. broke, Ben Bernanke says gold is not money. How times have changed.

Connect the Dots

Then : Gold > USD > PetroDollar

- Create Gold Demand: 1944 we steer world towards gold for good reason (we have it, and Germany's lack of Gold was the cause for WW2)

- Inflate Debt: 1971 we have to monetize debt to pay for wars in vietnam and korea > go off gold standard

- Create USD Demand: 1974 cut Arab deal USD for Oil > we sell them military arms, they buy UST

Now: PetroDollar > Gold / PetroYuan

- Arabs have their own strong army, US not buying as much oil, China wants more Oil

- China wants to replace USD as world reserve, Arabs want to sell more oil (without shale competition)

- Arabs cut deal to sell oil to china in Yuan. Arabs will buy gold with Yuan

- Arab world increasing trust in China, Russia a product of implicit backing of currencies with Gold

- Arab world increasing mistrust of US intentions- ambivalent to US policies

Endgame- Arabs get to sell oil locally to China and Russia. avoid shale oil competition in U.S. This is underpinned by Yuan and Rubble implicit backing by Gold, increasing mistrust of US, especially since Saudi's don't need our weapons any more.

US Counter Attack: Destabilize the ME more.

Grant Williams Gets it

This is the presentation Grant Williams gave at Mines & Money in London in early December laying out why he believed the gold price is languishing despite a wealth of what would ordinarily be positive catalysts. Currently, outside those who focus on precious metals, there is an enormous amount of apathy but, he suspects, that apathy will shortly turn to enthusiasm - an enthusiasm which will expose the rift between paper prices set in NY and the structural changes undergone in the physical markets over the last several years. But for now... Nobody Cares.

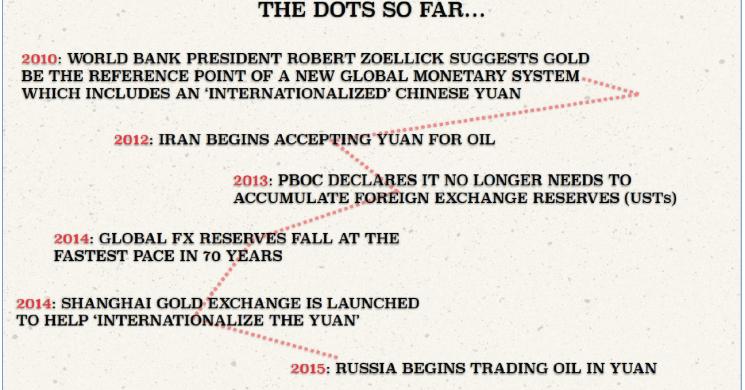

Grant's follow-up to Nobody Cares which focuses on gold's performance in 2016, the reaction to Donald Trump's election and joins a series of dots that may lead to the end of the petrodollar system and a new place for gold in the global monetary

Click HERE to see May 3rd Mines & Money Conference live stream - No strings

Read more by Soren K.Group