- Gold Dips Following Strong Jobs Gains

- Higher U.S. Yields are Capping the Gold Rally

- Wage Growth is the Key Metrics in the Jobs Report

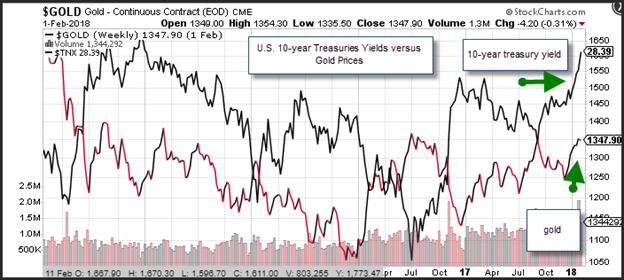

Gold prices are lower on the week on Friday morning in the wake of the stronger than expected U.S. jobs report. Prices were nearly unchanged ahead of the number but dropped nearly $15 per ounce as a knee jerk reaction to stronger than expected wage growth. U.S. yields moved higher which helped the dollar gain traction which paved the way for lower gold bullion prices. There is a relationship between U.S. yields and gold prices, which is currently driving the price of gold bars. Short-term, increasing U.S. yields might cap the gold rally, but solid growth in Europe will likely buoy the EUR/USD currency pair, which will help gold bar prices continue to rise.

Wage Growth Highlights a Strong Jobs Report

The stronger than expected jobs report featured a stronger than expected increase in wages which is the focus for most bond investors. Wage growth along with housing prices data are the main inputs used by the Federal Reserve to determine the correct level of inflation. Higher wages allow investors to compete for goods and services which make consumer goods more scares and spill over into prices.

The U.S. Department of Labor on Friday reported that non-farm payroll increased by 200K jobs in January. This compares to economist’s expectations of an increase of 185K. The December jobs numbers were revised higher by 12K to 160K while the November number was revised lower by 36K to 216K. The net decline of 24K puts the January increase in perspective, and in line with expectations. The BLS also reported that the unemployment rate was unchanged at 4.1% in January, but household employment surged by 409K versus 104K in December.

Wages Are the Catalyst for Higher Treasury Yields

The most important component was wages. The Labor Department reported that wages increased by 0.3% in January after rising by 0.4% in December. Higher wages increase inflation expectations which in turn increases expectations that yields will increase. Private payrolls increased 196k. Construction jobs were up 36k. Manufacturing employment rose 15k. Service sector jobs rose 139k. Government employment was up 4k.

In the aftermath of the report, the Fed's Neil Kashkari zeroed in on the wage numbers. The Fed governor said that if wage growth continues, it could impact rates. Kashkari has been one of the most dovish on the FOMC and dissented against last year’s rate hikes. He has been surprised by the optimism coming from the tax cut and he thinks it will leaded to stronger GDP growth this year but is not as sure about longer term prospects.

Productivity is an Issue for Growth

For U.S. growth to kick into another gear it will need help from productivity which is not cooperating. U.S. preliminary Q4 nonfarm productivity rate dipped by 0.1% following the 2.7% Q3 gain. A decline in productivity means that unit labor costs rose, notching up a gain of 2.0% last quarter after declining 0.1% in Q3. Output slowed to a 3.2% pace versus 4.0% previously. Employee hours more than doubled to a 3.3% rate versus 1.2%.

Manufacturing Remains Robust

The January data released this week was a net positive. Not only was jobs data strong (the government report was match by an equally strong ADP private payroll report), but the national manufacturing survey was also robust. The U.S. ISM manufacturing index dipped slightly in January but beat expectations. The ISM Manufacturing index came in at 59.1 compared to expectations that it would drop to 58.6 from 59.3 in December. The key metrics was a measure of new orders which cooled to 65.4 from an almost 14-year high of 67.4. Additionally, the ISM measure of prices paid jumped to 72.7 from 68.3 which helped treasury yields gain traction.

Good Investing,

Treasure Coast Bullion Group

Read more by Treasure Coast Bullion Group, Inc - Staff Writer