There’s no doubt about it: The falling U.S. dollar is making news like nobody’s business. And the way we see it, that’s great for precious metals.

But before we give you the nitty-gritty on why that’s true, let’s look at why the dollar is going down. And why those forces are likely to continue.

First off, some basics …

The dollar trades on markets just like any other product, service, stock, or commodity. It goes up and down depending on buyers’ appetites for what’s being sold. And while you may not be sensitive to dollar fluctuations as you do your shopping or go out to dinner, it’s rising and falling constantly behind the scenes.

So, why is the dollar going down so much lately? Stick with us, because this could get a little hairy …

First off, the dollar is going down because, like any other commodity or security, there are more sellers than buyers, more supply than demand. Investors are looking for other currencies to own, rather than dollars, so they’re selling them and buying the other currencies. In this regard, the dollar is behaving similar to just about any other product on the planet: If fewer and fewer people don’t want the dollar, sellers lower prices to make it more enticing.

So, why don’t investors like the dollar so much?

Well, they used to. In fact, right after president Trump was elected the dollar was trending up nicely. The main forces: The administration’s talk of lower taxes, less regulation, and massive infrastructure spending – among others – signaled to investors that the economy was going to blast off.

Those initiatives haven’t quite taken off as expected. Plus, while the stock market is going gang-busters, recent corporate profit data is soft. In addition, the terrible onslaught of natural disasters has taken its toll on consumers and their spending habits.

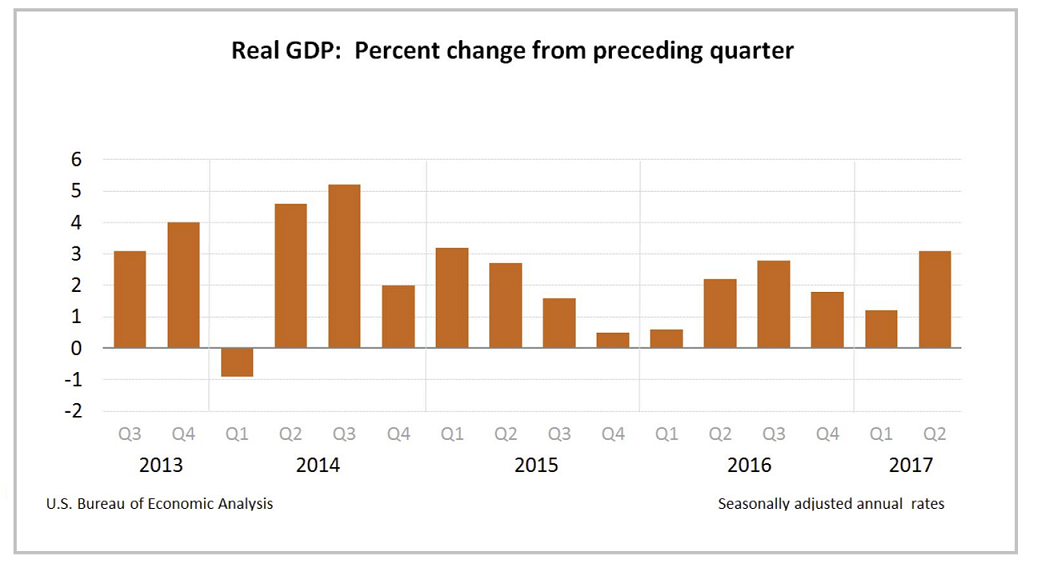

All told, these factors – plus a host of others -- have translated into ho-hum U.S. economic performance. See for yourself …

As you can see, while the latest U.S, GDP numbers are up, on average the economy still has a long way to go.

But that’s not all.

Investors are also shunning dollars because they think the outlook for higher interest rates not be as rosy as they once were. With the federal reserve proceeding cautiously toward higher rates, the dollar is looking less and less attractive. After all, if rates were really headed up, investors would buy dollars in droves, hoping to cash-in on those better rates.

Plus, the eurozone is finally beginning to get some traction, making investing there more lucrative. (During the second quarter, the eurozone economy grew at 2.3%, its fastest rate since the debt crisis.) That means investors looking to get in the action will have to sell dollars and buy euros. Result: More downward pressure on the dollar.

And don’t forget: While the mammoth amount of negative-yielding global government debt is coming down, it still stands in the trillions. And that continues to make interest bearing investments of any kind – including dollar-denominated investments – less attractive.

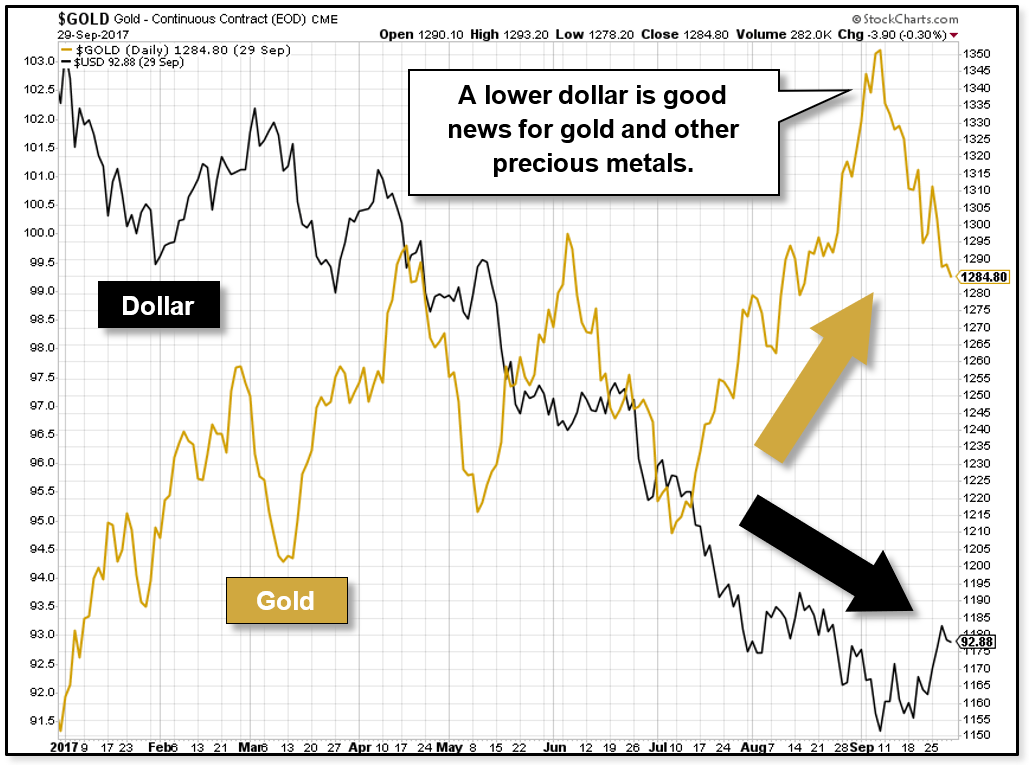

As a result, investors have sold dollars in droves. And since the beginning of the year, the dollar has simply been clobbered …

As you can see from this chart, the dollar – indicated here by the dollar index – has been slammed. And that simply reflects all the negative forces we just talked.

Is all this dollar bad news good for precious metals?

Take a look at the chart again and you can answer that yourself. Without a doubt, the declining dollar has been good for gold. As the dollar has gone down (shown by the black arrow and line) the price of gold has gone up (shown by the gold arrow and line).

And if you put a chart of silver up there in place of gold, you’ll get pretty much the same picture: As the dollar has gone down, silver has gone up. Ditto for platinum, too.

Ok, so …

The dollar is going down and that’s been a boon for precious metals. Will the downtrend in the dollar continue? And will that decline continue to power precious metals higher?

No one knows for sure. And no one has a crystal ball.

But if you look at the factors pushing the dollar higher – lackluster U.S. economic performance, stalled policy work in Washington, dreary interest rates, and rising eurozone performance – the cards tell us the dollar has more downside. And that’s bullish for precious metals.

And remember what we said earlier: When investors buy other currencies and sell dollars, the dollar does more than weaken -- those other currencies get stronger at the same time. And that makes anything denominated in dollars – from U.S. exported products to (you guessed it) precious metals – less expensive for investors who own those stronger currencies. And when products are less expensive, they’re more attractive.

The outlook for precious metals is super-exciting. And while we always recommend investors do their own homework, now is not the time to navigate the precious metals markets without someone at your back.That’s where we come in. We know the ins and outs of the precious metals business like no one else.

Good investing,

The Treasure Coast Bullion Group Team

Read more by Treasure Coast Bullion Group, Inc - Staff Writer